Volume III: Business Ownership – As women in business, we are doing more than shattering the “Glass Ceiling”; We are creating greater opportunities for ourselves, others, and driving the American economy.The WHER Report is the Women Housing Ecosystem Report, a vital read for women making change through and beyond the housing and real estate ecosystem in the 21st century.

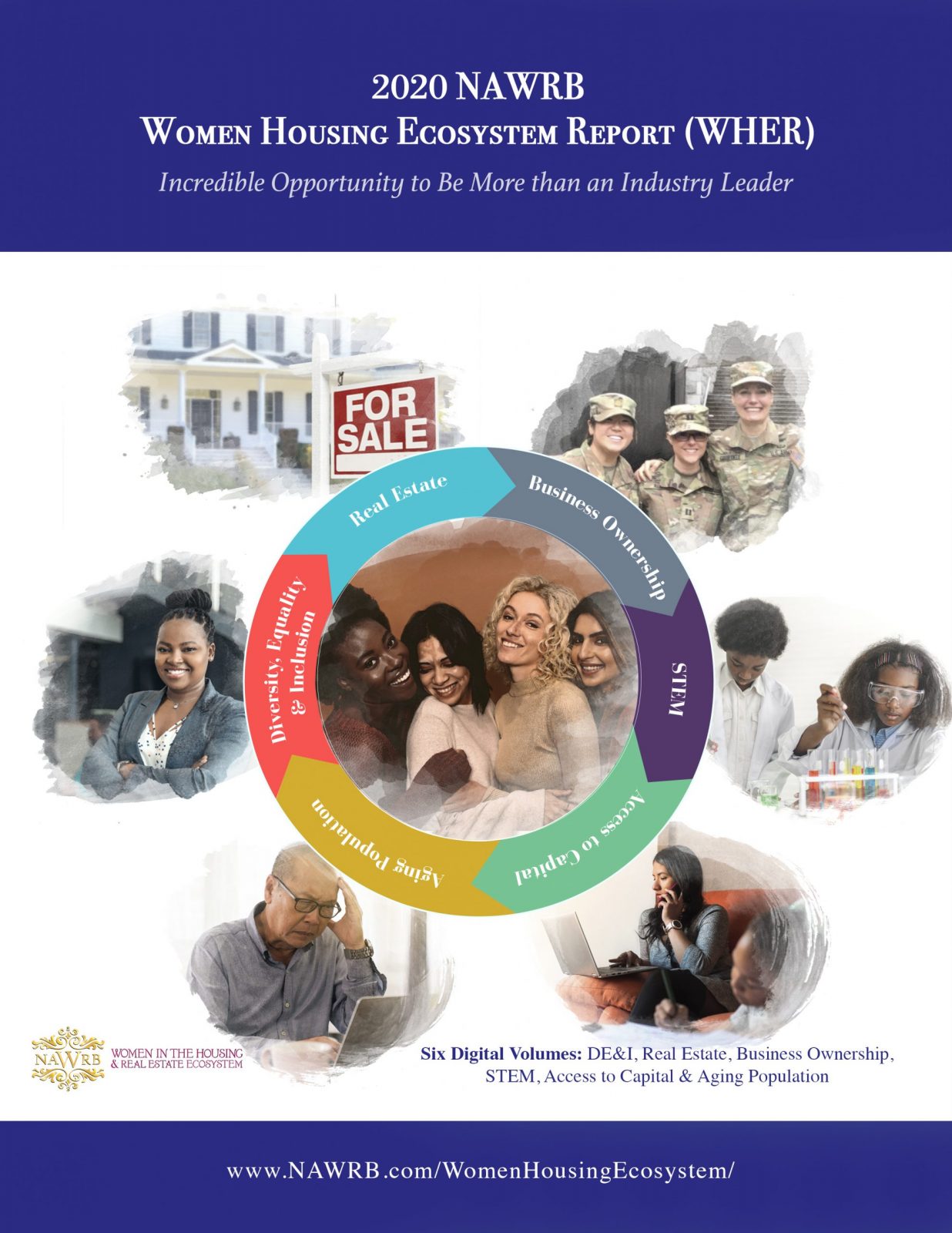

There are six volumes of the report, defined by their distinct but overlapping characteristics. The topics are highly intersectional: DE&I, Real Estate, Business Ownership, STEM, Access to Capital, Aging Population.

Visit tinyurl.com/2020WHER to learn more about each volume!

Login

Login