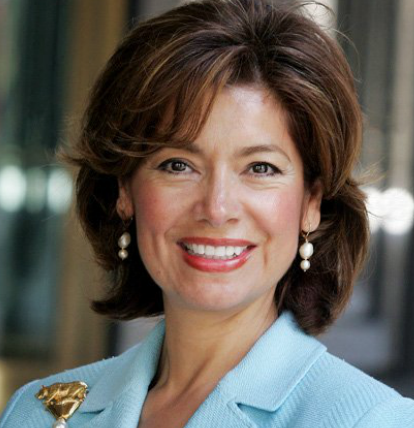

The 24th Administrator of the U.S. Small Business Administration (SBA)

Maria Contreras-Sweet

From founding ProAmérica Bank to her appointment by President Obama as the 24th. Administrator of the SBA, Maria Contreras-Sweet has made incredible strides in her career. She divulges to NAWRB her personal role models, journey to the SBA, and what she’s doing to champion for small businesses.

NAWRB: You have an extensive background working in government with your first introduction as a secretary for the Speaker of the California State Assembly. Was it a long-time goal of yours to work in government?

Maria Contreras-Sweet: I always believed in public service but my career path took me into business. My time in government has been some of the most rewarding work of my life. Before I started my own bank, I spent five years running a large government agency back in California that had jurisdiction over Business, Transportation and Housing. When I say “large” – we had 44,000 employees, 14 departments and a $14 billion budget. We were able to do a lot of important things, such as creating the Department of Managed Health Care and its Office of Patient Advocate, passing a $2.1 billion bond for affordable housing, and initiating construction on the San Francisco-Oakland Bay Bridge – one of the largest infrastructure projects.

My work at the SBA presents an opportunity to make an impact on a national scale. I’ve seen the pivotal role the SBA plays in our entrepreneurial ecosystem. As a bank chairwoman, I examined business plans, their viability, and management’s ability to execute. This not only strengthened my knowledge of the challenges that small businesses face, it also strengthened my resolve to help them overcome those hurdles and succeed.

Two out of three new jobs in America are created by small businesses. Millions of middle class families are working for folks who depend on the SBA’s ability to facilitate access to capital, counseling and contracting opportunities. As a banker and a former SBA lender in California, I’ve seen the difference this agency can make. It’s one of the reasons I was so motivated when President Obama asked me to take this challenge on. I know there’s so much we can do together to provide access to capital and be a resource for entrepreneurs and the lenders who serve them.

This country was founded by risk-takers, resourceful pioneers who built this prosperous nation. Entrepreneurialism is our heritage. The American Dream has always been about the opportunity to earn a good education and the keys to your own home, but the expanding American Dream is also about the opportunity to start your own business. I’ve lived that Dream. And as SBA Administrator, I’m determined to help others realize theirs, as well.

John F Kennedy once said “All of us do not have equal talent, but all of us should have an equal opportunity to develop our talents.” I’ve come to realize that access to the American Dream means access to capital. Entrepreneurs are the difference-makers in our economy.

NAWRB: At NAWRB, we offer Minority Women-Owned Business certification specializing to the housing economy and support the active implementation of supplier diversity. You have been vocal about the need to expand lending to diverse entrepreneurs as the face of entrepreneurship is changing in America. What can businesses do to promote themselves to supplier diversity programs?

Maria Contreras-Sweet: Supplier diversity programs are an important way for both women-owned businesses and minority-owned businesses to expand and grow by securing more contracts with government agencies and major corporations. Supplier Diversity was first introduced right around the time that the SBA was established in 1953. Today, a big part of what the SBA and our resource partners do is help qualified businesses get certified for these opportunities. During registration, you’ll need to provide information on your business, including ownership data, an org chart, product and services information, references and certifications, and a summary of your company’s accomplishments. Some are put off by the paperwork requirements, but it’s worth the investment of time! Certification can be the first step in dramatically building your book of businesses.

Small businesses that secure corporate contracts increase their revenue by an average of 250 percent and increase their hiring by an average of 150 percent. Many large corporations are required to report to their boards their work to include women-owned and minority-owned businesses in their supply chains. And many large federal contractors are looking to create more diverse supply chains to meet their federal procurement targets for small and medium-size businesses.

After your business is certified, SBA can help make introductions to help you realize the benefits of certification. We hold procurement events, supplier conferences, and do 1-on-1 matchmaking with federal buyers and the key decision makers for prime contractors. You can reach out to your local SBA district office, Small Business Development Center or Women’s Business Center in your area to learn more.

NAWRB: Along with President Obama, you announced the launch of SupplierPay last July. We applaud this initiative as it will foster the success of small businesses through expedited payments from the companies that hire them. What is the progress of SupplierPay since the announcement?

Maria Contreras-Sweet: Small firms create two out of three new jobs in America and account for half of all private-sector employment. One-quarter of our small businesses are firms that primarily supply other firms. On average, corporations take 46 days to pay their invoices of their suppliers – namely, small businesses that provide them with goods and services necessary for their business. Waiting 46 days or more to get paid leaves small businesses without the capital they need to hire and invest in new opportunities or equipment.

Thanks to SupplierPay, companies are now committing to pay small business contractors faster. This way, small suppliers get the capital they need and larger companies benefit from higher-quality goods, more stable suppliers, and lower prices. Twenty-six companies joined the President in the initial launch of SupplierPay, and now, 21 additional companies have signed on to the pledge, including Xerox, IBM, Hallmark Cards, Kaiser Permanente, and Zappos.com.

As I’ve traveled the country and asked America’s small business owners their No. 1 challenge, I hear the same thing over and over again: They tell me: “Our customers love what we’re selling. I just need steady working capital to scale up so we can service more of them.” That’s what SupplierPay is all about. It’s about giving our entrepreneurs access to affordable, consistent working capital. It’s about paying them on time. And it’s about keeping their interest rates low so they can invest in new equipment, new products and new people.

After taking the pledge, Intuit offered 10-day payment terms to 320 small businesses and moved more than 80 independent contractors to contracts that committed to pay them within 10 days. Intuit’s actions will impact an estimated $40 million in payments this year. Lockheed Martin, the world’s largest security and aerospace company, sources more than 60 percent of its work through its supply chain. They are committed to paying 100 percent of small business supplier invoices on an accelerated schedule. The company’s supplier portal flags small businesses so Lockheed Martin can accelerate payment, cutting payment time in half to just 15 days.

The SBA will continue to hold SupplierPay working sessions to bring together both existing and new SupplierPay companies to discuss best practices companies are taking to implement the pledge and put metrics in place to track and measure impact of this initiative going forward.

NAWRB: Beyond small businesses in general, there is one type of small business that has developed immensely over the decades: women-owned small businesses. However, they still face many obstacles.

Earlier in your career, you were one of the commissioners for the Federal Glass Ceiling Commission which helped spearhead studies on the glass ceiling that suppresses women and minorities. Do you believe women are close to meeting parity with their male counterparts and how can women continue to break barriers in the workforce?

Maria Contreras-Sweet: I was appointed by the United States Senate in the mid-1990s to serve on the Federal Glass Ceiling Commission. Our job was to explore why the executive suite was locked for so many women and to suggest what could be done about it. At the time, 97 percent of leadership positions at Fortune 500 and Fortune 1000 companies were held by white men. This did not reflect America, and it sent a negative message to young professional women interested in starting careers in business.

So the Commission issued a tough report. I think our most dire finding was that the situation was bad today, but tomorrow wasn’t looking much better. There weren’t many women in the leadership pipeline at top companies. Not only was this outdated thinking, it was bad for business. Corporate America was wasting an enormous talent pool. One of the commission’s key recommendations was that the government had to reduce barriers for women. Twenty years later, I’m delighted to lead an agency committed to doing exactly that for women entrepreneurs.

Women have come a long way, but we still have a long way to go. More than one in four U.S. companies today is owned or led by a woman, and these firms employ more than 7.8 million Americans. The SBA is deeply committed to fostering economic opportunity for women, through our work in the areas of capital, counseling, and contracting. Since 2009, SBA lending to women-owned businesses has gone up 31 percent across our lending programs.

Twenty-six years ago, Congress passed the Women’s Business Act, which was a watershed achievement because it allowed women to get business credit without the signature of a male partner or relative. Congress recognized that women are builders – building businesses, building jobs, building homes. Now, it is up to us to ensure that the next generation of women can build their entrepreneurial dreams.

We all have a shared responsibility to champion diversity and workplace flexibility to help women succeed. We must give women the choice to be what their skills and hearts desire – be it a homemaker who stays home with the kids, or a home maker who owns the construction company that is building the next residential development.

NAWRB: Those statistics are truly inspiring. As an immigrant from Mexico and member of a working-class family, you are an inspiration as well and prime example of what hard work and determination can produce. What advice do you have for those that want to work in government and/or politics to enact change but feel they don’t have the economic means to get started?

Maria Contreras-Sweet: In Los Angeles, I was founding president of a group called Hispanas Organized for Political Equality – or HOPE. The group’s mission is to empower Latinas to become more fully engaged in our democratic process. We founded HOPE, because whether we’re talking about the local school board, the city council, state government, or the Congress of the United States, our elected officials are a reflection of the people who show up on Election Day to send them there. So I tell Americans that if they feel frustrated by gridlock or bedeviled at the pace of our progress, you have to vote and fully participate in our democracy. Nothing will change unless we make it change.

It’s a remarkable sign of the progress we’ve made that there are now three Hispanics in the cabinet for the first time in this nation’s history.These are important milestones to be celebrated. When I became a cabinet secretary in California in the 1990s, I was the first Latina to do so at the state level. Hispanics have come a long way in the last two decades. Today, we see the fruits of our efforts everywhere with more diversity and more inclusion throughout this administration, in governor’s mansions, in Congress, in starring roles in Hollywood, even on the Supreme Court.

NAWRB: From Vice President of Public Affairs for 7-Up/RC Bottling Company to founding ProAmérica Bank and now Administrator of the SBA, you have steadily risen in your career. Do you have any particular mentors or role models that have inspired you to persevere throughout your career?

Maria Contreras-Sweet: A wise man once said, “A lot of people have gone further than they thought they could because someone else thought they could.” I believe in the power of mentorship. As a former small business owner myself, I know it can often seem like a lonely road. On any given day, I could be called upon to be the company’s human resources director, CFO, spokeswoman, or chief sales officer, all while competing against larger firms in highly competitive markets. Today, I believe in the power of mentoring young people on my staff. Those of us who’ve come from difficult circumstances have a special responsibility and opportunity to lower the ladder and lift people up behind us.

Even on days when our small business owners feel like there’s no one in their corner, it’s important for them to remember there are mentors in every community in this country. Call your SBA district office, your local Small Business Development Center or Women’s Business Center. Look up your local SCORE chapter to get paired with a mentor. There are literally thousands of SBA staff and retired executive volunteers whose job is to make your job easier. Please look us up, because when small businesses succeed, America succeeds.

My role models were people like my mother and grandmother, who made so many sacrifices to enable me to be where I am today. I was born in Guadalajara, Jalisco, Mexico, and immigrated to this country when I was five years old. We didn’t have much, but what we did have was an abundance of hope and a belief that America is a land of opportunity.

When I arrived, I didn’t speak a word of English. My mother took the job at a poultry processing plant so her children could have opportunities that she never would. She worked long hours doing grueling work for minimum wage, while her kids went to school.

I come from a family of migrant workers. After we immigrated, my grandmother back in Mexico would write me these wonderful letters. She’d tell me that if I worked hard and played by the rules in America, anything was possible. She said, “Maria, you could even work in an office some day and become a secretary!” Well, the good Lord heard her. I do hold office and became a cabinet secretary in California and now I’m in the President Obama’s cabinet. Only in America!

NAWRB: After the resignation announcement of the previous Administrator, there was much speculation about who and when someone would be nominated. What were your initial thoughts on your nomination by the President? Your appointment has been applauded by many and very exciting changes have already occurred in your first 100 days.

Maria Contreras-Sweet: I was humbled to receive the call from the President’s team, and I was eager to get to work. As a former banker, my first order of business was to modernize the SBA and make it easier for small business owners to access capital and easier for lenders to lend. I immediately announced important regulatory changes to help entrepreneurs seeking real estate loans.

We threw out the wealth test. No borrower should be turned down because they enlisted a wealthy investor to help underwrite their project. We want small businesses to attract private capital. So we’re no longer scrutinizing the personal liquidity of every investor.

We eliminated the nine-month rule. Business owners were being told they waited too long to apply for a real estate loan. It can take time to organize a project; permits can take months or years to secure. So we changed the rules so that it doesn’t matter when you apply for the loan, as long as the expense is related to the project.

We changed our collateral rules to give borrowers more flexibility. Under the old rule, the property or equipment financed by what we call a 504 loan had to serve as the loan collateral. Now, borrowers can put up other assets to get into this program and get a lower interest rate.

After the Recession, SBA loans to minority communities dropped, but I’ve made it my top priority to get those numbers back up. We zeroed out fees on small loans of $150,000 or less, which is what our Main Street businesses need. Many small business loaned money out of their own pockets to their businesses, so they wouldn’t have to lay employees off. We should reward – not punish – this sacrifice. So we’re putting more weight on business credit than personal credit when evaluating a loan application.

NAWRB: In the recent passage of the National Defense Authorization Act (NDAA) for Fiscal Year 2015, the sole source authority restriction for women-owned businesses was lifted. How will this impact certified women-owned businesses?

Maria Contreras-Sweet: When President Obama took office, he tasked the SBA to issue a new rule to make it easier for women-owned small businesses to access federal contracts. If we want corporate America to become more diverse, the federal government needs to lead by example when it decides who to include in its supply chain. Under the new rule, Uncle Sam – for the first time – was to set aside specific contracting opportunities for women-owned businesses. It’s about equal opportunity and leveling the playing field. Women-owned businesses have grown by a remarkable 20 percent in just five years. More than one in four U.S. companies is owned or led by a woman, and these firms employ more than 7.8 million Americans. Currently, women entrepreneurs are receiving less than five percent of federal contracts, and we can do better.

I called for sole-source authority for women entrepreneurs in my first major speech as SBA Administrator and I lobbied the Chairman of the Senate Armed Services to include this authority in the defense-spending bill. I’m so gratified he did. This will give women entrepreneurs much-needed parity with other disadvantaged groups, who’ve used this authority to secure tens of millions of dollars in new contracts from the government.

To view this article and many others in its original form: Click Here

Login

Login