Global real estate has been and will continue to be a constantly shifting landscape; of that we can be sure. Current events continue to shape country economies, impacting capital flow and global markets. Five years ago, America’s economy was in the throes of a recession and foreign investment was the lifeblood of many local real estate markets. Now, the American dollar is stronger than most world currencies and is a more expensive destination to buy and own property. Yet, it remains one of the world’s most popular destinations to purchase real estate.

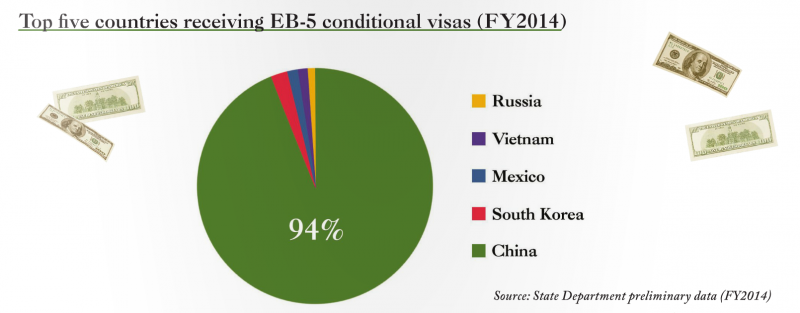

Last year, foreign investors accounted for $104 billion in U.S. residential real estate; and $91 billion in commercial property purchases. China overtook Canada for the first time as the number one purchaser, accounting for $28.6 billion in purchases. This is partly due to the relative safety and security of our country’s politics, economy, and lifestyle.

Among the many factors impacting demand for real estate, some of the more complex considerations relate to the laws and policies of various governments. From differences in tax treatments, to allowed investment strategies, or the ease of securing visas/residency status, all of these factors and more can play a significant role in where and how global buyers, especially of luxury properties, choose to acquire real estate.

While there is much to say about each of the following legal/policy topics impacting real estate, I will provide a brief overview of each, and encourage all of you to visit our web site, realtor.org, or our blog, theglobalview.blogs.realtor.org, for more comprehensive information on these topics.

Money Laundering

An unfortunate reality of today’s market is the issue of real estate money laundering. Governments around the world are being forced to adapt or create new policies to help prevent suspicious activity.

Wealthy buyers frequently use shell companies to take advantage of legal investment and tax strategies—or simply to maintain their privacy. However, they have also been used in money laundering schemes, designed to hide corruption and shelter criminal activity, including terrorism.

In and of themselves, shell companies are perfectly legitimate. They can be created in the names of accountants, lawyers or relatives, making it nearly impossible to establish money sources. Also, shell company ownership can be shifted at any time without updating property records. Further, since many high-end transactions are made in cash, ownership can’t be traced through mortgage documents either.

Typically, the first and most important layer of control for anti-money laundering (AML) and anti-terrorism financing (ATF) rests with banks and other financial institutions. However, depending on where real estate professionals practice, they may also be subject to compliance with AML and ATF regulations.

New York City is generally regarded as a top international destination for luxury real estate purchases, potentially involving money-laundering schemes.

Throughout 2015, The New York Times published a series of articles under the banner “Towers of Secrecy” which examined the people behind shell companies purchasing high-end Manhattan condos. The Times found that almost half of the most expensive residential properties in the U.S. (over $5 million) are now purchased anonymously through shell companies—a fact that may or may not relate to illicit activity.

In January 2016, the U.S. Financial Crime Enforcement Network (FinCEN, part of the U.S. Treasury Department), announced temporary requirements for title insurance companies participating in high-end all-cash shell company real estate transactions in Miami (properties over $1 million) and Manhattan (over $3 million).

The pilot data collection program, running from March 1 to August 27, 2016 requires some designated title insurance companies to determine and confirm the identities of natural persons with 25 percent or more ownership in a legal entity such as an LLC, corporation or partnership and to report those names and proof of identity to FinCEN.

The information collected may be used in conjunction with efforts by other law enforcement agencies, but no public disclosure is intended. The National Association of REALTORS® (NAR) is working to achieve greater assurances in this regard.

FinCEN’s announcement was made as an international Financial Action Task Force (FATF) team arrives in the U.S. to assess its anti-money laundering policies. The FATF was created by the G-7 nations in 1989.

NAR will meet with the FATF team to speak about the voluntary guidelines NAR developed in collaboration with FinCEN, as an effective means for its one million plus members to be aware of and partner with relevant government agencies when suspicious financial transactions take place.

U.S. EB-5 Regional Center Program

The EB-5 Immigrant Investor Program is designed to stimulate the U.S. economy through job creation and capital investment by foreign investors. In exchange for making a minimum investment into a new U.S. business that results in the creation of at least 10 jobs, foreign investors may secure legal residency for themselves and their families.

Typically, foreign investors find it advantageous to participate in the program by means of an authorized Regional Center—an economic entity, public or private, which promotes economic growth and job creation and adheres to the terms of the EB-5 Regional Center Pilot Program.

Since 2003, EB-5 Regional Centers have invested over $3.1 billion of foreign capital into the U.S. economy, creating over 65,000 jobs for U.S. workers. By stimulating the economy, the EB-5 program also stimulates real estate markets across the U.S.

Reauthorization

The EB-5 Regional Center Program was originally set to expire in September 2015. Six distinct reauthorization bills were introduced in 2015, attempting to usher in reforms that would make the program more transparent, accountable and permanent.

In spite of intense negotiations with the EB-5 Investment Coalition and other stakeholders, it became clear that the details of a complex and difficult EB-5 immigration reform bill could not be resolved prior to the deadline. Among the goals under review were fraud and security risks, job creation and national security.

At the last moment, the EB-5 Regional Center Pilot Program was extended until September 2016, giving the U.S. Congress more time to hammer out permanent reforms.

What is FIRPTA?

FIRPTA is the Foreign Investment in Real Property Tax Act of 1980. This legislation was enacted as a result of widespread concerns that foreign investors were purchasing U.S. real estate and then selling it at a profit without paying any tax to the United States. To solve the problem, FIRPTA established a general requirement on the purchaser of real estate interests owned by a foreign seller to withhold 10 percent of the purchase price. This withholding must be remitted to the Internal Revenue Service (IRS) at the time of closing unless certain exceptions are met.

Under the FIRPTA law, there is no withholding requirement if the sales prices does not exceed $300,000 and the residence is intended for the buyer’s personal use. For properties over $300,000 and up to $1 million, they are subject to a 10 percent withholding tax at the time of sale. The update in 2016 now increases the withholding of high-end properties, priced over $1 million, to a 15% withholding tax.

Usually, the settlement agent is the party that withholds and remits the funds to the IRS, but the buyer is legally responsible. If a real estate agent represents either the buyer or seller of a property subject to FIRPTA withholding, he or she could be liable for the tax that should have been withheld by the buyer in certain circumstances.

Good news for the U.S. commercial real estate industry: The Protecting American Taxpayers from Tax Hikes (PATH) Act includes two very positive FIRPTA provisions that are conservatively estimated to boost foreign investment in U.S. commercial real estate by $20-$30 billion per year. The increase in withholding rate is part of a package of tax changes to “pay for” the two provisions. It should be noted that residences purchased from foreign persons will not be affected by the higher withholding rate unless the purchase price exceeds $1 million.

The National Association of REALTORS® is heavily involved not only in the issues mentioned in this article, but nearly all real-estate related legal and policy decisions made by the U.S. government. For more information on NAR’s involvement, visit realtor.org/law-and-ethics.

Login

Login