Los Angeles has announced a new policy that gives LGBTQ businesses—those owned by members of the lesbian, gay, bisexual, transgender and queer community—opportunities in contracting and procurement, as well as for capacity building and educational programs from small businesses. This places the city as the United States’ largest municipality in population and economic size to have such a policy.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Monthly Archives: July 2019

WHER Chat: Gain Funding Opportunities through Diversity Certification

A diversity certification is a denotation awarded to businesses that are at least 51 percent owned by a disadvantaged groups of the population, such women, minorities, veterans and people with disabilities. A women-owned business, for instance, must be 51 percent owned, managed and operated by women. In addition to government contracting, diversity classification can open your business to newfound streams of funding, from banks to venture capital dollars.

Boulder, CO: Best Housing Market for Growth & Stability

Homebuyers should think about buying their first home in Boulder, CO, as it is ranked the best housing market for growth and stability by a recent Smart Asset report. According to their findings, the odds of a major drop in home prices are 0 percent in the city, while properties have increased 268 percent in price in the last 25 years. Metro cities in both Colorado and Texas make up a majority of the top ten housing markets.

WHER Chat: Supporting Girls’ Interests in STEM with a Growth Mindset

One well-supported reason for why there is a lower representation of women in the AI sector is that not many girls are encouraged to pursue STEM. Therefore, their interest in science and technology fields will quickly fade if that passion is not nourished with opportunity. According to a Microsoft survey, young women in Europe report that their interest in STEM began around age 11 or 12, but faltered when they reached the ages of 15 and 16.

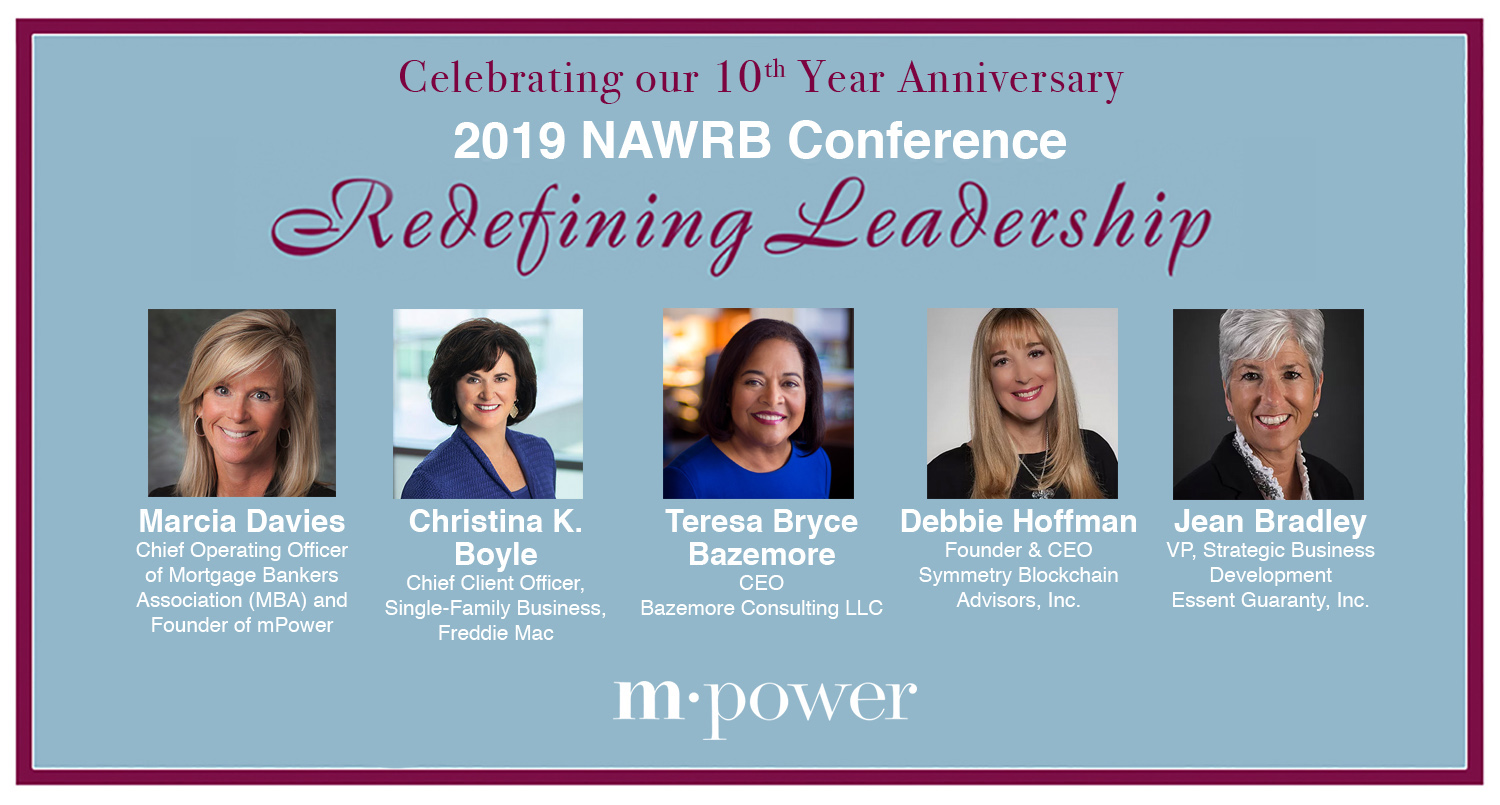

mPower Results Based Leadership Panel – Aug. 4th in Pasadena

NAWRB is pleased to announce that mPower will host a leadership panel for a second year in a row on Sunday, August 4th in Pasadena, CA from 3:30-5:00 PM! This special Results-Based Leadership panel will be moderated by Marcia Davies, COO of Mortgage Bankers Association (MBA), Founder of mPower, and NDILC Council Member.

Veterans Three Times More Likely to Be Homeless

According to a recent report by the U.S. Department of Housing and Urban Development (HUD), veterans comprise a little under nine percent of all homeless adults in the U.S., and 37,878 of veterans were experiencing homelessness on a single night in January 2018. Of these, 62 percent were staying in sheltered locations while 38 percent were staying in locations unsuitable for human habitation.

Approximately 18 out of every 10,000 veterans in the United States experienced homelessness on a single night in 2018. Veterans who are in poverty or are minority veterans are three times more likely to become homeless than the general population, according to a Zulu Time report titled “A Window into the Problems Military Veterans Face” by NDILC member Erica Courtney, President of 2020vet and Zulu Time, U.S. Army Aviation, Major NATO Gender Advisor.

WHER Chat: Gender Lens Investment for Venture Capital Firms

One up-and-coming trend in impact investing is gender lens investment. According to Veris Wealth Partners, investment of this type has risen 41 percent in the past year, up to $910 million. In addition, the number of mandated publicly traded gender lens investment strategies has reached a total of 22, after 5 years of steady growth. This is an incredible increase from the years 1993 to 2012, when there were only 5 strategies for gender lens investing.

Join the discussion at the upcoming 2019 NAWRB Conference on Aug 4th-6th in Pasadena, CA, as industry experts address this issue and more affecting the economic ecosystem. Have something to add to the discussion? Share your thoughts!

Amicus Brain Launches at the 2019 Alzheimer’s Association Conference

This past weekend, NDILC Member Dr. Chitra Dorai, Computer Scientist, Data Science and AI Expert, Founder and CEO, Amicus Brain Innovations Inc., launched Amicus Brain at the 2019 Alzheimer’s Association International Conference in Los Angeles. By her side was NDILC Chairwoman, CEO & President of NAWRB, and Advisor and Investor of Amicus Brain, Desirée Patno, and Supree Periasamy, Founder & President of Brimma Tech Inc. and Developer for Amicus Brain.

WHER Chat: Rise of Impact Investing in Family Office

A prominent finding among family office portfolios is the rising interest in impact investing and purpose-driven wealth, especially by the next generation. According to the 2018 GIIN Annual Impact Investor Survey, about 229 of the world’s leading impact investor organizations manage over $228 billion collectively in impact assets. More than one-third of family offices are involved in impact investing, increasing 4.2 percentage points from 2016.

Join the discussion at the upcoming 2019 NAWRB Conference on Aug 4th-6th in Pasadena, CA, as industry experts address this issue and more affecting the economic ecosystem. We would love to hear your take in the comments below!

Elder Financial Abuse, Private Wealth – What Are You Doing to Protect Yourself?

Elder financial abuse is a growing problem, leaving destroyed relationships and economic destruction in its wake. From straightforward theft to slow development through complex relationships, the tremendous loss of wealth incurred by senior citizens results in premature deaths and intergenerational loss of wealth. It ultimately rips at the fabric of society as a whole as trust among family members and faith in financial institutions are destroyed.

Login

Login