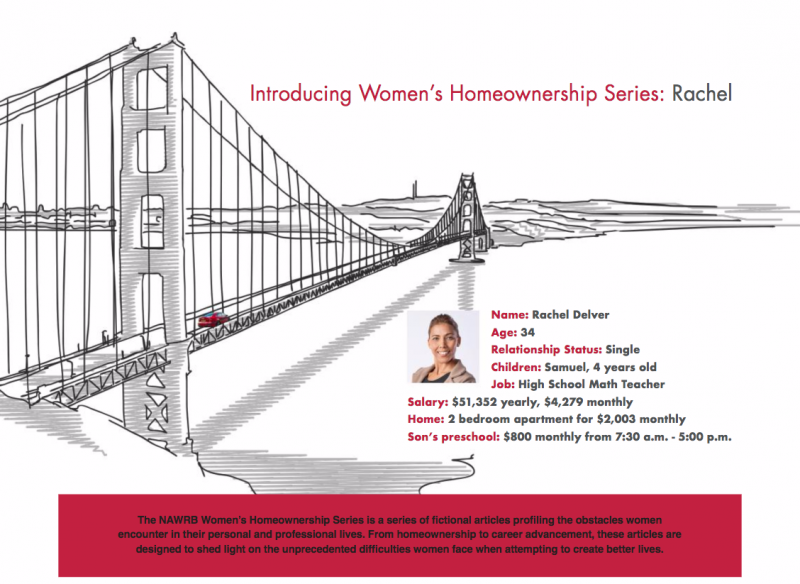

Rachel, a single mother living in Hayward, California, enjoys spending time with her son, seeing friends, going to the movies and imagining her dream home. Her weekday morning routine consists of waking up at 6:30 a.m. to pack lunches, dropping Sam off at preschool by 7:30 a.m. and driving 15 minutes north to her job at the local high school.

Rachel loves her job, and she’s great at it; helping her students thrive in a daunting subject matter is incredibly rewarding. Her talent and dedication as an educator recently earned Rachel a job offer from a private San Francisco school. It’s a dream job, head of the mathematics department with the opportunity to create her own programs and curriculums.

During the interview, Rachel fell in love with the school and felt welcomed by the staff. Whether she wants the job isn’t the issue, it’s whether she can make it work.

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour.

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour.

Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined.

Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined.

Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city.

Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city.

—

Rachel’s new salary—an attractive $60,071 a year—is a great increase from her current earnings; but still leaves her with less than $4,000 a month and makes a minimal dent in her projected living expenses. What does she do? What needs to change? What can change?

Let’s keep in mind that for a person seeking a move, Rachel is equipped well. She has a steady job, good credit, is a responsible mother and even has a job secured in her desired city. And yet, the obstacles facing her are powerful and pervasive. What would be the case for a person hoping to move without a good job or a great job offer? Would this feat be impossible and keep them perpetually stuck in their current location?

—

Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.

Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.

—

What if a person doesn’t have somebody to grant them the huge favor of lending money? Consider the impact commuting would have on Rachel’s quality of life. Spending hours driving every day to accommodate her job and rent. Having just a few moments to relax with Sam after her long commute rejuvenates the essence of being a working mother.

Rachel has put in the work, what does the future hold for her options?

Login

Login