Starting May 1, there will be a new way for seniors to attain reverse mortgages from what is called a Caregiver Loan. This loan will allow adult children or grandchildren of seniors to pool resources to provide a flexible line of credit at interest rates much lower than commercial reverse-mortgage lenders charge.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Monthly Archives: April 2015

$140 Million Settlement Has Ocwen & Assurant Pay Up

Riddled with countless financial setbacks, Ocwen was dealt another heavy blow with a $140 million class action settlement that must be paid by both Ocwen and Assurant Inc. to homeowners who were given inflated premiums for force-placed insurance.

Serious Delinquency Rates on Single-Family Loans at an All-Time Low

The serious delinquency rate on single-family loans has fallen to its lowest level in six and a half years. Serious delinquency is when a single-family mortgage is 90 or more days past due and the bank considers the mortgage to be in danger of default. When a mortgage is in default, a lender usually initiates foreclosure proceedings.

Update: Learn the Latest Developments at NAWRB

NAWRB is rapidly growing in presence and membership each day. Our corporate headquarters is buzzing with new business and exciting developments. With that being said, we’d like to share our growth with our readers to not only spread the enthusiasm but show what NAWRB is doing to advocate and promote for women in the housing economy.

The Mystery Behind Lending to Women

- Men tend to start businesses with twice as much capital as women, $135,000 vs. $75,000.

- The biggest difference in amount of capital between men and women was with regard to outside equity, in which women receive only 2% of total outside funding compared to men, who receive 18%.

- Women were more likely to be discouraged from applying for loans due to fear of denial – and justifiably so: in 2008, women-owned businesses were much more likely to have their loan applications denied than their male counterparts.

- Women entrepreneurs tend to raise smaller amounts of capital to finance their firms and are more reliant on personal, rather than external, sources of financing as compared to male entrepreneurs.

- Entrepreneurs should consider founding businesses with other people. According to the study, many investors are reluctant to fund a single business owner because of the difficulty for one person to scale a business. Additionally, they should also complete a cost-benefit analysis of what equity financing can do, carefully weighing the upside (financial, social, and human capital) of external equity with the downside (less control of the company’s future).

For Funders, the study recommends increasing outreach to find women entrepreneurs with investment-ready firms. Similarly, they should increase the number of women on the financing and investment side, such as angel investors, members of a venture capital pitch committee, and in other roles.

- For the Entrepreneurship Ecosystem, the study recommends encouraging women to participate in STEM fields prior to entrepreneurship. Although women are on par with men regarding educational attainment, previous research indicates that women are less likely to have degrees in STEM fields – and these fields are more likely to offer opportunities for growth-oriented entrepreneurship. Additionally, business programs focused on women and women-led and –owned businesses should be established and strengthened, including accelerator and incubator programs, equity financing programs, and business mentorship and training programs that target women-owned firms with high-growth potential.

- A recently published SBA Advocacy study, Understanding the Gender Gap in STEM Fields Entrepreneurship, backs up the last set of recommendations, finding that women who attended universities with industry-funded research and development are more likely to start an entrepreneurial venture. It also found that women are just as likely as men to be entrepreneurs when their first postdoctoral job is in a STEM industry.

Last, but certainly not least, women should think bigger and bolder by foregoing the notion that business debt is bad.

Professional Mentors: Why Women Need Them

Women can benefit a great deal by having professional mentors. Men already have an edge over females when it comes to earning appropriate wages and advancing to upper level management. Having smart, successful mentors for professional ladies can work wonders in bridging the inequality gap.

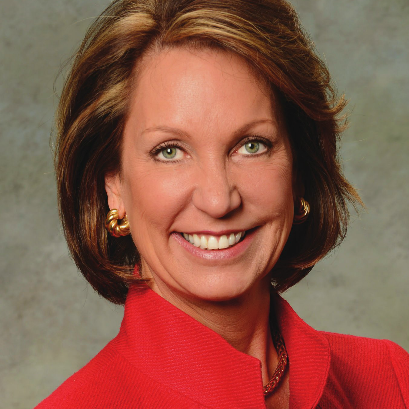

Margaret Kelly

RE/MAX’s CEO Powerhouse

Margaret Kelly

NAWRB is honored to have had the opportunity to have an insightful and candid interview with Margaret Kelly, CEO of RE/MAX. Kelly is responsible for the day-to-day operations and strategic direction at RE/MAX across North America and in more than 95 countries around the world. She is recognized by countless organizations for her exceptional leadership skills, commitment to community involvement, and for being an advocate for businesswomen around the globe. Kelly has not only had a phenomenal, 27-year career with RE/MAX, she is an incredible person with valuable insight to both personal and professional matters.

Continue reading →

Best Strategies and Courses for Selling to Senior Buyers

The population of seniors in the United States is increasing rapidly due to the aging baby boomer generation. Some cities are experiencing rapid growth more so than others. It’s important for real estate agents to be aware of these locales and understand the best strategies for appealing to this growing demographic.

5 Key Traits of Successful Female Professionals

You may be a professional woman in the housing industry who is also a wife and mother. While you make your career a priority, you get busy. If you compare yourself to others, professionally and personally, know that it is an energy drainer and it can do a lot to negatively affect your mental health.

Successful women tend to create their own mantras and follow their own rules. Not only do they not compare themselves to others, but they do not allow themselves to be defeated emotionally. The following are five key traits of successful professionals.

Coming To A City Near You: Micro-Apartments

With the scarcity of affordable housing in metropolitan areas, are micro-apartments the future of housing? The tiny home movement and creation of micro-apartments has taken international cities by storm. The rise in micro-living can be attributed to a lack of available land for housing, surges in population, and booming economies in urban areas. Cities such as Tokyo and Hong Kong have experienced the newest wave in housing…are U.S. cities next?

Login

Login