NAWRB’s Diversity & Inclusion Leadership Council (NDILC) recently introduced their Ten Women Leadership Principles, which they collectively created to help women in the workforce become more effective leaders at any stage of their careers, and empower other women to reach their full potential. This is a universal guide for all levels of leadership, and any woman can benefit from applying them. This week, NDILC presents the sixth principle, “Speak Out,” shared with a personal story by NDILC Chairwoman Desiree Patno, CEO & President of NAWRB.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Daily Archives: May 20, 2020

Three Ways to Increase Your Longevity in Real Estate

The real estate industry can be difficult to navigate for new agents. The success rate is not very high with about 90 percent of agents failing in their first five years. That means nine out of every 10 new agents can expect to fail in the industry. A part of being a successful real estate agent simply comes down to luck, and no one can control for that, but there are some strategies newcomers can use to increase their chances of making a long-lasting career in this exciting and ever-changing industry.

With three decades of experience leaving my mark in diverse real estate sectors, selling over 6,000 properties, providing relocation services for major Fortune 100 companies, and connecting entrepreneurs to billions of dollars in business resources, Desirée Patno, CEO & President of NAWRB, shares a few pieces of advice she would give her younger self about thriving in the real estate and housing ecosystem. Below are the top three tips she thinks any nascent real estate agent would benefit from knowing to help them fulfill their potential and guarantee their place among the successful 10 percent.

1. Educate Yourself & Never Think You Know Everything

Real estate is more complicated than a glamorous sales job, and it’s helpful to educate yourself—or better yet, earn a four-year college degree—in other fields, including business economics, construction, finance and law. Each of these topics are relevant to selling and buying a property, so it’s pivotal to have foundational knowledge in each of these fields to help your job performance.

In addition, it is useful to plan for disruptions that might arise in the industry, such as new laws and tax codes, novel technology developments and upcoming market trends. Technology can assist the industry in property management, application processing and data synthesizing so that agents and brokers can focus on connecting with clients and helping them with the emotional process of buying or selling a home. Find out how you can leverage these new developments now so that you can stay ahead of the competition.

Artificial Intelligence (AI) and Blockchain, for example, are emerging technologies that are impacting the way real estate businesses operate and interact with their customers and clients. AI can be a helpful tool that can make everyday tasks more efficient and provide assistance to clients at a moment’s notice rather than a replacement for the agent themselves. It’s important to remember that AI is not without flaws. Some worry that AI creators and users will include their own biases into new technology, causing more roadblocks and harm to minorities.

Innovators are working to make AI great at problem-solving, automatic processing, data collecting and so on, but being an agent or broker requires skills AI does not have: the expert advice of a professional who has worked in the field for over 20 years, the ethics to makes sure AI is used responsibly, the ability to listen and understand a client’s needs, the intuition to know when a property is a good fit or deal, and the empathy to sympathize and provide moral support when homebuyers get cold feet or things don’t go according to plan.

Innovators are working to make AI great at problem-solving, automatic processing, data collecting and so on, but being an agent or broker requires skills AI does not have: the expert advice of a professional who has worked in the field for over 20 years, the ethics to makes sure AI is used responsibly, the ability to listen and understand a client’s needs, the intuition to know when a property is a good fit or deal, and the empathy to sympathize and provide moral support when homebuyers get cold feet or things don’t go according to plan.

Blockchain will make property data more secure and accessible to the public, and it will make transactions efficient and safe. This increases accessibility of data integral to home buying and selling, and ensures independent industries are held accountable for sound business practices. Blockchain will also drive an increase in smart contracts, which allows contracts, escrows, property records and more to be completed and financial transactions to occur without the need of title companies or attorneys.

Forbes analysts predict that home buying and home selling might become as easy as using a shopping cart on a website. Blockchain has the capacity to ensure the homebuyer receives the deed or title, while the seller takes home the profit through cryptocurrency. Both AI and Blockchain are merely helpful tools for helping agents and brokerages serve their clients with the utmost care and efficiency.

An integral part of learning is always asking questions. When you are tasked with performing any task in the line of business, always ask why you are doing it. In doing so, you will understand the logic and purpose behind the things you do. As a result, you will develop a better grasp on the real estate business system in general and contribute your own insights on how to improve it.

2. Act & Prepare as a Business Owner

You are not only a real estate agent but an entrepreneur who owns their own business. Real estate is a business of sorts, and it is important to act like a business owner to ensure your future success. In fact, 86 percent of real estate agents are independent contractors, according to the National Association of Realtors 2016 Member Profile, so the law and the Internal Revenue Service (IRS) consider you a business owner and you will be treated as such. You have sole responsibility for your business interests, but that does not mean you have to do it by yourself.

Part of being a successful business owner is being a well-versed planner to juggle your multiple responsibilities as you are accountable for sales, expenses and marketing. Build a business plan and a great team that can help you carry out tasks and share in opportunities. You won’t be able to do this alone, so make sure you have people you trust to carry your business when needed.

Further educate yourself as a business owner and independent contractor by utilizing resources from the U.S. Small Business Administration (SBA) and the IRS. Women in the Housing & Real Estate Ecosystem (NAWRB) is proud to be one of only 11 of the SBA’s Partner Resources for Women-Owned Small Businesses, and we provide countless resources and consulting services to help you achieve long-term success.

3. Passion and Social Impact Ensures Longevity

Real estate is more than just putting up a sign and selling a house; in other words, it’s not just a glamorous sales job. A lot of the real estate business boils down to human interaction. You are dealing with someone’s sanctuary, foundation and investment. To an individual or family, a home is a place of personal freedom, security and comfort in an impacting world, and a source of financial stability.

Real estate agents are still an integral part of the home buying process as a dependable source of knowledge, advice and emotional support for clients during this important decision. Moreover, they have the invaluable tool of building relationships and empathy, which are pivotal to success in the industry. Agents are adept at handling hiccups in the buying process, such as when a client suffers a traumatic loss, loses their job or gets cold feet. As human beings, they can relate to these troubles and provide practical solutions. This is what no technology development can ever replace.

There might be moments when things do not go as planned or you make a mistake, but don’t worry because it is all part of the process. Nothing is ever perfect and you can’t please everyone, so remember to acknowledge your strengths and weaknesses, and find out what makes you stand out among the crowd. In return, clients and peers will respect your authenticity. Longevity is endured by those who are passionate, care for others and their needs, and create social impact.

* See this Article and many more in it’s original publication at https://issuu.com/nawrb/docs/nawrb_mag_vol9_issue1

Planet Ocean

Covering over 70% of the earth’s surface, the ocean impacts every human being on the planet, but she means something different to everyone.

The ocean fills the spirit of many, bringing peace and wonder with its meditative waves and unending mystery below the surface. She is life sustaining, providing oxygen for every other breath we take. She drives an economy, employing thousands through the fishing, transportation, hospitality, and restaurant industries. She shields us against climate change, absorbing 30% of carbon dioxide and regulating global weather patterns. And she offers promise to health and medical fields with compounds found in corals and sponges for treatments in cancer, arthritis, Alzheimer’s and other diseases. There are scores of books written about the human-water connection, or as Walter J Nichols calls it, the “Blue Mind”. Take a moment to consider what the ocean means to you.

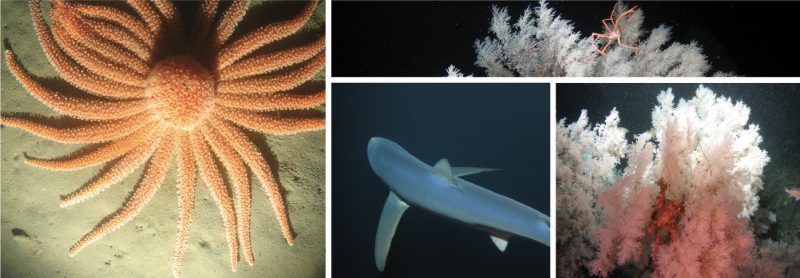

When you have an opportunity to take a good, long look at the ocean along the California coast, you will very likely see surfers and dolphins riding waves, whale spouts or breaches, and ships on the horizon. What you do not see are the fish and deep sea corals that are the very foundation of a healthy ocean, and feeding ground for the whales, dolphins and sea birds. Nor do you see the towering kelp forests off the coast that are home to over 1,000 species of animals and plants, and rocky reefs that explode with marine critters from elusive sharks to the endangered black sea bass.

When you have an opportunity to take a good, long look at the ocean along the California coast, you will very likely see surfers and dolphins riding waves, whale spouts or breaches, and ships on the horizon. What you do not see are the fish and deep sea corals that are the very foundation of a healthy ocean, and feeding ground for the whales, dolphins and sea birds. Nor do you see the towering kelp forests off the coast that are home to over 1,000 species of animals and plants, and rocky reefs that explode with marine critters from elusive sharks to the endangered black sea bass.

These deep sea ecosystems have been battling many threats over the past fifty years, including irresponsible and destructive fishing practices, invasive species, and climate change. Such threats have taken a toll on the parts of the ocean you cannot see. The great news is that with California’s Marine Protected Area program, we have the policy, technology and the tools to help her recover. When you can see a problem you can solve a problem. You may not be able to dive to 300 meters, but Marine Research & Exploration (MARE) can! With our specialized robotic submarines, MARE brings that deep sea to you, as well as to those responsible for making the rules about how we use our ocean through MPAs, our blue parks.

Marine Protected Areas are similar to national parks and forests; they are designated areas in the ocean that are monitored and managed to protect fish and invertebrates like octopus and lobster, and restore valuable habitats, like corals. With minimal human disruption through limited or restricted activity, such as fishing, marine life and habitat living in the MPAs are expected to revive and thrive. We know they are successful when we see a rebound in fish abundance and other marine critters both inside the MPA boundaries, and especially beyond the invisible boundary lines. Many recent scientific studies show that MPAs are working, and we are increasingly seeing more, and bigger, fish. For instance, a 2012 study off the coast of Santa Barbara found that lobsters were more abundant and larger within the designated refuge. In another study, MARE was able to show a 270% increase in fish inside the reserve over a decade of protection; this increase was seen outside of the MPA, as well, which made the fishing community very happy.

“People protect what they love, they love what they understand and they understand what they are taught.” – Jacques-Yves Cousteau

California’s blue parks are a powerful solution to bring our ocean back to her previous health. A recent study in the journal, Nature, indicates “MPAs represent a necessary and powerful recovery wedge across multiple components of the ocean ecosystem.” This idea is catching on: in 2000, only 0.9% of the ocean was protected, but MPAs now cover 7.4%. Scientists recommend that 30% protected by 2030 are the magic numbers to aim for in order to sustain our ocean’s health. With the current rate of protections like MPAs year over year, this is an achievable goal.

MPAs are just one tool in the toolbox to protect our ocean. Anyone and everyone can help ocean conservation. A dump truck’s worth of plastic enters the ocean each minute, 8 million tons annually. Researchers have predicted there will be more plastic than fish on the ocean by 2050. On the consumer side, we can all bring more intention to eliminating the need for single use plastics that end up in the ocean. There is an opportunity on the innovation side to develop more sustainable alternatives, too. Purchasing power extends to food choices. With over 3 billion people depending on the ocean for their primary source of protein, the ocean’s food security is neither infinite nor invincible. The global “we” can and are depleting [it: 90 percent of the largest ocean fish, like Atlantic salmon, tuna, halibut, and swordfish are gone. Apps and sites like www.seafoodwatch.org help all of us make more informed seafood choices.

No matter how you personally use the ocean – to swim, to fish, to dive, to deliver your favorite seafood dish – a healthy ocean benefits everyone. So breathe deeply. Close your eyes and let the sound of the waves wash over you. And know that you have a vital role to play in her renaissance.

About MARE

As an earlier adopter of the MPA strategy, California has been a leader in ocean health solutions and is decades ahead of many coastal governments. Marine Research & Exploration (MARE) has been working with the state for over 16 years to monitor and document ocean health. Using proprietary marine technology, MARE brings critical information and imagery to those who govern our state waters, so that they know what to protect and why. We also show, with pictures, video and data, that MPAs have been effective in California, which benefits everyone in the state. During these unprecedented times, we appreciate all donations of time, treasure and talent to assist in the intelligent management of our oceans. To learn more, tune into our discussion on Know the Rules of the Game podcast. Thank you in advance!

ERIN O’Toole, Director of Development at Marine, Applied Research & Exploration (MARE)

ERIN O’Toole, Director of Development at Marine, Applied Research & Exploration (MARE)

Kellie Aamodt, Board Member of Marine Applied Research & Exploration (MARE), and Former UPS, VP of Corporate Inside Sales

Kellie Aamodt, Board Member of Marine Applied Research & Exploration (MARE), and Former UPS, VP of Corporate Inside Sales

* See this Article and many more in it’s original publication at https://issuu.com/nawrb/docs/nawrb_mag_vol9_issue1

How the Coronavirus is Affecting Short-Term Rental Business Owners and Travelers

Coronavirus disease (COVID-19) is now a global pandemic that has altered many facets of human life in the past few months, especially in the past couple of weeks, as countries are taking measures to contain the outbreak and protect the safety of their citizens. The travel industry has especially been affected as people are being forced to cancel or change their preexisting travel plans, whether international or domestic, as more countries are being labeled as high risk areas for contracting the virus.

This has taken a toll on the short-term rental business, such a Airbnb and VRBO, as short-term renters and hosts are working through solutions in response to the coronavirus-related cancellations. Individuals who have created a small business out of offering their properties as short-term renters for travelers are faced with the financial burden offering a full refund for travelers who wish to cancel their stay due to the coronavirus.

Business owners and travelers can purchase insurance policies for unforeseen cancellations, yet very few, if any, have clauses about pandemic coverage as this situation is unprecedented. It is resulting in a substantial revenue loss for businesses who depend on the funds from renting out their properties to pay their mortgage and make other necessary payments, or as a source of passive income. In addition, many short-term rental businesses are seeing loss in potential revenue as less people are booking stays for peak seasonal travel times, including holidays, both domestically and internationally, when hosts make most of their revenue.

Business owners and travelers can purchase insurance policies for unforeseen cancellations, yet very few, if any, have clauses about pandemic coverage as this situation is unprecedented. It is resulting in a substantial revenue loss for businesses who depend on the funds from renting out their properties to pay their mortgage and make other necessary payments, or as a source of passive income. In addition, many short-term rental businesses are seeing loss in potential revenue as less people are booking stays for peak seasonal travel times, including holidays, both domestically and internationally, when hosts make most of their revenue.

On the other hand, travelers who have already booked their short-term rentals in advance for an impending trip are in the unfortunate predicament of having to cancel their plans in order to limit their chance of contracting the coronavirus or spreading it to others. Social distancing is one of the new best practices. In addition, many countries, states, and counties have limited traveling to essential travel only.

Many popular airlines such as Delta, United Airlines and JetBlue are waiving change fees to help accommodate travelers as they reassess and change their travel plans. However, those who have booked flights have most likely booked their accommodations, as well. Using Airbnb or VRBO for booking accommodation is typically a budget-friendly option for travelers on a tight budget, but these companies have their own unique cancellation policies that might differ from hotels or other mainstream options.

The following are the up-to-date cancellation policies for Airbnb and VRBO, some of the most popular short-term rental third-party websites. As of March 15, 2020, Airbnb provides the following coverage for COVID-19 under their extenuating circumstances policy:

“Reservations made on or before March 14, 2020 for stays and Airbnb Experiences, with a check-in date between March 14, 2020 and April 14, 2020, are covered by the policy and may be cancelled before check-in. Guests who cancel will receive a full refund, and hosts can cancel without charge or impact to their Superhost status. Airbnb will refund all service fees for covered cancellations. The host’s cancellation policy will apply as usual to reservations made after March 14, 2020, and to reservations made on or before March 14, 2020 with check-in dates after April 14, 2020.”

“Reservations made on or before March 14, 2020 for stays and Airbnb Experiences, with a check-in date between March 14, 2020 and April 14, 2020, are covered by the policy and may be cancelled before check-in. Guests who cancel will receive a full refund, and hosts can cancel without charge or impact to their Superhost status. Airbnb will refund all service fees for covered cancellations. The host’s cancellation policy will apply as usual to reservations made after March 14, 2020, and to reservations made on or before March 14, 2020 with check-in dates after April 14, 2020.”

Note that reservations for stays or Airbnb Experiences that are made on or before March 14, 2020, with a check-in date after April 14, 2020, will not be covered under their extenuating circumstances policy, except if the guest or host has contracted COVID-19. Therefore, the host’s cancellation policy applies as usual. Because each host has a different cancellation policy, Airbnb recommends that travelers read the fine print before booking their stay and choosing the most flexible option.

In the event that Airbnb hosts cancel a covered reservation, the company ensures that they will not be charged, there will be no impact on their Superhost status, if they have it, and they will refund all service fees.

In response to coverage for COVID-19, VRBO makes the following comment on their website: “Vrbo® advises travelers to follow travel advice from the World Health Organization and local authorities. Refunds of payments made for vacation home rentals are based on the homeowner’s cancellation policy. If a homeowner or property manager refunds a booking due to COVID-19 (coronavirus) concerns, Vrbo will automatically refund the traveler service fee. Travelers who have purchased travel insurance should contact the insurance company for any claims processing.”

In a direct letter to homeowners, VRBO recommends that they review their cancellation policy and “consider adopting a flexible or moderate policy for the time being,” and they encourage them to offer a full refund to travelers who cancel or delay their travel plans due to the coronavirus, although neither is required. Thus, short-term renters are at the mercy of homeowners, who are also understandably worried about the costs to their business, regarding the content of their cancellation policy.

VRBO is also offering to waive cancellations so that they do not affect the ranking metrics for hosts worried that the cancellation will negatively impact their business. To waive a cancellation, hosts are required to cancel and refund their reservation in full and call customer support at their earliest convenience.

Whether you’re a short-term rental guest or a homeowner, it’s important to keep updated on the current cancellation policies of the organization through which you book a rental or rent out your space. In this time of uncertainty, the best thing we can do is be prepared for any possible scenario and make the best decision we can for the safety of ourselves and others.

* See this Article and many more in it’s original publication at https://issuu.com/nawrb/docs/nawrb_mag_vol9_issue1

Leading through Turbulent Times

Leading a group in any capacity is a big responsibility; more importantly it is one that was generally sought by the person in the role. During my 42 year career with UPS, I had the opportunity to lead many different size groups through many crises. It started in my first assignment with leading nine employees and ultimately ended as Vice President of U.S Operations leading over 200,000. Being in the logistics industry, these crises included earthquakes, hurricanes and attacks such as Sept. 9/11. However, this COVID-19 pandemic is like nothing we have seen as Americans.

Terms and Conditions

We have all purchased something in our lives where a warranty was offered. When you purchased the warranty, the idea that the item needed some additional protection popped into your mind. The warranty had specifications and they were identified in the “Terms and Conditions” of the contract. Employees come with their own “Terms and Conditions” as well.

Think for a moment about your job or profession. What do you expect from your employer? Sound communication, respect and a supportive environment are some natural expectations. Are these things “less” important during a crisis? If anything, they become even more important in difficult times.

When you purchase an item, the “Terms and Conditions” of the contract become invalid if you misuse or abuse the item. People are the same way. They will not support the leader if the “Terms and Conditions” of their employment have been abused. Leaders must consciously consider how their daily interactions impact the psychological “Terms and Conditions” that their people have with them. If they do not consider this, they will be ineffective leaders at some point.

When you purchase an item, the “Terms and Conditions” of the contract become invalid if you misuse or abuse the item. People are the same way. They will not support the leader if the “Terms and Conditions” of their employment have been abused. Leaders must consciously consider how their daily interactions impact the psychological “Terms and Conditions” that their people have with them. If they do not consider this, they will be ineffective leaders at some point.

I remember walking with managers to talk with their employees during times of crises. Many times, the employees were upset due to the hours they were working, or that the job was different than what they expected. This was due to the fact that the “Terms and Conditions” with these employees were unclear or were being changed without explanation. In these instances, the level of commitment and dedication of these employees was less than desired. This is always a problem when the psychological “Terms and Conditions” of employment are broken.

Clear Digestible Messaging

Think back on the times you have attended a meeting and after it was done, you still had unanswered questions. Or how about a meeting when, after the leader had left, there were comments like these: Are you kidding me? Seriously! What are they thinking?

When reactions like those mentioned above are exhibited, the employees just experienced “mental indigestion.” Like a cook who served a meal that gave everyone indigestion, it becomes visible. The same thing happens when a poor message is given. It’s visible on your people’s faces. You can choose to see it or not.

Words are the meal you feed your people. When your words come out of your mouth, they decide (not you) how they are digested. It is one thing to gather a group together and read the memo. It is another to inspire them with your words and clearly give direction. Just like a chef must prepare and take care when making a meal, the leader owns the clarity and openness involved in the message.

Preparation and care must precede the giving of the message. Too often leaders will serve a bad message and later say, “Well, he or she didn’t listen!” Leaders need to consider that when they delivered their message indigestion was delivered as well. Clarity checks are important and it is necessary to ask a few questions of the audience to ensure understanding. This will validate the message and determine whether it tasted good, or if it gave your people indigestion.

Preparation and care must precede the giving of the message. Too often leaders will serve a bad message and later say, “Well, he or she didn’t listen!” Leaders need to consider that when they delivered their message indigestion was delivered as well. Clarity checks are important and it is necessary to ask a few questions of the audience to ensure understanding. This will validate the message and determine whether it tasted good, or if it gave your people indigestion.

During my time as UPS President of Virginia, we experienced one of the most destructive hurricanes (Isabel) to hit the state. This required our employees to give discretionary effort to do their jobs to ensure people could receive essential items. I found that clear and direct communication, from the leader, calmed my employees and allowed them to focus on the mission. Being able to clearly understand the needs of the team and to serve others, assisted in keeping a positive mental outlook.

Setting Direction for the Team

The single most important reason to set up a structure of leadership in any organization is because it is needed! Without leaders, people would come to work, read memos, and look at messaging boards to get direction. If this method worked effectively, it would be in use everywhere. Organizations just simply would not make this investment. It is too expensive!

Leaders are expected to set direction and guide teams towards goals and objectives. The organization’s strategy is the game plan. Like players on a professional sports team, your players expect you to coach them daily.

The minute they come to work, the whistle is blown, and they are playing the game. As a leader, you are expected to participate in it visibly. You do so by setting direction and calling plays that align with the organization’s strategy.

So the question you have to ask, is what type of leader are you? Are you the command and control leader who simply passes the orders down? Or are you truly setting direction and coaching your people supportively every day? How does it look, taste and feel?

When they don’t execute the right plays, do you blame them or yourself? How many times have you heard a professional coach blame the players when a professional sports team loses? When they won, how many times did the coach say, “Yes, we won, but it was my excellent coaching that did it!”

Here are the facts of leadership. As a leader, you will have losses and wins. The leader gets all the credit for the losses and none of the credit for the wins. It’s called taking ownership for what you lead! When the position was open, you raised your hand and said, “Pick me! Pick me!” If you weren’t selected, you were disappointed, upset, and even angry.

Well, you were selected, so taking ownership for what you asked for means setting direction daily for your team and actively coaching them. During a crisis, it means that on steroids.

As the UPS Vice President of U.S. Operations from 2016-2019, I was privileged to lead large groups of people during many different crises, but none challenged me more than the holiday season of 2018: E-commerce demand more than doubled. Consumers demanded fast, on-time delivery. This required flawless execution to ensure our customer commitments were met.

The team did an excellent job and had the best service in our history. The challenge was ensuring that I was setting a strong direction reflective of the UPS CEO and his team, and that the direction was understood down to the front line, encompassing over 200,000 employees at multiple levels.

People run towards leaders during a crisis and its imperative the direction is well thought out and includes the input of many advisors. I had a staff of experts I consulted with to ensure we all agreed on the direction to move forward. Then I communicated to my teams repeatedly to ensure understanding. I’ve never felt prouder of my teams and their leaders as I did during this time.

In summary, the following three principles are critical during turbulent times:

Leaders must understand the “Terms and Conditions” of their relationships: The leader who doesn’t understand these will be unable to gain the support of their people. If you don’t fulfill these expectations, your people won’t fulfill their agreements.

Leaders must make certain their messaging is clear and digestible: When communicating with your people, make certain your messaging is clear, supported and digestible. If it is not, you will see it clearly in their reactions. If it is not “digestible,” then it will create “indigestion.” When that happens, it is obvious.

Leaders must set direction for the team: The team on their own decides if something makes sense to them. If it doesn’t make sense to them, then it is the opposite of making sense, which to them is nonsense! People generally won’t support nonsense. Do you?

Those in leadership positions, no matter how big or small, should realize you are needed now more than ever. In a crisis, everything moves faster. Information, physical goods and the days run into each other. Slow down and let the game come to you. When it does, be the calming force that your teams need. You can’t be human with your emotions and decisions right now; you need to be superhuman. That means blocking out the noise of distraction and staying focused on your people’s needs. Do this, and when the crisis ends, your team’s support of you won’t.

The amount of “Times” your people will support a lack of clarity, poor communication and you leading from a distance? NONE TIMES!

By Noel Massie, Author, Speaker and Retired UPS Vice President of U.S. Operations

* See this Article and many more in it’s original publication at https://issuu.com/nawrb/docs/nawrb_mag_vol9_issue1

COVID-19 Financial Assistance for Small Businesses, Independent Contractors and the Self-Employed

Over 30 million U.S. small businesses who make up the backbone of our economy, and they have all been affected by the recent global pandemic as many businesses have had to close shop, shorten hours and lay off workers. If you are a small business that has suffered economic injury due to the coronavirus (COVID-19), it is important to know that there are many financial resources at your disposal, such as disaster loan assistance from the U.S. Small Business Administration (SBA). Renters and homeowners, as well as businesses, are eligible to apply for the SBA’s no cost, low-interest rate disaster loans even if they do not own a business. (*Disclaimer: Due to daily changes to the economy and an increasing rate of updates, please note that this information is subject to change since time of writing.*)

In response to the recent effects of COVID-19, SBA Administrator Jovita Carranza announced that the agency will be granting automatic disaster loan deferments through December 31, 2020, to help borrowers who are still paying back SBA loans from previous disasters.

“The SBA is looking at every option and taking every action to cut red tape to make it easier for small businesses to stay in business. Automatically deferring existing SBA disaster loans through the end of the year will help borrowers during this unprecedented time,” said Administrator Carranza in the SBA’s official press release. “Today’s announcement adds a list of growing actions the SBA is taking to support small businesses. These actions include making it easier for states and territories to request a declaration so small businesses statewide can now apply for economic injury disaster loans, and changing the terms of new economic injury loans to allow for one-year deferments.”

– SBA Disaster Loans –

The SBA offers low-interest disaster loans for businesses, private nonprofits, homeowners and renters who need assistance with uninsured costs. Even those insured for natural disaster damage are encouraged to apply for a SBA Disaster Loan The SBA can lend you the amount of your total loss, even if you are unsure about how much your insurance will cover.

The Coronavirus Aid, Relief and Economic Securities (CARES) Act, which was signed into law by President Trump on March 27, 2020, provides $349 billion in relief for American workers and small businesses. The CARES Act also established several new temporary SBA programs to address the COVID-19 outbreak: SBA Economic Injury Disaster (EIDL) Loans & PPP (Paycheck Protection Program).

At time of writing, the SBA has run out of these funds within two weeks of providing financial aid to small businesses, and the federal government is working on funneling more money to the SBA to carry on their funding programs. However, U.S. Congress reached a deal on a roughly $480 coronavirus relief funding package to continue helping small business and hospitals, and expand COVID-19 testing. This new funding package comes after the initial funds set aside for the U.S. Small Business Administration (SBA) Paycheck Protection Program and Economic Injury Disaster Loan (EIDL) were exhausted in just two weeks — due to over 1.66 million loans for more than $342 billion. The Senate has approved the deal, and now it goes to the House.

A few reasons why the funds were exhausted in such a short amount of time is that $6 million was used to cover lender fees and 71 publicly-traded companies, especially restaurant chains, received aid from the Paycheck Protection Program, equating to $300 million, before the money ran out for small businesses. The reason for this is that foreign businesses, large restaurant chains and hospitality businesses successfully lobbied for an exemption to a rule restricting the small business loan program to businesses with 500 or fewer employees.

For example, Forbes notes that Shake Shack obtained a $10 million loan and was eligible for the Paycheck Protection Program because it does not employ more than 500 people at a single location. However, the restaurant chain said it would be returning their loan as they had $112 million of cash on hand before selling another $150 million of stock at the time.

– EIDL Loans –

Small business owners in all U.S. states, Washington D.C., and territories impacted by the COVID-19 pandemic are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. As stated on the SBA’s website, “This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available following a successful application. This loan advance will not have to be repaid.” Please note that “successful application” does not mean you have to be approved for the loan. Moreover, loan approval is not necessary to receive the loan advance.

This program is for any small business with less than 500 employees (which includes sole proprietorships, independent contractors and self-employed persons), private non-profit organization or 501(c)(19) veterans organizations affected by COVID-19. In certain industries, businesses may have more than 500 employees if they meet the SBA’s size standards for respective industries. The U.S. Small Business Administration has updated their application for Economic Injury Disaster Loans. Interested businesses as well as previous applicants are being asked to apply or reapply here. On the application, make sure to check the $10,000 box to access the emergency grant.

For businesses who applied prior to Monday, March 30th, you will need to reapply with the SBA (even if you were rejected or pending approval). To apply for a COVID-19 Economic Injury Disaster Loan, go to https://lnkd.in/gkjJVFE. For more info, visit https://www.sba.gov/page/disaster-loan-applications.

– Paycheck Protection Program (PPP) –

The Paycheck Protection Program provides loan forgiveness for retaining employees by temporarily expanding the traditional SBA 7(a) loan program. Just like the aforementioned EIDL Loan Advances, the SBA will forgive loans received through this program if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.

As stipulated by the SBA, small businesses can apply for PPP through “any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating. Other regulated lenders will be available to make these loans once they are approved and enrolled in the program. You should consult with your local lender as to whether it is participating in the program.”

Lenders may begin processing loan applications as soon as April 3, 2020, and the PPP will be available through June 30, 2020. To find a lender or learn more about the PPP, click here! Read the Interim Final Rule, as of April 4th, 2020, announcing PPP here: https://www.sba.gov/sites/default/files/2020-04/PPP–IFRN%20FINAL_0.pdf.

Three Rules for Know the Rules of the Game ® Podcast for SBA Economic Injury Disaster (EIDL) Loans & PPP (Paycheck Protection Program)

Rule: 1 Eligibility: SBA is listening to the feedback and providing clarity where necessary. An example of this is the recent clarification on the SBA Faith-Based Business Eligibility.

Rule: 2 Forgiveness: The loan can be 100 percent forgiven as long borrowers dedicate 75 percent of the forgiven funds to pay-roll expenses

Rule: 3 EIDL Loan and PPP Compatibility: If you received an EIDL loan for payroll, that loan will be rolled into your PPP loan and would be eligible for forgiveness under the PPP loan program. You can also take out an EIDL loan for non-payroll expenses and a PPP loan for payroll expenses.

– Resources for Small Businesses –

Small business owners have additional resources at their disposal during the recovery process. If you have a loan from the SBA, you may be eligible for deferred loan payments. For instance, if your loan postdates August 25, 2017 and you are located in a federal disaster area, your principal and interest payments will be deferred for 12 months. If your business is located near a disaster area, you may be eligible for a 9-month payment deferral.

Small business owners can apply for federal assistance—in the form of cash grants— through the FEMA, online or by calling 1-800-621-FEMA. Local Small Business Development Centers (SBDCs) are available to help small businesses complete forms for disaster relief, recover records and relaunch their businesses.

Businesses can be proactive in protecting themselves against damages from potential natural disasters by being insured for Business Interruption. Many commercial insurance policies provide coverage via endorsement for business income loss due to a direct loss, damage or destruction to the insured property by a natural disaster.

– Resources for Independent Contractors and Self-Employed –

The self-employed make up an astounding 57 million people countrywide, and they are also vulnerable to the recent changes to the economy due to the nation’s COVID-19 response and its effect on the economy. If you’re an event photographer, for instance, your business has probably been hit by the recent closures of businesses, centers and events for which you might have been hired. There are many examples like this, but the good news is that there are resources to help self-employed individuals recover their losses and sustain their business through this challenging time.

Previously, self-employed people and independent contractors have not been eligible to collect unemployment except if their business is an S-corp. However, since the government has recently passed the Coronavirus Aid, Relief and Economic Securities Act (CARES), a $2 trillion stimulus package, unemployment insurance has been extended to self-employed workers and independent contractors.

Those who qualify will be able to collect unemployment benefits for 13 more weeks than the usually allotted time and receive an additional $600 a week on top of state unemployment benefits for up to four months. Note that the rate of state pay might be lower for self-employed, freelance workers and independent contractors in your state. To apply, visit your state’s unemployment website and be ready to provide your Social Security number (and those of your dependents), and driver’s license or state ID.

The recent CARES Act will also grant the SBA to give out a total of $349 billion for guaranteed loans through its loan programs. With the developing changes, you might also be eligible for the SBA’s Economic Injury Disaster Loans for qualifying small businesses, as indicated by an article from Forbes. As mentioned above, these are low-interest loans with terms that might last as long as 30 years for small businesses and nonprofits.

– Resources for Renters and Homeowners –

Renters and homeowners are eligible to apply for the SBA’s no cost, low-interest rate disaster loans even if they do not own a business. According to the SBA website, renters and homeowners may borrow up to $40,000 to repair or replace clothing, furniture, cars or appliances.

Homeowners may borrow up to $200,000 to repair or replace their primary residence to pre-disaster condition. Moreover, loans may be increased up to 20 percent of the total amount of physical loss to make improvements that lessen the risk of future property damage.

Renters and homeowners can apply for both FEMA assistance and SBA disaster loans simultaneously with zero cost, so do not wait until you get a response from FEMA. You do not have to accept an SBA low-interest rate loan even if you are qualified.

Whether you are a renter, homeowner, business, or nonprofit, know that there is always support available to you in times of need. NAWRB is dedicated to help those affected by these recent natural disasters find resources that can help them rebuild their homes, restart their businesses and regain a sense of stability in their lives.

New Relaxed Criteria

The relaxed criteria for small businesses seeking an economic injury declaration has two immediate impacts:

(1) “Faster, Easier Qualification Process for States Seeking SBA Disaster Assistance. Under the just-released, revised criteria, states or territories are only required to certify that at least five small businesses within the state/territory have suffered substantial economic injury, regardless of where those businesses are located.”

(2) “Expanded, Statewide Access to SBA Disaster Assistance Loans for Small Businesses. SBA disaster assistance loans are typically only available to small businesses within counties identified as disaster areas by a Governor. Under the revised criteria issued today, disaster assistance loans will be available statewide following an economic injury declaration. This will apply to current and future disaster assistance declarations related to Coronavirus.”

– Frequently Asked Questions –

Are you a small business impacted by the coronavirus and in need of an SBA disaster loan? Learn the steps to apply here! If you are interested in applying for this loan, SBA has answered some FAQ’s below:

We do offer low-interest Economic Injury Disaster Loans (EIDL) due to the COVID-19 Pandemic declarations in virtually all states.

Information for the loan program for SBA’s Office of Disaster Assistance can be found at: www.sba.gov/disaster

Interest rates are 3.75% fixed for small businesses, 2.75% fixed for nonprofits, 30 year terms, 1st payment deferred until the 12th month from the note date.

No cost to apply, amount needed not required upon application, no obligation to take any money if approved, take only the amount needed to survive the recovery period. If you get approved, and find that you still need more or a longer recovery period than expected, you can request an increase. No prepayment penalty.

If you get stuck while trying to apply online, you can call for help at the Customer Service Center at 1-(800)-659-2955, Wait times may be long, but the agency is hiring as fast as possible!

Completed Applications with supporting documents requested are processed on a first come, first served basis.

For more information on SBA disaster loans, follow us on Facebook, LinkedIn, Instagram and Twitter for updates, and subscribe to our newsletter by visiting www.nawrb.com!

* See this Article and many more in it’s original publication at https://issuu.com/nawrb/docs/nawrb_mag_vol9_issue1

Login

Login