Women in the economy are proving to be a force to reckon with as they make up 40 percent of the world’s workforce and secure $20 trillion in consumer spending. In an effort to continue supporting women and their financial accessibility, the Global Banking Alliance for Women recently announced it will gather $4.3 billion in capital for women-owned businesses throughout the world.

Women in the economy are proving to be a force to reckon with as they make up 40 percent of the world’s workforce and secure $20 trillion in consumer spending. In an effort to continue supporting women and their financial accessibility, the Global Banking Alliance for Women recently announced it will gather $4.3 billion in capital for women-owned businesses throughout the world.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Monthly Archives: September 2014

Lenders More Cautious Toward Women Small Business Owners

With almost 8 million women-owned businesses in the U.S., more female entrepreneurs are making an impact and growing at a rapid pace. However, some women are struggling to obtain the funds needed to start and maintain a successful business.

WIPP Features Exciting NAWRB Announcements

Irvine, CA— Women Impacting Public Policy (WIPP) has featured NAWRB’s upcoming developments regarding the NAWRB Inaugural Conference and the latest issue of NAWRB Magazine, the leading publication for women in the housing economy.

WIPP is a nonpartisan organization that assists women-owned businesses by educating and advocating for them. The organization represents 4.7 million business women and uses a collective voice to make a powerful statement on Capitol Hill and the Administration.

WIPP shared NAWRB’s announcement which showcased two profound speakers set to participate at the NAWRB Inaugural Conference. Mentioned speakers included Barbara Kasoff and Tami Bonnell. Kasoff is the President and Co-Founder of WIPP and previously owned Voice-Tel of Michigan, Voice Response Corporation and in a global expansion, opened Voice-Tel of Australia and New Zealand. Bonnell is the CEO of EXIT Realty Corp. International and has 30 years of experience in real estate.

The exciting Inaugural Conference will take place at the Hyatt Regency in Long Beach, Calif. on Oct. 27-29. The conference will provide awareness, opportunities and access to help women grow and expand their businesses. Moreover, it will feature speakers and mentors who specialize in finance and the housing economy such as the FDIC Senior Deputy Director Melodee Brooks, U.S. SBA Mentors and countless CEOS. The conference will also include fun and lively aspects such as a Roaring Twenties-themed Gala, raffles, silent auction, live band and more.

The newest issue of NAWRB Magazine was also highlighted by WIPP for its riveting interview with Emmy Award-winning producer and Founder of the inspiring Adelante Movement, Nely Galan. In the interview, Galan discusses her involvement with the inspiring Adelante Movement and her journey to success.

NAWRB Magazine is an international monthly publication full of insightful information geared toward women specializing in the housing economy. From prominent female figures spotlighted in the sheCENTER(FOLD) and feature articles written by leaders and experts, to apps to help get people organized, NAWRB Magazine encompasses what’s trending now in the housing industry, business and culture.

WIPP Features Exciting NAWRB AnnouncementsHousing Starts on the Decline

The housing industry is feeling the negative effects from an increasing amount of families living in rental properties. The Commerce Department spoke today about recent findings in the industry. Overall, housing dropped in August after reaching its highest point in seven years, causing multifamily projects to head U.S. real estate.

The housing industry is feeling the negative effects from an increasing amount of families living in rental properties. The Commerce Department spoke today about recent findings in the industry. Overall, housing dropped in August after reaching its highest point in seven years, causing multifamily projects to head U.S. real estate.

Women Invest in the Future

Many entrepreneurs are using the internet as a tool to achieve more financial support for their business or product idea, but more women are benefiting from it. A recently released paper titled, “Gender Dynamics in Crowdfunding: (Kickstarter)” by Dan Marom, Alicia Robb, and Orly Sade, found that women have an eight percentage-point advantage over men in effectively obtaining funds through the popular website.

U.S. Senator Maria Cantwell Introduces Legislation S. 2693 – The Women’s Small Business Ownership Act of 2014

Bill would improve access to lending, business training and federal contracting for women-owned businesses

Senator: ‘This legislation will help break through the 21st Century glass ceiling’

WASHINGTON, D.C. – U.S. Senators Maria Cantwell, Chairwoman of the Senate Committee on Small Business and Entrepreneurship, joined Senators Ben Cardin (D-MD), Jeanne Shaheen (D-NH), Kirsten Gillibrand (D-NY), Tammy Baldwin (D-WI), and John Walsh (D-MT) in introducing legislation this week aimed at giving women entrepreneurs equal treatment when it comes to starting and growing their own businesses.

The “Women’s Small Business Ownership Act of 2014” (S. 2693) would improve access to lending and increase business counseling and training services for women entrepreneurs, and give women-owned businesses the same level of access to federal contracts as other disadvantaged groups.

“Women make up half of the population, and we have a lot of ideas that could become great products and spur our economy,” Cantwell said. “This legislation will help ensure women entrepreneurs get the right tools they need to turn those ideas into new businesses and create jobs.”

The legislation adopts recommendations from a recent Senate Small Business Committee report that showed significant barriers for women looking to start or grow their own business. The report highlighted how women-owned businesses represent a $3 trillion economic force and support 23 million jobs, but still face significant barriers compared to their male-owned counterparts.

Women entrepreneurs account for just $1 out of every $23 in small business lending, despite representing 30 percent of all small companies. They are also more likely to be turned down for loans or face less favorable terms than men, according to the July 23 report, 21st Century Barriers to Women’s Entrepreneurship.

To address those gaps, the legislation would:

- Expand and improve the U.S. Small Business Administration (SBA) Microloan and Intermediary Lending programs to reach more women borrowers who need up to $50,000, as well as reauthorize the SBA Intermediary Lending program – now a pilot program – to provide more women access to loans between $50,000 and $200,000. The legislation would allow Microloan lenders to increase lending capacity from $5 million to $7 million and improve the program to better meet borrowers’ needs through more flexible terms and expanded technical assistance. Women often face difficulty in getting right-sized loans that fit their needs, according to the report, and this will help fill a gap not met by traditional private lending. The Microloan program targets new and early-stage small businesses as well as borrowers with limited credit history who can’t receive financing from a traditional lending institution.

- Allow sole-source contracting for federal contracts awarded through the Women-Owned Small Business Federal Contract program, which would put women-owned businesses on equal footing with other disadvantaged groups in the contracting process. The legislation would change current law, and aims to help the federal government meet its goal of awarding 5 percent of contracts to women-owned businesses – a goal that has never been reached since it was established by legislation 20 years ago. When this goal is not reached, women-owned companies miss out on $4 billion in federal contracting opportunities each year.

- Increase funding for the Women’s Business Center program to expand and improve counseling and training services to reach more women entrepreneurs, especially in low-income areas. The program, overseen by SBA’s Office of Women’s Business Ownership, issues grants to nonprofits that provide these services. The centers assist 150,000 clients annually, and helped women to access more than $25 million in capital in fiscal year 2013. The centers help address the unique challenges women entrepreneurs face, such as less capital to invest and responsibility for child care or elder care. The legislation would reauthorize the program through 2019 and nearly double the annual funding authorization. It also would establish clear metrics to measure each center’s success.

- Require data on women-owned small businesses by establishing a 2015 deadline for an SBA study to identify industries in which women-owned small businesses are under-represented. The original deadline was 2018.

“Small businesses are at the heart of America’s economic engine. We need to ensure that our women entrepreneurs have the right tools available to help them succeed,” Cardin said. “I’m proud to support the Women’s Small Business Ownership Act, which gives women a fair shot at helping improve our economy and strengthen the middle class through small business ownership.”

“Small businesses are at the heart of America’s economic engine. We need to ensure that our women entrepreneurs have the right tools available to help them succeed,” Cardin said. “I’m proud to support the Women’s Small Business Ownership Act, which gives women a fair shot at helping improve our economy and strengthen the middle class through small business ownership.”

“Women are an essential part to growing our economy and creating jobs, but they are wholly underrepresented as business owners and contract and loan recipients,” Shaheen said. “By addressing the challenges women entrepreneurs and business owners face, we will give women, job seekers and our economy the tools they need to grow and succeed.”

“Our economy desperately needs to grow more small business start-ups,” Baldwin said. “This legislation invests in job creation, supports our American entrepreneurial spirit, and will help strengthen the economic security of women and their families.”

“This bill will ensure that women entrepreneurs have access to capital and opportunity,” Walsh said. “By making sure today’s leaders have the resources to start their own businesses, we will encourage the next generation of entrepreneurs to pursue their goals, strengthening Montana’s economy and creating jobs.”

“Small businesses are the backbone of our economy and the most powerful job creators we have,” Gillibrand said.“And the fact is, women are increasingly the new family breadwinner. Women are the primary income earner for a growing share of homes across America. The key to a growing economy, and the key to an American middle class that is built to thrive in the 21st century is women. When we equip more working women with the tools and the opportunities to achieve their best in the economy, and their best for their family, that’s when America’s middle class will thrive again. Without a doubt, if given a fair shot, women will be the ones who ignite our economy and lead America’s middle class revival.”

The Women’s Small Business Ownership Act has received strong support from key stakeholders including Women Impacting Public Policy, the Association for Enterprise Opportunity, the Association of Women’s Business Centers, U.S. Black Chambers, Inc., the U.S. Hispanic Chamber of Commerce, the National Venture Capital Association, and 32 community development organizations from 20 states.

-Press Release from U.S. Senate Committee on Small Business & Entrepreneurship

New Research Shows Funding Challenges Persist for Women-Owned Businesses

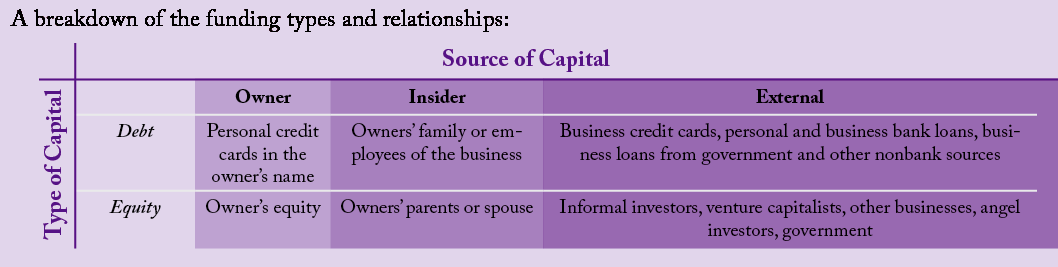

The National Women’s Business Council (NWBC) released a new research report outlining the differences between men and women business owners, regarding the scale of business growth, amount and sources of financial capital, and the relationship between the two. Unfortunately, the statistics on funding for women-owned businesses, whether it concerns bank loans, angel investments, or VC funding continue to discourage. As the government’s only independent voice for women entrepreneurs, the NWBC’s two-fold mission is to conduct and support groundbreaking research that provides insight into women business enterprises from startup to success, and to share the findings to incite constructive action and policy. To that end, the NWBC saw the need tackle the thorny issue of funding and women owned businesses once again. The NWBC just released a new research report looking at current trends in female entrepreneurship and funding with an eye towards spurring discussion and finding solutions. Here are some of the most salient highlights from their work:

Access to Capital and Women Entrepreneurs

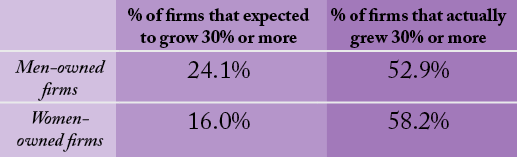

Access to capital continues to be a major issue for all, but especially for women entrepreneurs. The NWBC research suggests there is a direct correlation between access to capital, and company growth in terms of employment for both men- and women- owned businesses: women-owned firms exceeded their growth expectations, while men-owned firms had much greater growth in revenue.

Men-owned firms used significantly more capital than women, particularly with respect to equity from external sources such as venture capitalists and angel investors. Only 20% of all angel-backed companies were women-led in 2013. The NWBC’s research concludes high growth women-owned firms may be an underutilized tool for economic growth; increased access to capital is important because more money for the business will undoubtedly maximize their potential to contribute to the economy.

Overcoming The Fear Factor

When it comes to broadening the pathway to success for women business owners, women who are sole owners should consider finding a business partner who has previous startup experience. The NWBC’s research findings suggest firms with team ownership and/or owners with previous startup experience typically have higher amounts of capital and were more likely to have high growth potential. This research also revealed women-owned firms were also less likely to apply for credit when needed because they feared being turned down.

Anecdotally, many successful business owners were rejected repeatedly by banks before ultimately obtaining a loan. It is important for women to ask, and to keep asking. From the standpoint of risk aversion, a number of studies have similarly identified the fear of failure as a major impediment to the launch and growth of women-owned firms. For example, at NWBC’S March 2014 public meeting, Divya Nag—one of STEM’s youngest woman entrepreneurs—discussed Stanford’s StartX accelerator. She noted that only 5% of founding teams with women reapply when rejected as compared to 65% for all-male founding teams. The NWBC concludes that it is essential that entrepreneurs believe in their product, be able to communicate how it fulfills an unmet need in the market and continue to tell that story despite rejection.

Beyond the Boys Club: Reasons Men Receive More Capital

Research and other supporting research show, men and women approach debt differently, including the application process. Since women had lower growth expectations than men, it is possible they pursue less capital at the outset. Also women  are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.

are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.

The Role of the Banks, Incubators and Accelerators

There is substantial opportunity for financial institutions to ramp-up their efforts to target and increase lending to women entrepreneurs. The NWBC concludes that one particularly effective strategy to maximize the potential of high growth oriented women entrepreneurs would be incentivizing accelerators and incubators to address the specific needs of and support women entrepreneurs. In addition to financial resources, this would allow women to get the tangible startup experience they need, the help with the business growth planning process and offer the added benefit of social networking—possibly resulting in team ownership.

Tackling the Problem on Both Fronts

Ultimately, it looks like there is both a demand-side and supply-side issue. It’s important for women business owners with high growth potential to set themselves up for success financially—but also for institutions and individuals offering financing to work with growth-oriented women to maximize their potential. The NWBC would like to see more women entering the investment side, as angel investors or as part of a screening committee at a venture capital fund.

There is no doubt that great strides have been made in the women’s entrepreneurship movement, but there is clearly more work to do. Change or action doesn’t happen without impetus. If we continue to build on the progress that has already been made women, women-business owners and the economy as a whole will benefit tremendously.

“New Research Shows Funding Challenges Persist for Women-Owned Businesses” was originally published on ProjecteEve.com.

The National Women’s Business Council continues to be a leading voice in advancing the women’s entrepreneurship agenda with a strong focus on providing key insights and solutions to increasing economic gains for women business owners. The NWBC has identified four priorities: Access to Capital, Access to Markets, Job Creation & Growth, and Data Collection. The NWBC will be highlighting the challenges and opportunities for women entrepreneurs through several research efforts, including: undercapitalization as a contributing factor to business failure; Supplier Diversity Initiatives and Supply Chain Analysis; and Women’s participation in accelerators and incubators.

Login

Login