Founder & President of Money Strong, LLC, and author of Fed Up: An Insider’s Take on Why The Federal Reserve is Bad for America

Danielle DiMartino Booth

Danielle DiMartino Booth exemplifies the passion and unique perspective powerful women bring to the table. Chronicling life milestones—such as having college dreams pulled out from under her at the last minute and the process of writing her pioneering book on the Federal Reserve—the mother of four shares sage guidance with women and consumers, providing abundant food for thought about the future of our industry and country.

Interview by Desirée Patno

NAWRB: You have attended the University of Texas at San Antonio and at Austin and Columbia University in New York. Which of these educational institutions and/or cities do you hold most dear?

Danielle DiMartino Booth: San Antonio College. I was accepted into the scholar’s program at New York University; I was one of 15 individuals who were admitted to their journalism program who was then admitted to their really elite group of high school seniors in America. We were to go to one different country every year as part of the program; Russia would have been that first year.

They were going to pay for half of my education in New York; this was my life dream come true. As soon as I received my acceptance letter my father informed me that he hadn’t been paying his taxes for several years and that I wasn’t going to any university, my parents were going to be getting a divorce and I might want to consider community college.

It was one of those formative moments in my life and I was forced to go off to community college. I was working probably 80 hours a week at the time, even as a high school senior, to make my way and help my mom. I entered community college as bitter as you can imagine.

I emerged two years later with the ability to start at the University of Texas at San Antonio with a great degree of respect for kids who have nothing and are forced to start in community colleges and keep going. That’s where I started and I kept going.

The one journalism program that did reject me in my high school years, even though I had been an editor and planned to become the supreme writer—I wasn’t going to Wall Street, the big lights and big city to work in finance; I was going to be a writer—Columbia University rejected me and NYU let me in, but by golly, later on in life you see where I got my second Master’s. It all started in community college.

The one journalism program that did reject me in my high school years, even though I had been an editor and planned to become the supreme writer—I wasn’t going to Wall Street, the big lights and big city to work in finance; I was going to be a writer—Columbia University rejected me and NYU let me in, but by golly, later on in life you see where I got my second Master’s. It all started in community college.

There are two things in my life that shaped who I am, over which I have no control. They were: being forced to abandon my dream of being a journalist when I was all of 16 years old, and September 11. Those were two monumental, pivotal moments in my life that changed everything. You have to accept that that is what life is sometimes.

We came to find out years later that my father has basically bribed my mother’s divorce attorney. This is before the IRS introduced innocent spouse laws. My mother and I didn’t realize that giving up everything but the shirts on our back—including the house, the cars, everything that presented this façade of wealth that was a lie—didn’t mean we could walk away free. My mother worked for the Disability Division of the Social Security Administration for 37 years and because my father bribed her divorce attorney, she was never informed that the debt would be fully on her as well, 50 percent of it. So, we lost everything and my mother’s wages were garnished from day one.

It was traumatic and bear in mind, my father taught at the university I eventually had to attend, there was no other place for me to go but the University of Texas at San Antonio after the two years of community college. I had to see him in the hallway because he was the most popular instructor on campus. He was Mr. Eco Finance, which I swore I would never ever touch. As God is my witness, I will never go into finance.

Not a lot of this is in the book. The publisher wanted for me to tell a story that helped people become financially literate, that’s what Fed Up is all about. It’s about translating the huge, too-many-syllable econometrician mumbo jumbo speech so that the average working American can understand what economics and finance is all about.

As far as I’m concerned, financial literacy is sorely lacking in this country, and if I have to pull the curtain back and translate it for everybody, fine. I took that on.

NAWRB: Congratulations on your new book, Fed Up: An Insider’s Take on Why The Federal Reserve is Bad For America! What is the most valuable lesson you’d like readers to take away from Fed Up?

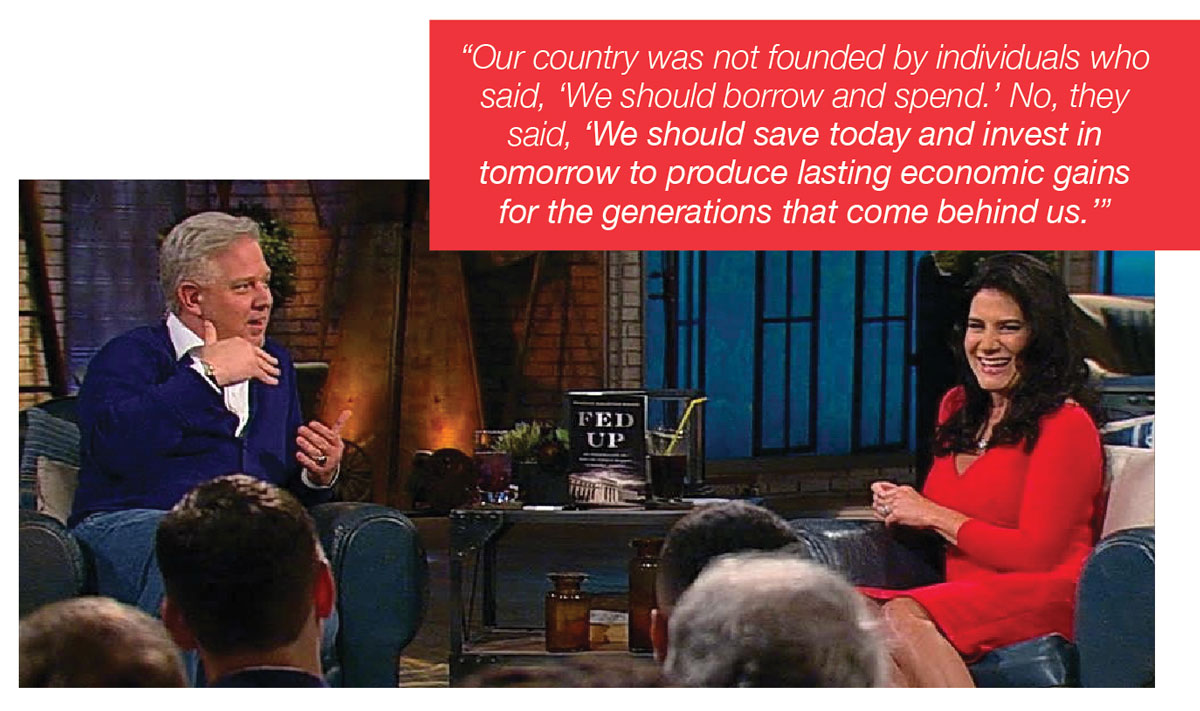

Danielle DiMartino Booth: The greatest takeaway for me is, counter to what our politicians and central bankers tell us, it is not our patriotic duty to take on debt, it’s not. Our country was not founded by individuals who said, “We should borrow and spend.” No, they said, “We should save today and invest in tomorrow to produce lasting economic gains for the generations that come behind us.”

Instead, we’ve gone the opposite direction as a nation and buried ourselves in debt, whether you’re talking about Uncle Sam himself, corporations, or households on an individual level. We have become a nation of borrowers, and that is not what we should be. I want for Americans to understand, from day one and the first paycheck they get, it’s okay to go out and spend that and then some, and it’s also okay to save your money so you can eventually invest it in something you can build.

Instead, we’ve gone the opposite direction as a nation and buried ourselves in debt, whether you’re talking about Uncle Sam himself, corporations, or households on an individual level. We have become a nation of borrowers, and that is not what we should be. I want for Americans to understand, from day one and the first paycheck they get, it’s okay to go out and spend that and then some, and it’s also okay to save your money so you can eventually invest it in something you can build.

In his recent published biography [Alan Greenspan] admits that he wanted to be popular in Washington, and that even though he knew that there was damage being done to the household sector, and that the housing situation was going to be harmful, he didn’t want to make any waves.

It’s just disturbing to me if you look at where we are today in the economic cycle. Now we’re talking about subprime car loans, and every economist will tell you that they don’t matter because it’s a small industry. My rebuttal is, do you realize that you’re harming the same exact individuals who got hurt most by the subprime house crisis, again? And then they scratch their heads in their ivory towers and can’t make heads or tails as to why we have an angry populace.

I can tell them exactly where the anger is coming from; they don’t need to put it into a model. This gets to the root of debt turning hardworking Americans into indentured servants. It’s just wrong.

NAWRB: What was the most difficult aspect of writing the book?

Danielle DiMartino Booth: Not getting sued. It was truly the fact-checking; there are 100 pages of endnotes. It was a huge, tall order because you can’t criticize people who have nothing over which to be criticized if you don’t do your homework. It was making sure that I dotted every single “i” and crossed every single “t” so that the sacrifices my family had endured wouldn’t be all for naught.

I’m proud to say that there were only two things that the Penguin Random House attorneys took issue with after they had the final manuscript in hand, and they were minor. It’s so cliché to say to do your homework, and trust me when I tell you I say it a million times a day; why did I pray for boys? Do your homework and that way your work is not questioned.

Writing a book is not a walk in the park, it’s not easy. You have to weave a story and deal with editors. I was expecting some aspects of this. Think about Timothy Geithner’s book, what was it titled? Stress Test. What about Ben Bernanke? The Courage to Act. Hank Paulson’s was On the Brink. These are self-congratulatory tones about central banking and the inside of the Treasury.

Fed Up is the first of its kind from the inside. You’ve got a bunch of people wearing tinfoil hats out there who criticize the Fed all day and all Sunday, but you show me a book that’s from an insider’s perspective. I had to make sure I covered myself because these people do not like to be criticized.

NAWRB: What is the single biggest concern of which consumers need to be aware in the current marketplace?

Danielle DiMartino Booth: In a nutshell, public pensions. I have a friend of mine who lives in Stockton, CA and she told me what the average California taxpayer’s bill is to cover state and local pensions. If there’s one thing that I write about continuously, it is the public pension situation that the average American does not know about that is coming soon to a city or state near you.

It will affect the social fabric of our country and the way our economy operates for the next few generations, as Baby Boomers move from being actuarial assumptions to cash flow realities. This is a situation that has not been covered that will affect each and every one of us.

People do not understand. Cook County, IL, if you look at the most recent Census data, had the largest outmigration of any major metropolitan area last year. That is people trying to escape this massive pension burden that is barreling down on the state of Illinois and the city of Chicago. They’re moving to places like Texas and Florida where there is no income tax, which is intuitive, but it only works in a vacuum for so long. Once people realize that their federal taxes are going to be rising, it’s going to affect all of us.

People do not understand. Cook County, IL, if you look at the most recent Census data, had the largest outmigration of any major metropolitan area last year. That is people trying to escape this massive pension burden that is barreling down on the state of Illinois and the city of Chicago. They’re moving to places like Texas and Florida where there is no income tax, which is intuitive, but it only works in a vacuum for so long. Once people realize that their federal taxes are going to be rising, it’s going to affect all of us.

When I write about pensions it elicits such anxiety from the readers of my weekly newsletter. Say you’re a teacher who has taught in San Francisco your entire career, you’ve earned your pension. You could have worked in a more lucrative industry but you didn’t, you knew you had that security for life coming and you wanted to do what was right by society, teach the children of tomorrow. Wonderful. Do you deserve your pension? Absolutely.

Let’s consider a different person in San Francisco who has a 401k plan and whose taxes are going through the roof because they have to pay for that underfunded pension. They feel as though they’ve been wronged. You know what? They’re right, too.

Women have longer life expectancies, so we need our retirement investments to last longer. I’m gravely concerned about an elderly poverty issue in this country and things like people losing their homes to foreclosure because they can’t afford to pay their property taxes.

The average homeowner is more in debt now than they were in the 2008 crisis. We recently surpassed that threshold, but we don’t have as much to show for it as we did in 2008. In 2008, on paper it looked like we had home equity. The debt that’s been taken on since 2008, since the last peak of household debt, is unsecured. These are student loans, car payments, credit card debt; this is not mortgage debt where you’re building something up over a factor of time so that you own a home over your head when you want to retire. It’s a completely different kind of household debt, and it is pernicious.

These are intractable situations that are going to begin to tear at our social fabric and present massive challenges for the politicians of tomorrow to undertake. Nobody wants to talk about it because it’s such a big situation. Pay attention to pensions, wherever you are.

NAWRB: In 2017, MarketWatch named you one of the four economists to watch in the Trump era. What makes you one of the country’s top economists? Is this a characteristic you’ve always held, or did you develop it throughout your career?

Danielle DiMartino Booth: The reason I had value inside the Fed is that, unlike so many of the PhD economists there, I didn’t have an agenda or intellectual axe to grind. I wasn’t a Keynesian or a Ricardian. There was no school of thought that I was following or trying to push forward. I just wanted to study the data, understand the financial markets and communicate how that should affect what the Fed should do as we headed into this great financial crisis and bursting housing bubble.

I’ve always had the reputation of being an independent thinker and not caring what people think about my views, because I just say it like it is. I think that when Trump was elected people gravitated toward my views because they also viewed Trump as being not beholden to any special interests and lobbyists. The independent thinking aspect and the way I view economic data in the financial markets has set me apart and established my reputation.

I’ve always had the reputation of being an independent thinker and not caring what people think about my views, because I just say it like it is. I think that when Trump was elected people gravitated toward my views because they also viewed Trump as being not beholden to any special interests and lobbyists. The independent thinking aspect and the way I view economic data in the financial markets has set me apart and established my reputation.

I think some of it is DNA. The other side of it is that I had to overcome a fear of being confrontational. My mother was, is, and remains to this day my rock. Without her I would not be grounded at all. I’ve had to learn certain things in life from the mistakes that she makes. My mom being non-confrontational is a weakness that I’ve had to recognize. As a businesswoman, I’ve needed to gain the ability to be confrontational in order to save my company. Sometimes you have to learn from what your parents can’t teach you.

NAWRB: Are other moments in your life or career that stand out to you as pivotal to the path you chose and the manner in which you approached it?

Danielle DiMartino Booth: I’m not a feminist, and I don’t think men and women should be judged differently based on whether they’ve got certain body parts or not. I was raised on a trading floor where you are what you eat, you are what you produce, and that is your value to the firm. But, I will tell you, when I was in the operating room having an emergency C-section and heart attack as I delivered my twins, and they said it was a girl, everything changed in that moment.

Not because I don’t think my daughter can accomplish just as much as any man; it changed as far as how I viewed my career path. I had to all of a sudden become my mother all over again because you can tell a boy they can grow up to be anything they want, but you have to show a girl.

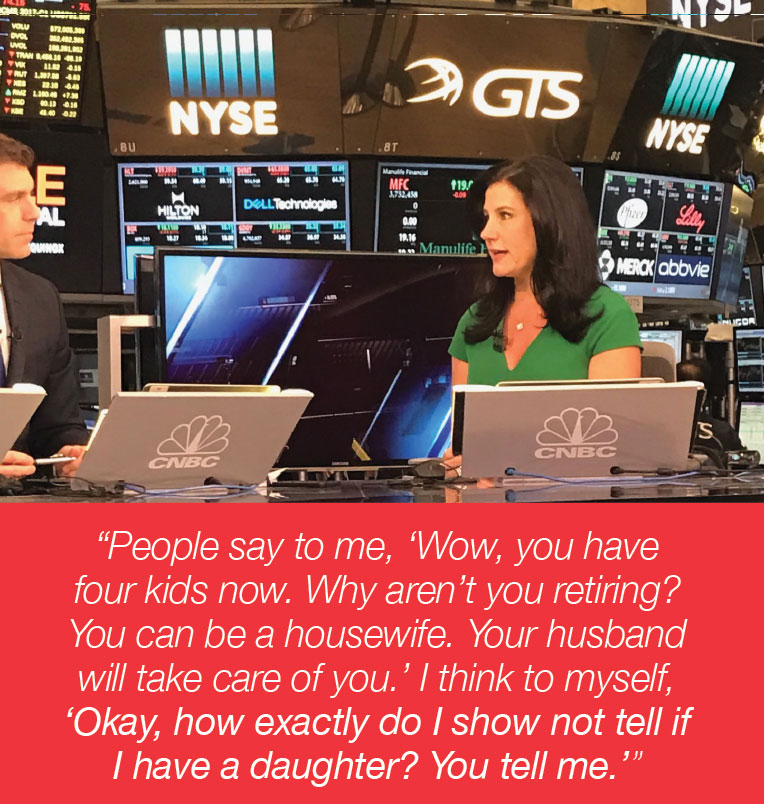

People say to me, “Wow, you have four kids now. Why aren’t you retiring? You can be a housewife. Your husband will take care of you.” I think to myself, “Okay, how exactly do I show not tell if I have a daughter? You tell me.”

I live in a very tony area of the world where a lot of the girls grow up thinking that as long as they’ve got the right shade and length of blonde hair, and they get on the drill team, that they’re going to succeed in life because they’re popular. That works for your ego but it’s not long-lasting.

My one regret is showing my daughter my closet. Be careful out there, women. Now she’s my shoe size at nine years old and I have to tell her, “That’s not reality, that’s a parallel universe in my closet. You don’t need that many shoes.” She asks, “Well, why do you need that many shoes?” I tell her, “Because I said so.” You can’t show girls everything, including shoe collections.

NAWRB: Who has inspired you most throughout your life?

Danielle DiMartino Booth: By a country mile, my mother. The most inspirational thing she has taught me is work ethic. She has taught me to never quit and to do right by my children no matter what the sacrifice might entail.

These are things that she showed me, she didn’t tell me. She showed me by working overtime every weekend so that I could be afforded a few hours here and there to study.

I knew well before I left the Fed that I would be writing the book. She said at the time, “This is important to you, this is important to me. I’ll be there for you.” There have been times during the writing of the book that she had to move in because you can’t really hit a button and put your four kids on remote control. William, my oldest, just turned 13. Henry, my middle, is 11. Caroline and John Jr., the twins, are nine. My mother continues to sacrifice to this day and she continues to be my main inspiration.

NAWRB: Have you encountered gender or diversity-based obstacles in your career? If so, what were they and how did you succeed past them?

Danielle DiMartino Booth: There were obvious gender biases on Wall Street, but it didn’t really matter as soon as I became the highest-producing person in my class. It wouldn’t have mattered if I had three heads and was of a third sex. I was surprised at the elitism inside the Fed. My supervisor said, “Well, you don’t have a PhD, but at least you have a Master’s from an Ivy League college and you dress better than anyone in the building.”

When I worked on Wall Street they wanted to send me to sensitivity training. I was pretty bad; I called my two sales assistants “girls” who were boys.

When I was born, I was named Danielle Renee DiMartino. They would judge the baby’s sex back then by how the mother was carrying them, so they thought I’d be a boy. I was named after a French airline pilot that my father had met during the Vietnam War, Daniel Rene. All they did was slap an “e” to the end of both names and voila, there I was a girl.

I was a tomboy; I’d run up and down the street in the summertime wearing shorts and nothing else because that’s what the boys got to wear. My mom would say, “No, come back here and put a shirt on young lady!” I never really grew up with the distinction. I had an office in my bedroom growing up, not dolls. I was trying to run pretend businesses.

I was a tomboy; I’d run up and down the street in the summertime wearing shorts and nothing else because that’s what the boys got to wear. My mom would say, “No, come back here and put a shirt on young lady!” I never really grew up with the distinction. I had an office in my bedroom growing up, not dolls. I was trying to run pretend businesses.

NAWRB: What financial advice would you give to recent college graduates entering the job market while balancing high living costs and significant student loan debt?

Danielle DiMartino Booth: This is a toughie. I’ve just written recently about this subject. The best news that I can offer is that there are record levels of apartments coming online this year and next year. At the same time, we’re seeing a breaking point in home prices, and we know they are finally starting to decline.

My best advice would be, if you can live the new cliché American dream and stay with your parents for a little while or get two or three roommates, there is relief coming your way. Don’t be tempted to spend 60 percent of your income to get that apartment when it’s going to eat up everything you have and the ability to pay off your student debt and start saving for tomorrow.

They released a study a few weeks ago that showed the average American spends $56,000 a year, 33 percent of that goes to housing expenses, 19 percent goes to what you pay for your car. Your biggest line item in your budget, regardless of how old you are, is housing.

What you have to do is resist the siren call of some fancy apartment where you’re completely strapping your budget in order to live there. Do what you can to not spend money right now on overpriced housing, whether it’s renting or buying, and open up your first IRA. Start saving your money now, but don’t put it in the market. I know it sounds counterintuitive, but bull markets do not end well and we’re coming to the end of a very long bull market.

Having roommates or investing in a home with three or four people is really smart financial innovation and a way to buy yourself time. Work as hard as you possibly can, save your pennies, and be innovative in terms of ways to save your dollar.

I say this to young people all the time, “You become higher maintenance every single day of your life. Relish, embrace those chapters in your life when you’re so low maintenance that you can live in a shoe box, because you won’t have the patience for it later on in life, and you won’t want to be forced into that situation later on. Right now you don’t care. Capitalize on that financially and live as frugally and as minimally as you possibly can.”

If there’s one thing specifically related to residential real estate that keeps me up at night, it’s the concern over who will buy Baby Boomers’ homes. We have 10,000 Baby Boomers retiring every day, an entire generation of first-time homebuyers who aren’t in the position to buy the move-up homes, such that the people in move-up homes can then buy the Baby Boomers’ McMansions. What are we going to do unless there’s a big air pocket underneath of price decline for higher-end homes?

NAWRB: What career did you envision pursuing when you were a teenager? Is this still a passion of yours?

NAWRB: What career did you envision pursuing when you were a teenager? Is this still a passion of yours?

Danielle DiMartino Booth: I grew up wanting to be a journalist and now I’m a Bloomberg columnist. I don’t regret Wall Street and I don’t regret being a central banker. These jobs were as formative as anything else. I’ve combined every aspect of my life, whether it was planned or not, into my current career and I’m my own boss. If there’s an issue with management, I just need to turn around, look in the mirror, and move on.

NAWRB: What do you believe is the power of homeownership for women? In today’s economy, what is the best way for women to build wealth?

Danielle DiMartino Booth: There is wealth to be had in owning a home, I certainly wouldn’t deny that, but there’s also wealth to be lost in buying an overpriced home. The advice I would give to women would be to speak to a real estate agent who’s been in the business for more than several decades and understands what a long-term price per square foot should be, the economic key leads enough to know that we’re in the third-longest post-war economic expansion in U.S. history, and that if you do have to rent before buying, that’s a better option than buying an overpriced home.

I think timing can be everything and you don’t have to be buying in this overpriced market.

NAWRB: Your weekly newsletter has over 20,000 subscribers and LinkedIn ranked you the 3rd Top Voice in 2016. What marketing advice do you have for women entrepreneurs attempting to widen their network and increase exposure of their products and services?

Danielle DiMartino Booth: Be unrelenting and know what you do for a living. I come across make-up artists from time to time, thank God, because what would I look like on TV without fake eyelashes? These make-up artists use Instagram, and that’s their perfect platform. Figure out your best social media fit.

For me it was LinkedIn because just their markets and economic division has eight floors of the Empire State Building, so that pretty much explained it to me. LinkedIn was going to be the best conduit to reach potential readers, subscribers and book buyers. Twitter is my number two because it helps me be a voice out there, a public speaker.

Understand which social media platform is going to fit your career path the best and put all your effort into it. This is something they teach you on day one on Wall Street, you have to know yourself and you have to know your client. If you are your own client, you should know which platform is going to maximize your exposure and stretch your marketing efforts and dollars the furthest.

I’m always distressed when I see Twitter feeds where people get sucked in by their critics or they get pulled into a discussion in which they really don’t belong or even worse, if profanity starts flying around. This goes back to standing up for yourself and being confrontational. If something offends you or you don’t want to be a part of it, say so. I say it on my Twitter feed all the time. It has not failed me yet.

NAWRB: What is something about you most people don’t know that they would be surprised to find out?

Danielle DiMartino Booth: When I was 17 years old I went off half-cocked and drove through Mexico for six weeks. I just about turned every last hair on my mother’s head white. I speak fluent Spanish, even though I’m Italian by blood, but my passion for the Latin American culture is such that I ended up moving to Caracas, Venezuela. That’s where I did my summer internship.

I fell in love with the Venezuelan people and actually worked in the steel industry when I was there. I am a total groupie for industrial metal as well as the plight of the Venezuelan people and I don’t think we’re paying enough attention to what’s going on down there. Some days I wake up and say, “Where’s the CIA, where’s the justice in this world? We know as a country that there are children dying every day of starvation in a country that is as abundant in natural resources as Venezuela.

I’m a total Salsa and Merengue dancer and a Latin freak, but most people probably wouldn’t know that about me.

NAWRB: What goals do you have on your horizon, either in your personal or professional life? Where do you see yourself in 10 years?

Danielle DiMartino Booth: I’m hoping that I end up being a very vocal voice for financial literacy, to be impactful and be on several boards. I think CEO compensations are way off the reservation and we need better accountability among boards in this country. My main goal is financial literacy, spreading the word and making it accessible for everybody. That puts us on a sure footing as a country. I’m not shooting for hyperbole here, but it might be a communist country and they might do financial regulation at gunpoint, but all four of my children take Mandarin because I worry about the long-term viability of a country that revolves around the creation of debt and whether or not the reserved currency status of the dollar is at risk.

Reserved currency status tends not to be lost without a real war occurring, not a currency war. With three boys, I’d rather have them working at the state department decoding and knowing Mandarin like the back of their hands than on the front lines. These are the things that I worry about which financial literacy could begin to resolve.

NAWRB: How do you enjoy spending days when the office and work responsibilities aren’t on your mind?

Danielle DiMartino Booth: I take the opportunity every single time I get pneumonia to binge watch a documentary on Netflix. That’s when I stop, when I get pneumonia. The Crown is my most recent binge watch that I’ve done.

Danielle DiMartino Booth: I take the opportunity every single time I get pneumonia to binge watch a documentary on Netflix. That’s when I stop, when I get pneumonia. The Crown is my most recent binge watch that I’ve done.

Anytime I’ve remotely enjoyed anything, it’s typically been binge watched on Netflix from the comfort of my bed. I might be surrounded by my twins, watching a six-part biography on the Great Barrier Reef, but these are times when my brain can literally shut down and stop with the constant feed. Typically the stock market is closed, that’s great.

As long as the stock market is open I actually can’t function in a relaxing manner. That’s part of what was so weird for me working at the Federal Reserve. At 11 o’clock they’d go to lunch, they’d go to the executive dining room and shoot the breeze, and come back at 1 o’clock. I would think, “How can anybody walk away when the market’s open for two hours, I don’t understand.”

I highly recommend binge watching something that has nothing to do with what you do every day and just plugging in.

Login

Login