The Housing and Economic Recovery Act of 2008 (HERA) established the Federal Housing Finance Agency (FHFA) to supervise and regulate the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal Home Loan (FHL) Bank System. The FHFA is an independent government agency that employs examiners, analysts, attorneys and industry experts. Congress provided the Director of the FHFA the authority to appoint the FHFA as the conservator of Fannie Mae and Freddie Mac and this authority was utilized in 2008.

By overseeing the functioning of Fannie Mae and Freddie Mac, the FHFA plays an important role in empowering the nation’s housing economy. According to the FHFA, the Agency’s main functions are to:

• Ensure a reliable source of liquidity and funding for housing finance and community investment

• Protect taxpayers and manage conservatorships

• Increase transparency in the housing finance markets

• Preserve homeownership

• Oversee building a shared single-family securitization infrastructure

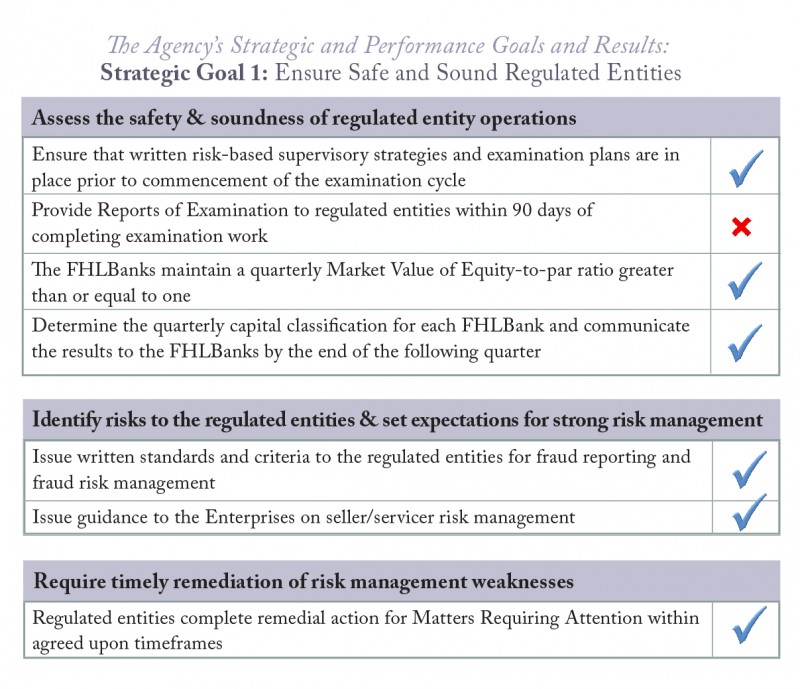

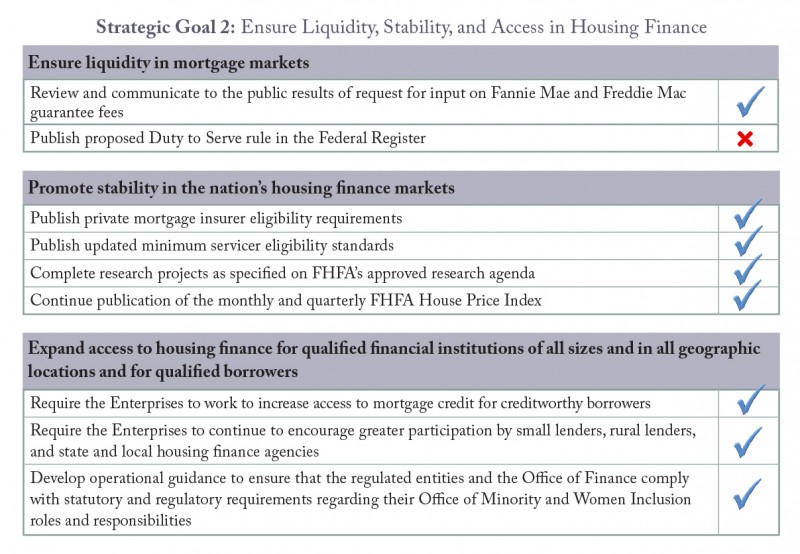

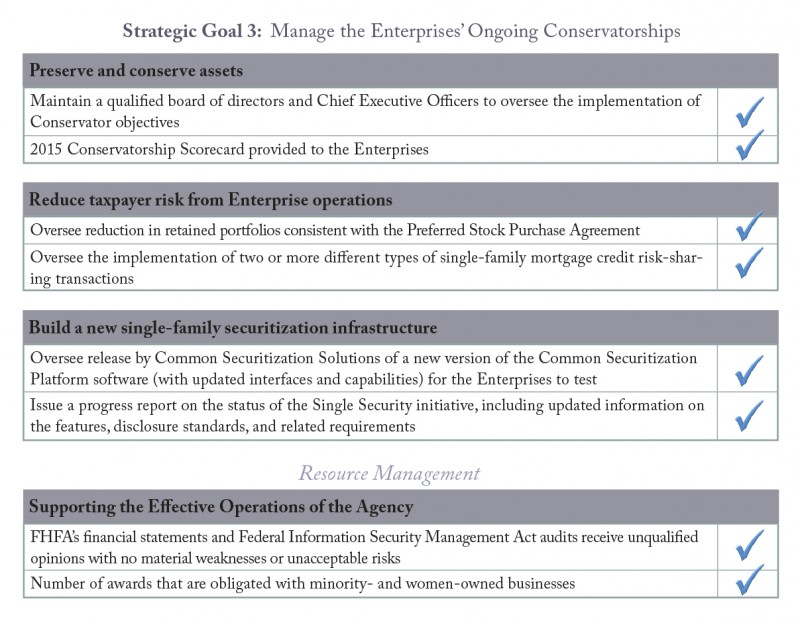

The Agency’s three main strategic goals and nine performance goals are listed in their 2015-19 Strategic Plan. In their Performance and Accountability Report for fiscal year 2015, the FHFA reports successfully completing 22 of its 24 goals this year.

Forecast for 2016:

For the financial year of 2015, the FHFA employed 554 individuals and functioned with a budget of $199.7 million. The Agency’s budget for 2016 is $199.1 million.

The FHFA’s Main Priorities for 2016:

For the New Year, the FHFA will continue the Regulation and Conservatorship of Freddie Mac and Fannie Mae. This will involve ensuring the proper management of the conservatorships, supervision of information security and cyber risk management. The Agency will also be involved in the supervision of non-bank counterparty risk management, maintenance of foreclosure prevention activities, and will provide expanded access to mortgage credit for creditworthy borrowers. It will also extend support to more affordable rental housing, monitor credit risk transfers, implement the Common Securitization Platform and Single Security and supervise Common Securitization Solutions (CSS).

Apart from Freddie Mac and Fannie Mae, the FHFA is also responsible for the Federal Home Loan Banks. In 2016, it will continue to focus on the core mission activities of FHL Banks, monitor the expansion of various mortgage programs and evaluate their member requirements.

Another important FHFA goal for FY 2016 is the promotion of Diversity and Inclusion (D&I) with the help of its Office of Minority and Women Inclusion (OMWI).

The FHFA bestows special priority upon D&I and has a fresh plan for its OMWI, aiming to create a work environment that is conducive to “diverse perspectives and encourages collaborative approaches to achieve business success.”

Special performance metrics and plans are in place to achieve the Agency’s D&I goals. The FHFA OMWI takes all responsibility for the effective application of matters of “diversity in employment, management, and business activities at FHFA as well as programs to monitor the inclusion of minorities, women, and individuals with disabilities at the regulated entities.” It will also ensure compliance with Equal Employment Opportunity laws and regulations.

The FHFA has proposed three key measures for implementing the principles of Diversity and Inclusion and Equal Employment Opportunity (EEO) in 2016. They plan to “issue and seek comment on a proposed rule that would require all regulated entities to include diversity and inclusion in their strategic planning process.” The Agency will work on creating a Diversity and Inclusion examination program and module to review the D&I programs of Freddie Mac and Fannie Mae, and will also compose and present EEO standards that will help build a structure favorable for establishing equality in the workplace.

NAWRB believes diversity and inclusion should be a business cornerstone of the American workplace, a parallel among the core values of companies not an exception. Just as the FHFA promotes D&I throughout the entities it regulates, it is crucial for the housing continuum to embrace D&I at the core of their business. Together we can change our workforce to provide equal opportunities for all.

Login

Login