Here is an opportunity for advice from Joyce Cofield, Ex-ecutive Director of the Office of the Comptroller of the Currency’s Office of Minority and Women Inclusion.

Joyce, what is the Office of the Comptroller of the Currency?

The Office of the Comptroller of the Currency [OCC] is the federal agency that charters, regulates, and supervises national banks and federal savings associations. The OCC’s mission is to ensure that these institutions operate in a safe and sound manner, provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations.

Login

Login

When an obese person loses weight, he or she immediately starts to feel better. Blood pressure improves, cholesterol levels diminish and energy levels rise. Because that person is no longer obese, the risk of developing type 2 diabetes, as well as liver, colon and breast cancers and other diseases linked to obesity, diminishes, right?

When an obese person loses weight, he or she immediately starts to feel better. Blood pressure improves, cholesterol levels diminish and energy levels rise. Because that person is no longer obese, the risk of developing type 2 diabetes, as well as liver, colon and breast cancers and other diseases linked to obesity, diminishes, right?

NAWRB: What is your favorite characteristic of Washington, D.C.? What sets the nation’s capital apart from other cities in which you’ve lived?

NAWRB: What is your favorite characteristic of Washington, D.C.? What sets the nation’s capital apart from other cities in which you’ve lived?

by Vanessa Montañez

by Vanessa Montañez

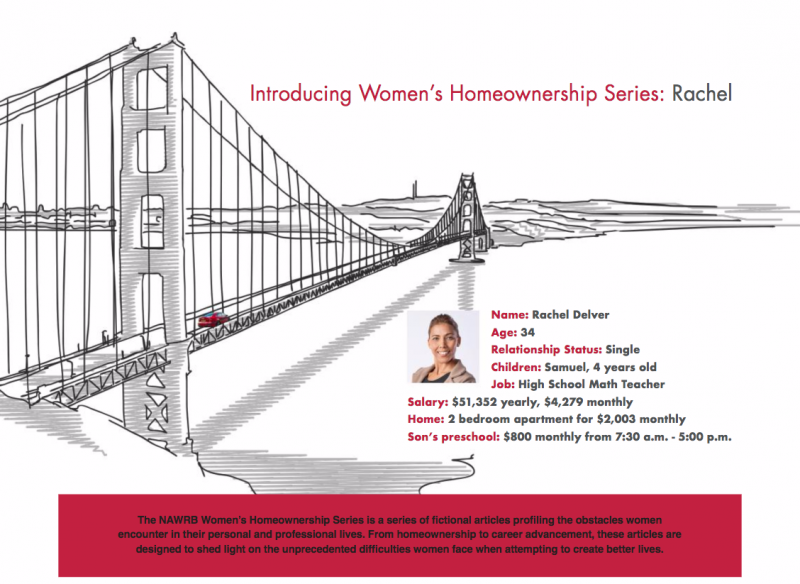

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour.

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour. Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined.

Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined. Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city.

Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city. Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.

Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.