A family office is a family controlled investment group that families of significant wealth can have to manage their wealth and assets. Family offices are attractive to investors with business leadership inclinations because the model gives them complete control with little regulatory oversight.

Family offices can either be single-family (SFO) or multi-family (MFO). SFO’s are created to support the financial needs of one family that has at least $100 million or more worth of assets as it typically can cost over $1 million a year to operate . MFO’s, on the other hand, are for families with at least $50 million in assets each and provide the advantages of an SFO without the expense and potential managerial dilemmas. MFO’s are especially attractive when well run and offer collaborative opportunities and support.

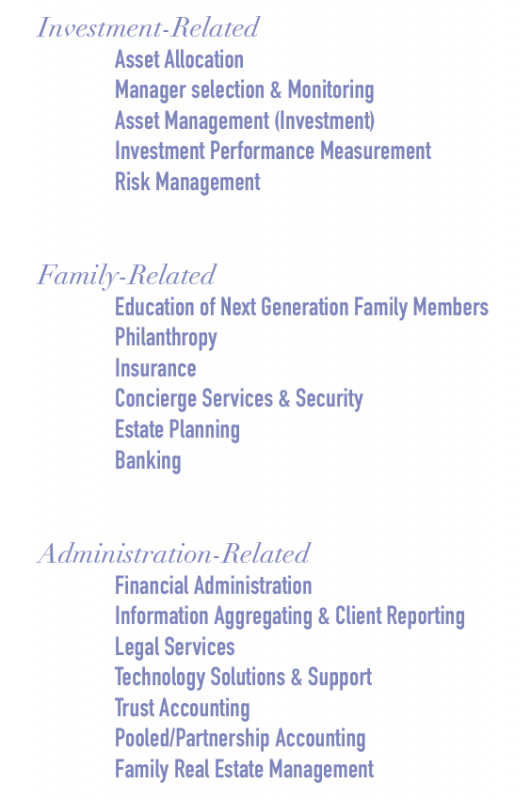

![]() Tasks of family offices range from key family assets and tax, accounting, property and estate management, to offering educational, professional and lifestyle services.

Tasks of family offices range from key family assets and tax, accounting, property and estate management, to offering educational, professional and lifestyle services.

Family offices originated in Europe, but the concept was developed in the United States by the House of Morgan and the Rockefellers. The main motivation for the offices was wealth management, however the purpose of them have evolved with time. Other drivers include a desire for advisors to assist in global volatility, more investment options and multi-generational wealth preservation.

Family offices originated in Europe, but the concept was developed in the United States by the House of Morgan and the Rockefellers. The main motivation for the offices was wealth management, however the purpose of them have evolved with time. Other drivers include a desire for advisors to assist in global volatility, more investment options and multi-generational wealth preservation.

As the number of billionaires rise, and the time it takes to make significant amounts of money decreases, we are seeing a growth in the number of family offices across the globe. According to EY reports, there were an estimated 1,000 single-family offices in the world in 2008. Today, there are more than 10,000 family offices globally. The estimated number of family offices in the United States is over 5,000.

Martin Graham, Chairman of Oracle Capital Group, shares that family offices have developed into a one-stop-shop for wealthy families. In addition to asset management and facilitating wealth preservation within and between generations of the family through trusts and foundations, family offices help with immigration, finding homes, setting up charitable foundations, getting children into local school systems and project financing.

Family offices are also taking advantage of new opportunities, such as forming partnerships to conduct buyouts and acquisitions, financing startups, purchasing real estate and insurance products, lending to companies and becoming activist shareholders of companies.

There are some disadvantages to family offices, however. For instance, family offices often face challenges in having diverse perspectives in such a small network. Also, as the organization is often, but not always, kept within the family, each generation may bring with it new ideas on the best tools and techniques to grow and manage the wealth. Subsequent generations can also feel pressured to not make any mistakes regarding the family’s finances, which can lead to flawed decision-making.

All of these issues reflect a need of outside and impartial perspectives, such as advisers, who can support the family in making the best decisions for the organization. Advisers will be neutral regarding any family politics that sometimes cause disruption and discord. As neutral parties, advisers focus solely on asset management and the family office’s best investment choices. However, they often perform the informal role of family counselor.

For more information on working with family offices, Check out our Know the Rules of the Game Podcast “Working with Family Offices” episode with special guest Wendy Craft, Chief of Staff for Fulcrum Equities LLC.

Login

Login