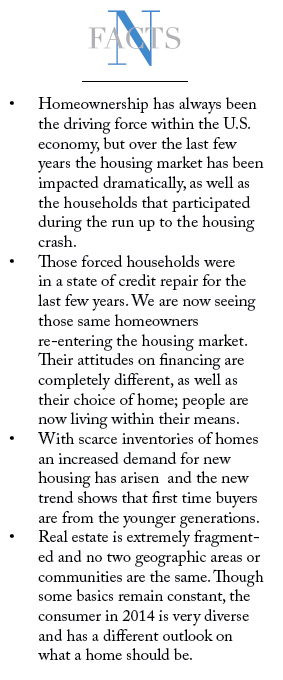

The Great Depression left the United States with widespread unemployment and financial collapse. Two million construction workers were out of work. Home mortgages were typically short-term loans that were limited to 50% LTV. In 1934, the National Housing Act created the Federal Housing Administration (FHA) to improve housing conditions and provide a more accessible housing finance system to rejuvenate and stabilize the broader housing finance market that was then only serving borrowers with means. Today’s FHA is still focused on stabilizing the broader housing markets by ensuring that properly documented and qualified borrowers, including those in the low to median income ranges, and in some cases, those adversely affected by and recovering from the recent economic crises, can systematically access affordable mortgage financing, purchase good, safe homes priced at or below the median income.

The end of 2013 marked the expiration of the emergency legislation implemented during the economic crisis from which the US is only now recovering. In similar fashion to the Depression era emergency legislation initially creating the FHA, the Economic Stabilization Act (ESA) of 2008, now expired, and it’s successor, the Housing and Economic Recovery Act of 2008 (HERA) both included provisions to stabilize the broader housing markets when the US housing market had been once again roiled by a severe national economic crises.

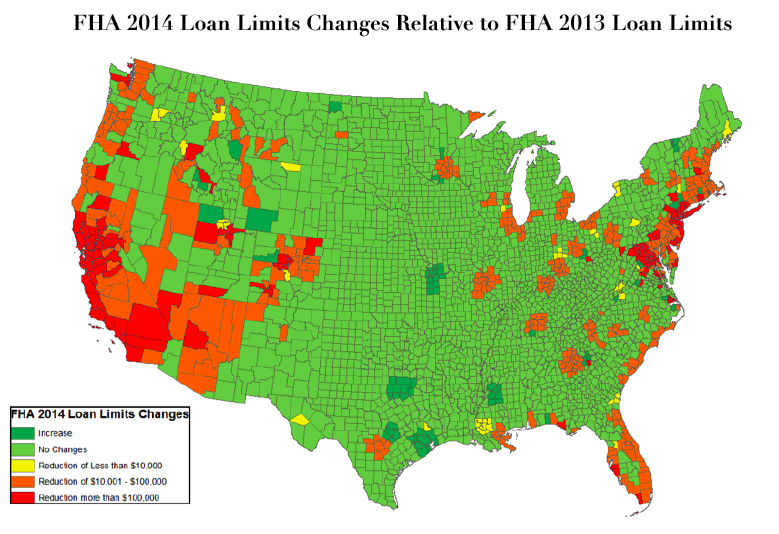

ESA increased the national FHA loan ceilings nationwide and allowed the highest cost markets to hold a $729,750 loan limit to maintain housing finance liquidity. Now, the HERA regulations reduce the national loan ceilings in approximately 20% of the more than 3,200 counties for which FHA establishes loan limits, adjusting for median house price corrections and recovering markets. Under HERA, the highest cost markets now have a loan limit of $625,500 – a reduction of $104,250.

Tom Clifford, Branch Manager of New American Funding in Paulsbo, Washington shared, “Yes, we have been affected by the FHA loan limit reductions in Washington State. Our county limits decreased from $475,000.00 to $307,000.00. The larger challenge however, is the drastic increase in the monthly MIP (mortgage insurance premium) making it a monumental challenge for median income homebuyers to afford FHA financing with home prices stabilizing and or increasing.” Clifford goes on say that “Realtors are telling their buyers that FHA financing is not a viable option any longer and steering them away, which has not been the case in years/decades past.”

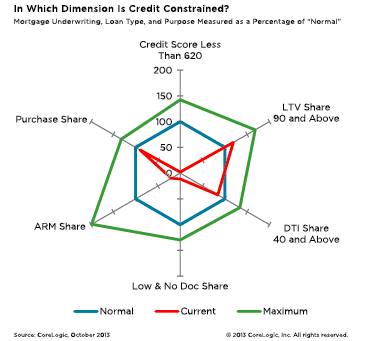

Nevada Area Sales Manager for New American Funding, Chris Garza, also confirms the lower loan limits “have negatively impacted [Las] Vegas.” In addition to the downward pressure that reduced loan limits are having on the prospective homebuyer’s purchasing power, Garza says that “…Fannie Mae and Freddie Mac having much tougher…credit guidelines,” is also negatively impacting the Nevada market. So let’s unbundle each of these significant changes and the effects they’re having on the housing markets and the borrower’s purchasing power. In both of these high cost markets, the senior mortgage professionals identified three major changes; (1) The HERA implementation lowering the FHA and Conventional (GSE) loan limits; (2) the increased Mortgage Insurance Premiums required to insure the FHA loan product, and (3) the seemingly more restrictive credit environment in which the GSEs are operating.

2014 Loan Limits

On December 6, 2013, HUD announced the new loan limits with the January 1, 2014 effective date. Fortunately, the first-time and affordable homebuyers seeking to purchase homes in markets where the housing costs remain low, did not experience any loan limit changes. Their maximum available loan amounts remained at $271,050.

However, about 652 (20%) of the 3,234 counties for which HUD sets loan limits, will see reductions to their maximum loan amounts as FHA implements the long delayed requirements promulgated by the HERA legislation. These 652 counties are considered “high cost” markets and FHA historically provided for them to have loan limits higher than the median housing price for that county. ESA allowed the ceiling to rise to 125% above median housing price to keep mortgage funds available and sufficient to cover the high house prices created in the advent of the crises. HERA corrects the ceiling in these high-cost markets to 115% of the county’s current median housing price.

It’s important to understand that the emergency legislation deployed through ESA enabled the federal government to fill the housing finance liquidity void created by the mass and abrupt exodus of private sector financing during the U.S. mortgage crisis. Housing is the second largest contributor to our nation’s Gross Domestic Product (GDP), historically comprising 17-20% of GDP and second only to Consumerism, and the federal government could not allow the funding for housing finance to evaporate. This temporary emergency measure was intended to be a short term “plug” and, in 2009 was to be replaced by the more sustainable and permanent HERA, which amended the National Housing Act to tie the FHA’s loan limit “ceiling” and “floor” to the conforming loan limit standard used by Fannie Mae and Freddie Mac.

We can see in the graph above, that as a result of HERA, 183 counties across the US now have loan limits that are lower by a whopping $100,000 or greater!

As you might expect, California felt the heaviest impact of HERA, with 54 counties receiving downward adjustments. In contrast, Texas saw 27 counties receive upward adjustments. While California was the largest issuer of FHA Single Family endorsements in 2013, in both dollar volume ($24.7B) and loan count (89.1MM), only 7.7% of those issuances were above the 2014 loan limits.

Nonetheless, reductions of this nature have constrained the purchasing power of borrowers in the impacted markets, causing them to rethink their home buying strategy and possibly even their timing.

The map above provides a visual depiction of the heavily impacted markets.

Note that the concentration of “reds” and “oranges” are along the coastal regions where population density is higher. Typically, the high and highest cost markets are designated as such as they tend to also be higher job producing markets, which create higher density populations, which in turn create higher housing demands. And as we all know, increased housing demands tend to increase house prices.

So why is all of this important for the real estate professionals working across the housing continuum? The job seekers filling the red and orange landscape fit the traditional first time homebuyer profiles for which the FHA program was developed. 2013 was a very strong recovery year for housing prices, with many markets showing strong improvement. And even though some of these high and higher costs markets were hit so severely during this economic crisis, they had risen so high prior to it, that with the reduced loan limits, their current prices are out of reach for the gainfully employed first-time homebuyer. Legitimate homebuyers who managed to save the 3-3.5% required to buy their entry level home were also located in those 183 counties who’s loan limits were reduced by $100,000 or more. Where do they now derive the additional funds to fill the down payment gap created by the reduced loan limits?

The National Association of Realtors (NAR) reports that in a normal market environment, first-time homebuyers consummate 40% of home sales. By the end of 2013, NAR reported that only 28% of the home sales were to first time homebuyers!

At upwards of 80%, the GSEs and FHA remain the main sources of housing funding. While it’s important to enact the requirements of any final piece of legislation, would it have been truly detrimental to have enacted these particular requirements/corrections in phases? Especially, since it had already been completely delayed 5 years past its legislated enactment date.

Brainpower and models much larger and more intense than ours evaluated these changes and made the decision to move forward on all fronts in one swooping, market pervasive move. With the overall economic recovery still progressing very slowly, the recovery in the housing sector still far from “full-steam-ahead”, and the prevailing lack of meaningful private financing, one begins to wonder. Is it possible that all three agencies are repressing “bubble” fears?

Come back next month to get our perspective on drivers and impacts of FHA’s higher MIP and the increasingly “intense” credit mindset in the conventional loan arena.

—

Ingrid Beckles

Founder & CEO of The Beckles Collective, LLC

NAWRB’s Regulatory & Policy Chair

ibeckles@thebecklescollective.com

Login

Login

The Inland Empire is comprised mainly of blue-collar workers, and a potential industrial spike will likely increase blue-collar jobs. In John Husing’s same presentation he highlighted that manufacturing could be a major growth source for the Inland Empire. This in turn will attract more workers, and as a result increase the demand for housing. With the median wage for manufacturing sectors between $40,000-$55,000, and using the industry standard that a mortgage payment should not represent more than 35 percent of monthly wages, the higher quartile of blue-collar workers qualify for a $225,000 dollar home, with a 3.5 percent down payment. What the above figure describes is a need for moderately priced housing.

The Inland Empire is comprised mainly of blue-collar workers, and a potential industrial spike will likely increase blue-collar jobs. In John Husing’s same presentation he highlighted that manufacturing could be a major growth source for the Inland Empire. This in turn will attract more workers, and as a result increase the demand for housing. With the median wage for manufacturing sectors between $40,000-$55,000, and using the industry standard that a mortgage payment should not represent more than 35 percent of monthly wages, the higher quartile of blue-collar workers qualify for a $225,000 dollar home, with a 3.5 percent down payment. What the above figure describes is a need for moderately priced housing. Scott Kueny

Scott Kueny

Mel Watt, Director of the Federal Housing Finance Agency (FHFA), is facing mounting pressure regarding his decision to lift a temporary suspension on allocating funds to the national Housing Trust Fund (HTF) and Capital Magnet Fund (CMF). With the lifted suspension, 4.2 basis points of each dollar of the unpaid principal balance for new business purchases from Fannie Mae and Freddie Mac will be diverted towards the funds.

Mel Watt, Director of the Federal Housing Finance Agency (FHFA), is facing mounting pressure regarding his decision to lift a temporary suspension on allocating funds to the national Housing Trust Fund (HTF) and Capital Magnet Fund (CMF). With the lifted suspension, 4.2 basis points of each dollar of the unpaid principal balance for new business purchases from Fannie Mae and Freddie Mac will be diverted towards the funds.