In a recent news release, the Federal Housing Finance Agency (FHFA) revealed that United States house prices in February rose 0.6 percent from the previous month, according to its seasonally adjusted monthly House Price Index (HPI). The previous house price increase in January, at 0.8 percent, has been adjusted to reflect this new finding.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Tag Archives: housing

NAWRB Announces New Name: Women in the Housing and Real Estate Ecosystem

The National Association of Women in Real Estate Businesses (NAWRB) is proud to announce its new name, Women in the Housing and Real Estate Ecosystem (NAWRB), which accurately captures NAWRB’s expansive bandwidth as a leading voice for women in the housing and real estate ecosystem, and champion for gender diversity and women’s economic growth.

Existing Home Sales Increase 5.6 Percent in November

According to the National Association of Realtors® (NAR), the sale of existing homes increased for the third straight month in November, reaching the strongest pace in over a decade. The West was the only major region to not experience a surge in buying activity last month. Total existing home sales—completed transactions of single-family homes, townhomes, condominiums and co-ops—increased 5.6 percent to a seasonally adjusted annual rate of 5.81 million in November.

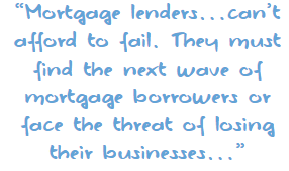

Catching the Next Wave of Mortgage Borrowers

Sometimes, a transition calls for a radical change, though some people try to avoid such shifts because they can be jarring. The sudden loss of refinance business has been that way for many lenders, and it will get worse in the future. How lenders respond to this transition into a purchase money market will set the winners apart from the rest.

The approaches loan originators will take to solve this problem will vary. Many will double their efforts to attract new refinance business, as writing that business has become their core competency. Others will seek out more purchase money business, pulling out old playbooks and relearning the rules of building strong business referral networks. A few will look for the radical change and catch the next wave of mortgage borrowers.

Speaking of catching waves, when learning to surf, even when you fail, you still learn something about yourself and become better for it. Mortgage lenders, on the other hand, cannot afford to fail. They must find the next wave of mortgage borrowers or face the threat of losing their businesses, which is all the more reason for them to consider the radical change.

Jumpstarting Your Career & Business in the Housing Ecosystem

As a professional in the housing ecosystem, it is crucial to think outside the box and utilize the resources at your disposal to grow and advance your business and career. Analyzing your market, familiarizing yourself with the competition and crafting a superior business plan are great first steps, but pioneering decisions are what will make or break you in the market.

Adapting to the changing times, leveraging your differences, preparing for the future of the market and surrounding yourself with people invested in your success will help you seize opportunities for advancement.

Balancing New School and Old School

If you consider your favorite products, are they the “best” or the most inexpensive choices on the market? Or, have you developed a relationship with a particular brand that you buy because it has done right by you? Similar to your preferred items, your business can become the go-to for customers.

Continue reading →

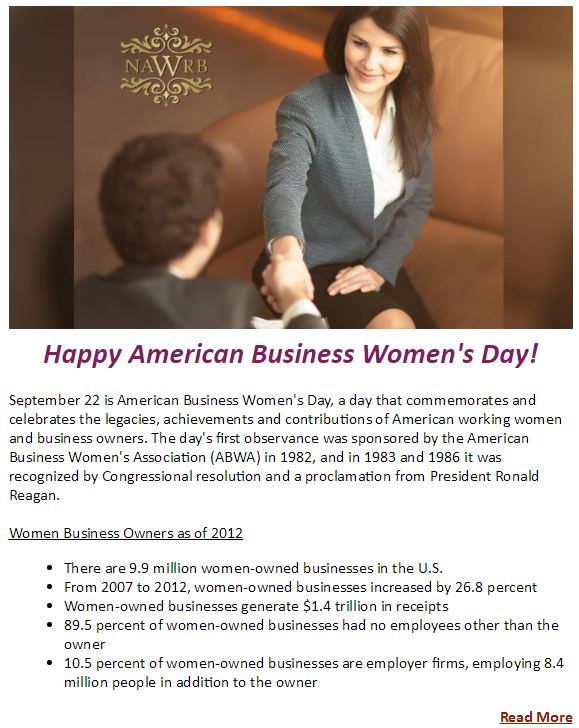

Newsletter: American Business Women’s Day – MBA mPowering You, October 21 – Single Women Homebuyers

NAWRB is the Women’s and Small Business Validator: Collaboration, Influence, Access and Opportunities (#CIAO). To find out how you can get involved, contact NAWRB at (949) 559-9800 and info@www.nawrb.com or visit www.NAWRB.com.

Have You Been a Victim of Stolen Funds? – Home Prices Up 6.3 Percent – Hispanic Women Entrepreneurs

|

|

|

NAWRB is the Women’s and Small Business Validator: Collaboration, Influence, Access and Opportunities (#CIAO). To find out how you can get involved, contact NAWRB at (949) 559-9800 and info@www.nawrb.com or visit www.NAWRB.com.

|

Pam Patenaude Confirmed as HUD Deputy Secretary

The Senate has confirmed Pam Patenaude as Deputy Secretary of the Department of Housing and Urban Development (HUD). Patenaude was confirmed on Thursday, September 14th with a final vote of 80-17.

Affordable Housing for Teachers in Expensive Cities

Recently, NAWRB published an article addressing the scenario of a professional, in our case a teacher named Rachel, working in a city she could not afford to live in, and the consequences of this situation on her life. The city of San Francisco—home to one of the most expensive housing markets in the country—is taking steps to resolve this problem.

The Hottest Housing Markets in the U.S.

Realtor.com recently released their Market Hotness Index, ranking the current hottest real estate markets around the country according to the latest statistics on housing inventory and demand. In August 2017, the national median home price sits at $275,000 with a national median age of inventory of 66 days.

Login

Login