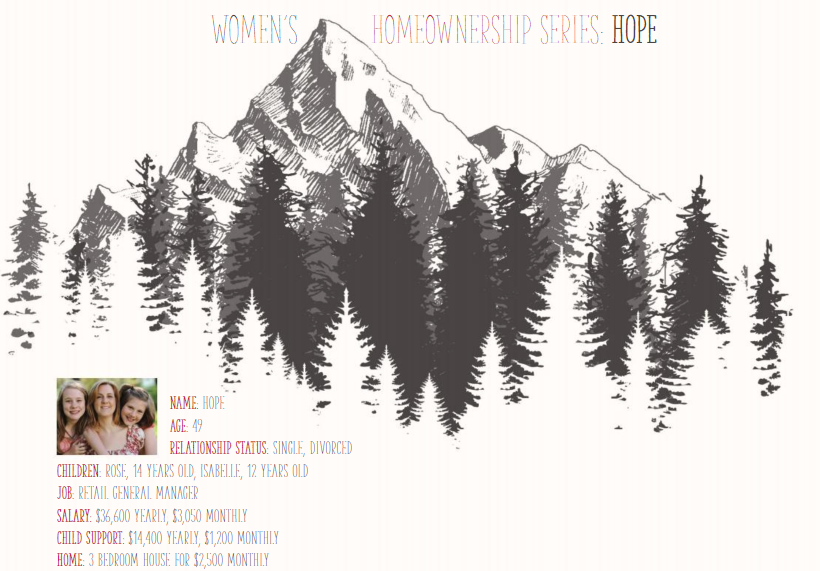

Hope and her husband, with their two daughters, moved into a beautiful 3 bedroom, 2 bathroom home in Boulder, Colorado two-and-a-half years ago. Previously living in a smaller 2 bedroom condominium a few miles away, the family enjoyed the comfort and convenience of a larger space. Their daughters, Rose and Isabelle, were happy to have their own private rooms and a backyard to practice soccer in after school.

Since the couple divorced a few months ago, Hope has taken full responsibility of the $2,500 rent. When she is not busy managing a popular clothing department store, she enjoys spending time with her daughters and painting. She aspires to feature her eclectic paintings in a gallery at the thriving art district in North Boulder, a place she frequents with friends.

Hope has fortified her career with over 20 years of hard work and dedication. Despite not having a college degree, her weekly earnings of $762 exceed that of the average female worker with only a high school diploma. She, however, earns less than the median weekly income of women ages 25 and older with a bachelor’s degree or higher.

Hope’s ex-husband provides $1,200 of monthly child support to help with expenses. Nevertheless, both her income and child support are not enough to continue living at the house with adequate savings for an emergency fund or retirement plan. More than 50 percent of her $3,050 monthly paycheck goes to rent, not including utilities.

Common advice from financial planners is that, at most, a person should spend 30 percent of their income on housing expenses. Hope is already experiencing the burden of not having leftover income to put in savings. With additional living expenses, she only has $200 left every month for unexpected costs and the occasional take-out meal with her daughters.

Continue reading

Login

Login