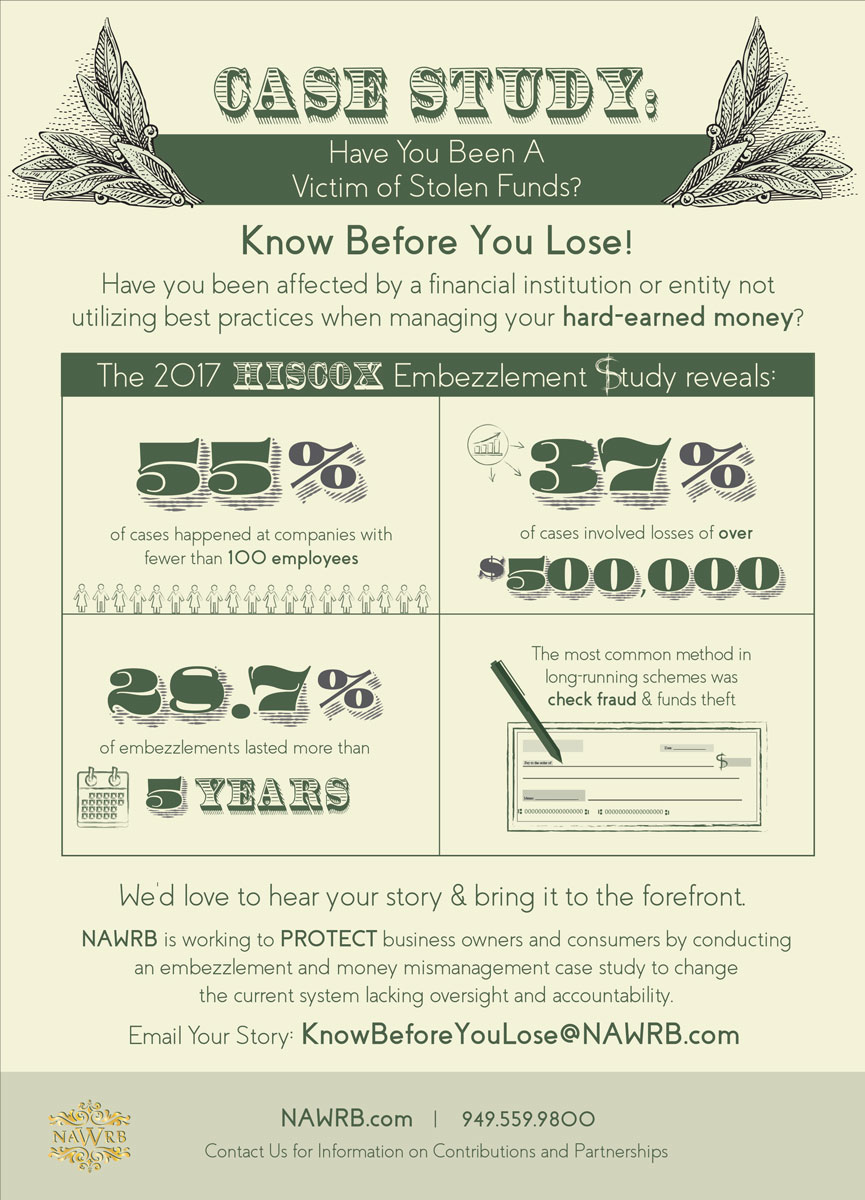

Case Study

Make a difference, send us your story or help contribute to the collection of financial resources to drive a bigger impact. Email KnowBeforeYouLose@www.nawrb.com to submit your story or for more information.

NAWRB’s Small Business Sustainability Initiative: Know Before You Lose!

NAWRB’s Small Business Sustainability Initiative: Know Before You Lose!

“Within 60 days of when we first send or make the statement available, you cannot assert a claim against us on any items in that statement, and as between you and us the loss will be entirely yours. This 60-day limitation is without regard to whether we used ordinary care.” This bank’s statement should spark consumers, especially small business owners, to become more vigilant about where they are keeping their money.

• The California Department of Business Oversight (DBO), responsible for protecting consumers and overseeing financial services and products, oversees 341,000 licenses in California, 137 commercial banks and three industrial banks, as of June 30, 2016. The 2016-17 Governor’s Budget authorizes 142 positions to fulfill this responsibility.

• According to the Small Business Administration (SBA), there are 30 million small businesses in the U.S. Eighty percent of these businesses have no employees, and in the case of women-owned businesses, 91 percent employ no one other than the owner.

Are 142 positions enough to oversee these licenses and banks and ensure the protection of small businesses?

Small businesses must be proactive in securing their resources. Moreover, this effort to protect the sustainability of small businesses must be taken on by all consumers of these financial institutions. The NAWRB Small Business Sustainability Care Package addresses five main elements we can all utilize to help small businesses.

1) Cybersecurity – Over 34,000 computer security incidents occur every day, 62 percent involving breaches of small and medium-sized businesses, according to the Wall Street Journal. With depleted resources, small business owners may remain at increased risk of cyber-attacks. Small businesses should inquire about the services, products and providers available to fortify their cybersecurity.

2) Insurance – Crime Prevention and Employee Dishonesty Riders. Be aware that not all insurance providers offer these specialty services. Therefore, having a customized insurance policy helps protect small businesses. Search for insurance companies that offer this service, paying particular attention to how they stack up against their competitors and where they write.

3) Small Businesses Vetting Financial Institutions – This involves a 11-point question checklist to better evaluate the most secure and best service for your business’s needs. Know before you lose! Find out how your bank, credit union or account provider rates. Is a national company better protected than a local or community institution? Is there a difference dependent upon your state or county?

4) Payroll Alert/Assistance – When a small business opens an account with a payroll processing service like Intuit or ADP, the owner should request a text when funds are being extracted from their account. A simple text stating funds are leaving will help businesses ensure funds are not being taken without their knowledge.

5) Small Claims Accountability – Disputes between small businesses, business owners or businesses and subcontractors are common and sometimes require legal action to resolve. Small claims courts can be used for resolving disputes or bill collection in a cost-efficient manner if the case meets the court’s dollar limit. Small businesses benefit from being as informed as court officials about the process of filing claims, given the court’s responsibility to handle claims with proper care and financial literacy.

Introducing the Fifth Pillar: Small Claims Accountability

Small businesses are sustainable when they secure and use their resources efficiently. Business owners have to be proactive in protecting their resources from internal and external threats, such as from employee fraud, cyberattacks, or faulty practices from financial institutions. However, sometimes businesses must be reactive in securing their assets when in dispute with other entities, such as businesses or subcontractors.

Filing a small business claim in a small claims courts offers certain advantages, like saving time and money that may have been lost to legal fees and processes. In small claims court, the rules are simple, and the plaintiff and defendant represent themselves without attorneys present, unless in an appeal trial.

To prepare, small businesses should be informed of their court’s dollar limits, statute of limitations, and requirements in the filing process, and consult an advisor in preparation for their trial.

Appeals will be necessary for defendants who feel as if their case was not judged with enough consideration of all aspects at play, or if they were at an unfair disadvantage. Consider that the California Judicial Branch requires that “You must file your appeal within 30 days of the date the small claims judgment was mailed to you.”

If you miss this deadline, you miss the opportunity to appeal your case. Also, a judge or the opposing party can try to prove that your appeal was filed in “bad faith.” In either situation, your case will be dropped regardless of pertinent documents, such as security deposits applied, you feel were overlooked and, if acknowledged, would have changed the outcome.

Court officials should be held accountable to review your case just as meticulously as you are required to present it. As part of our commitment to the success of small businesses, our fifth pillar—Small Claims Accountability—helps businesses ensure that accountability is taken on all sides of their case.

To find out more about the Small Business Sustainability Care Package, or about how you can make a difference in this movement, contact NAWRB at (949) 559-9800 and info@nawrb.com today!

Erin E. Andrew

Former Assistant Administrator, Office of Women’s Business Ownership at the SBA

“We are thankful to NAWRB and all of the women’s organizations who have contributed greatly to the continued successes of the Women-Owned Small Business (WOSB) Program since it was launched in FY2011.”

Login

Login