This month marks the 35th anniversary of the Small Business Development Center (SBDC) program, the foremost small business assistance network in the United States. The SBDC program is hosted by educational institutions and state economic development agencies, and is financially supported partly by the United States Congress through the U.S. Small Business Administration (SBA). Continue reading

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Monthly Archives: September 2015

WIPP International President Participating in the Women-20

Women Impacting Public Policy International (WIPP International) has announced that President Jennifer Bisceglie will participate in the Women-20 (W20), a recently-formed engagement group dedicated to advocating gender equality and inclusiveness. Continue reading →

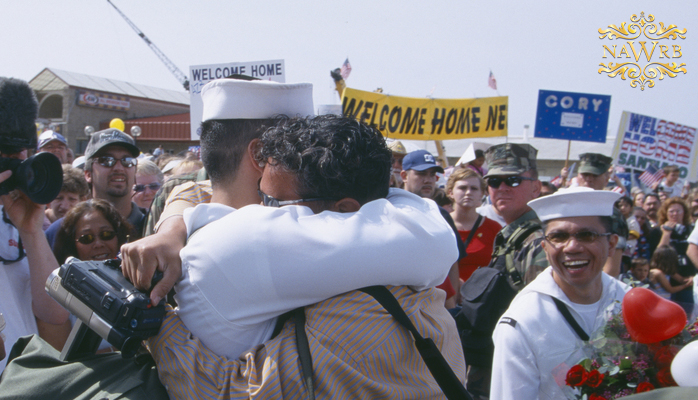

Military Lending Final Rule

Last week, the Department of Defense (DOD) issued a final rule modifying regulations set forth in the Military Lending Act (MLA). Passed by Congress in 2006, the MLA was created to protect active duty service members and their families from elevated interest rates in credit transactions, limiting the Military Annual Percentage Rate (MAPR) to 36 percent. The rule provides additional protections to military members from numerous credit products that the existing regulations do not address. Continue reading →

A Win for Women-Owned Small Businesses

The Women-Owned Small Business (WOSB) Program allows Federal contracting officers to limit competition for Federal contracts to qualified Women-Owned Small Businesses (WOSBs) or Economically Disadvantaged Women-Owned Small Businesses (EDWOSBs), in select industries. Continue reading →

HUD and FHA Encourage Home Inspections

It is a good time to be an American consumer. Last decade’s housing bubble left behind a collapsed market and millions of disheartened and mistreated homebuyers. If the current effort to protect consumers suggests anything, it’s that if a phenomenon like the housing crisis occurs again, it will not be as a result of inattention or irresponsibility from the housing sector. Continue reading →

On the Move: 10 September 2015

NAWRB recognizes Aerial Development’s Turner with Gershwin Award

The National Association of Women in Real Estate Business has honored Britnie Turner, founder and CEO of Nashville-based Aerial Development Group, with its 2015 Gershwin Award.

Turner was recognized Aug. 18 during the NAWRB gala awards and annual conference in Long Beach, California.”The Gershwin Award honors the woman who is writing a soundtrack for success while mentoring fellow members in an effort to foster and grow new talent,” according to a NAWRB release.

At 21, Turner founded Aerial Development Group, which bills itself as a “social venture real estate development company that revitalizes urban neighborhoods and supports orphans in Kenya.”

Continue reading →

China’s New Middle Class

China’s economic Great Leap Forward stands as one of the defining moments of the closing of the 20th century. Now an economic powerhouse, China and its $3.7 trillion in foreign exchange reserves are viewed by some with fear and trepidation. Others see it as an immense opportunity to create more widely shared prosperity, bring people closer together and remove barriers in the way of understanding and peace. Continue reading →

NAWRB Brings Women To The Forefront Of The Historic Diversity And Inclusion Movement

IRVINE, CA – Last month, the National Association of Women in Real Estate Businesses (NAWRB) held its 2nd Annual Conference in Long Beach, CA seeking newfound ways of connecting resources and sharing best practices across women’s platforms while bringing women’s diversity and inclusion (D&I) to the forefront of the housing continuum. “As a leader through this exciting and historic D&I movement, our primary focus is bringing women to the forefront with accountability and results. Through our Diversity & Inclusion Leadership Council, we are championing all financial institutions, servicing companies, secondary mortgage

“As a leader through this exciting and historic D&I movement, our primary focus is bringing women to the forefront with accountability and results. Through our Diversity & Inclusion Leadership Council, we are championing all financial institutions, servicing companies, secondary mortgage markets and associated real estate services to increase their D&I efforts especially for women. As women don’t have geographical roots like their minority counterparts, we are spread thin across several platforms and are even skeptical of one another. As a collaborative community, women must support women in their respective industries and ultimately they will secure sustainable growth,” stated Desirée Patno, CEO of NAWRB. From the keynote opening remarks by the SBA’s Yvonne Lee, to the directors

From the keynote opening remarks by the SBA’s Yvonne Lee, to the directors for the Office of Minority and Women Inclusion (OMWI) at the CFPB, FDIC and FHFA, and a TRID update from the CFPB’s Laurie Maggiano, NAWRB unites leaders across several government agencies with the private sector to grow and support opportunities for women in housing.

Women’s inclusion in upper management is pivotal to the success of the D&I movement. Attendees gained valuable insight as over 82 percent of the speakers were women in executive roles. Rebecca Steele, a former Managing Director at JPMorgan Chase and SVP National Servicing Executive at Bank of America, spoke about her experience forging a path for women to climb the corporate ladder and emphasized the importance of women supporting women.

NAWRB Brings Women To The Forefront Of The Historic Diversity And Inclusion MovementReasons to Invest in Women Entrepreneurs

The National Women’s Business Council (NWBC), a non-partisan federal advisory council that advises the President, Congress and the U.S. Small Business Administration on economic issues concerning women business owners, recently released their Reasons to Invest in Women Entrepreneurs fact sheet: Continue reading →

Single-Family Home Rental Sector

In its aftermath, the American housing bubble left millions of discarded single-family homes. Slowly but surely, these homes have come off the market in the past few years. Some were bought, and countless others were purchased by investors and put out to rent. Currently, the number of homes for sale in the United States is dwindling considerably, and developers have turned to creating entire neighborhoods of single-family homes not to sell, but to rent. Continue reading →

Login

Login