The Federal Housing Finance Agency (FHFA) announced a Request for Comments (RFC) from the public regarding proposed amendments to its regulation on the Federal Home Loan Banks’ Affordable Housing Program (AHP or Program). The deadline for submitting comments has been extended to June 12, 2018.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Tag Archives: FHFA

FHFA House Price Index Increases 0.6 Percent in February

In a recent news release, the Federal Housing Finance Agency (FHFA) revealed that United States house prices in February rose 0.6 percent from the previous month, according to its seasonally adjusted monthly House Price Index (HPI). The previous house price increase in January, at 0.8 percent, has been adjusted to reflect this new finding.

FHFA Director Melvin L. Watt Delivers Moving Speech at Connect 2018

The Federal Housing Finance Agency (FHFA) has released the prepared remarks of Director Melvin L. Watt at the national Connect 2018 conference organized by the National Association of Minority Mortgage Bankers of America (NAMMBA). He shares a glimpse into his personal journey from a small community in North Carolina to becoming an influential leader of an agency that oversees trillions of dollars, and highlights how the intersecting factors of inclusion, economic opportunity and homeownership form the lives of countless Americans.

FHFA Director Mel Watt Delivers Moving Speech – The State of Women’s Homeownership

FHFA Releases RFC for Responsibilities of Boards of Directors, Corporate Practices and Corporate Governance

The Federal Housing Finance Agency (FHFA) has recently announced a Request for Comments (RFC) regarding proposed amendments to its regulation on the Responsibilities of Boards of Directors, Corporate Practices, and Corporate Governance for all its regulated entities. These amendments will require directors of all entities to have strategic business plans in effect throughout the year, including annual reviews, re-adoption and reporting requirements.

Jumpstarting Your Career & Business in the Housing Ecosystem

As a professional in the housing ecosystem, it is crucial to think outside the box and utilize the resources at your disposal to grow and advance your business and career. Analyzing your market, familiarizing yourself with the competition and crafting a superior business plan are great first steps, but pioneering decisions are what will make or break you in the market.

Adapting to the changing times, leveraging your differences, preparing for the future of the market and surrounding yourself with people invested in your success will help you seize opportunities for advancement.

Balancing New School and Old School

If you consider your favorite products, are they the “best” or the most inexpensive choices on the market? Or, have you developed a relationship with a particular brand that you buy because it has done right by you? Similar to your preferred items, your business can become the go-to for customers.

Continue reading →

Newsletter: New SBA Lending Tool – NAWRB WOSB Award Winners – FHFA Foreclosure Preventions

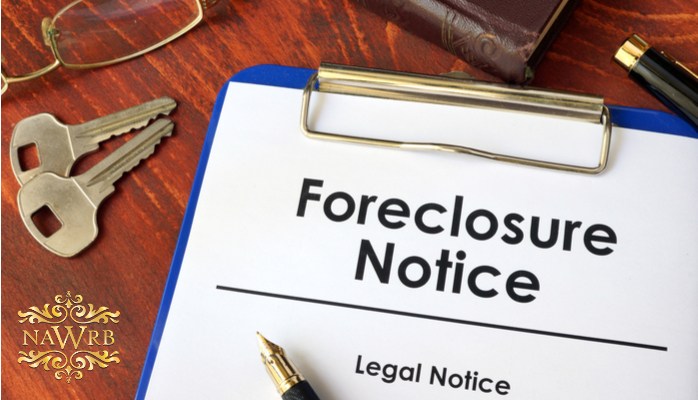

Over 48,000 Foreclosure Preventions in Q2 2017

The Federal Housing Finance Agency (FHFA) has released its second quarter Foreclosure Prevention Report showing that Freddie Mac and Fannie Mae completed a total of 48,760 foreclosure prevention actions in the second quarter of 2017.

Is the Mortgage Industry Painting with too Broad a Brush?

Becoming a homeowner helps safeguard a person’s professional achievements and can pull them out of poverty. However, current mortgage lending trends show that a significant portion of Americans are being all but excluded from homeownership by stringent credit-assessing practices leading to mortgage rejections.

The Great Recession, which saw nearly 8 million American homes fall into foreclosure, highlighted the risks and issues in housing boom mortgage lending; it was this financial crisis that set the scene for the Dodd-Frank Act of 2010, which imposed rigid standards for home loan qualification.

Recent research by Alberto Rossi and Francesco D’Aunto, assistant professors of finance from the University of Maryland’s Robert H. Smith School of Business, shows that following the passage of Dodd-Frank, mortgages obtained by middle-class households decreased by 15 percent. Aiming to protect the economy, financial institutions and prospective homebuyers, these regulations have at times overburdened the mortgage process, leaving Americans stagnant in their journey to a better future.

When it comes to lending, is the mortgage industry painting with too broad a brush?

Minorities

Pew Research Center data reveals that Black and Hispanic homebuyers experience significantly higher difficulty obtaining conventional mortgages than whites and Asians, and usually pay higher interest rates when they are approved. Mortgage rejection is one contributor to the homeownership rate disparity of Black (41.3 percent) and Hispanic (47 percent) households in comparison with white households (71.9 percent).

According to Pew Research Center analysis of Home Mortgage Disclosure Act (HMDA) data, in 2015, 19.2 percent of Hispanic applicants and 27.4 percent of black applicants were denied mortgages, compared to 11 percent of white and Asian applicants. For Blacks, credit history is the number one cited reason for mortgage rejections; for the three other groups, debt-to-income ratio was the foremost explanation.

Contributing to lower affordability, mortgage rates also enact an uneven impact on homebuyers. In 2015:

• 60 percent of Black householders and 65 percent of Hispanic householders had mortgage rates below 5 percent, compared to 73 percent of white householders and 83 percent of Asian householders

• 18 percent of Hispanic householders and 23 percent of Black householders had mortgage rates of 6 percent or more, compared to 13 percent of white householders and 6 percent of Asian householders

In addition to these mortgage difficulties, an emerging trend is a significantly smaller and less diverse mortgage applicant pool. Pew reports that in 2005, about 10 percent of conventional mortgage applications were from Black households, and 14 percent came from Hispanic households. In 2015, less than 4 percent of these applications came from Black households, and fewer than 7 percent were from Hispanic households.

The inequality in mortgage accessibility and interest rates is formidable, meaning that a disparate amount of Black and Hispanic households are unable to achieve homeownership like their white and Asian counterparts. One issue that must be understood in order to successfully navigate the future of the industry is the reason behind the sharp decline in conventional mortgage applications.

Is poverty the main factor?

U.S. Census Bureau data shows that poverty levels of Hispanic and Black households are actually decreasing. From 2014 to 2015, Hispanic poverty level declined from 23.6 to 21.4 percent, and the median annual income of Hispanic-origin households rose 6.1 percent, from $42,540 to $45,148. Similarly, the poverty level of Black households decreased to 24.1 percent from 26.2, and their median annual income increased 4.1 percent, from $35,439 to $36,898.

Are Americans losing the desire to own homes?

While the role of poverty cannot be underestimated, it is necessary to assess the other aspects at play. As recent U.S. Census Bureau data affirms, the 63.6 percent homeownership rate in the first quarter of 2017 was not statistically different from the 63.5 percent rate in the first quarter of 2016 or the 63.7 percent rate in last year’s fourth quarter.

This means that in the past year, the homeownership rate has neither worsened nor improved, but it has been on a steady decline since 2006. Mortgage rates, which have hit historic lows in recent years, add another piece to the puzzle.

According to the Federal Housing Finance Agency (FHFA), the average interest rate on all mortgage loans increased in December (3.91 percent), January (4.17 percent) and February (4.25 percent) before dropping 13 basis points in March (4.12 percent). The FHFA House Price Index (HPI) also reveals that home prices went up 6.2 percent from the fourth quarter of 2015 to the fourth quarter of 2016. The flex in interest rates and rising prices could be outweighing the benefits of homeownership for prospective buyers.

Women

Women

Women are another market expressing uncertainty towards the housing market. Like minorities, women face roadblocks when procuring mortgages. A new study from the Urban Institute, Women Are Better than Men at Paying Their Mortgages, describes that when examining loan performance for the first time by gender, women’s lower credit scores do not indicate weaker performances, and women actually perform better than men. The report found that female-only borrowers actually default less than male-only borrowers. For mortgages originated from 2004 to 2007, the default rate for female-only borrowers was 24.6 percent, compared with 25.4 percent for male-only borrowers.

Despite this repayment performance, single borrowers, particularly women, have higher mortgage rates; from 2004 to 2014, the average rate for female-only borrowers was 5.48 percent compared to 5.41 percent for male-only borrowers. A 2011 Journal of Real Estate Finance and Economics study also shows that on average, women pay more for mortgages than men; women’s mean interest rates are .4 percent higher than men’s. While the repayment figures are not statistically different, women perform on par with men, emphasizing the lack of evidence-based explanation for the higher mortgage rates women experience.

In some demographics women even depict higher homeownership rates than men. In 2015, the homeownership rate of female householders in 1-person households was 24.56 percent higher than the homeownership rate of male householders in the same category, according to Census Bureau data on national household demographics.

There remains the question; do women want to become homeowners? When analyzing the benefits, homeownership may not be a desired step, especially if women are single and have only one paycheck. With lower incomes and higher mortgage rates, women experience a tougher time paying back their loans, and their interest rates make accumulating wealth through homeownership a discouraging task. It isn’t difficult to recognize that for some women, homeownership can seem like a more prudent step in the future.

Credit

On the road to access mortgages, Americans’ relationship with banks is often center stage. The FDIC’s 2016 biennial National Survey of Unbanked and Underbanked Households shows:

• 7 percent of households were unbanked, having no account relationship with an insured institution

• 19.9 percent of households were underbanked, encompassing households in which a person had a bank account, but still resorted to alternative financial services providers throughout the year

• The survey found that 27 percent of households, or 90 million Americans, were unbanked or underbanked

• The following segments have a higher probability of being unbanked or underbanked

o 42 percent of households with incomes below $30,000 per year

o 49 percent of African American households

o 46 percent of Hispanic households

o 46 percent of households headed by a working-age individual with a disability

Without a solid baking relationship, it is hard for a person to have credit scores that satisfy current mortgage lending standards. Unbanked and underbanked describes millions of families in the United States, meaning millions of people without the benefits of homeownership and an economy missing out on their buying power.

The recent Bankrate Financial Security Index found that only 52 percent of Americans have more money in emergency savings than credit card debt, and 24 percent have more credit card debt than emergency savings; 17 percent remain in the middle with no savings or debt. These figures emphasize the importance of protecting what little savings consumers have. As the U.S. continues to recover from a recession that saw millions of people’s homes and life savings slip out of their hands, the need for banks and financial institutions that protect consumers’ savings through sound financial practices is paramount.

Irresponsible lending led to the worst recession in recent history, but stringent standards are effectively preventing Americans from accessing mortgages, homeownership, and creating better lives. People capable of repaying home loans should be allowed the opportunity to do so, and those not in a position to obtain mortgages need to make the necessary changes to situate themselves for homeownership, such as opening a bank account. With rising prices, unpredictable interest rates and a stagnant homeownership rate, actions need to be mindful in order to empower today’s American homebuyers and would-be homebuyers.

FHFA Proposes Amendments to Minority and Women Inclusion Regulations

The Federal Housing Finance Agency (FHFA) has issued a Notice of Proposed Rulemaking (NPRM) and is seeking comments on proposed amendments to its Minority and Women Inclusion regulations.

Login

Login