The risk management landscape for real estate professionals seems to be transitioning to a new stage with changing economic trends including relaxed lending rules, lower unemployment and gas prices, all likely

resulting in an uptick in the housing market. The evolving valuation world will now be faced with the new

Collateral Underwriting (CU) procedures. Depending on one’s perspective, CU is either a blessing or a curse. How will these changes impact real estate professionals ability to successfully perform their duties while avoiding the pitfalls that lead to missed opportunity, malpractice insurance claims or licensing complaints?

Easy Money

While the factors that led to the “Great Recession” were numerous and complex, it would not be an overstatement to include the all-too-available mortgage dollars, relaxed borrowing standards and minimized industry oversight that allowed the unscrupulous to take advantage of the situation and further compromise the financial and housing markets. Many professionals and members of the public otherwise made decisions that contributed to the financial woes. The government and industry responses were numerous and a combination of helpful, confusing or painful, depending on one’s professional perspective. Dodd-Frank, UAD, HAMP, the AMC appraisal format and other regulatory intervention (often resulting in large fines and sanctions) did have some effect on calming the market. One ancillary consequence of the recession was a significant increase in professional liability insurance claims against real estate professionals which includes appraisers, agents, title agents, mortgage brokers and even real estate attorneys. Another was a purging of professionals from the licensing roles, most notably appraisers, whose licensed numbers are reduced up to 20 percent in some locations.

Nevertheless, the economy has improved as has the housing market, according to many sources. Trulia’s Q4 2014 Housing Barometer states that three of its five indicators—existing home sales excluding distressed sales, home price level and delinquency plus foreclosure rate—are all moving back towards “normal.” (Their other two indicators are new construction starts and employment amongst the millennial 25-34 year old age group which did not show significant improvements). CoreLogic’s November National Foreclosure Report states that there was a decrease of over 35 percent of homes in the United States in some stage of foreclosure between November 2013 and November 2014.

Further optimism results from factors including FHA lowering insurance premiums for low income and first time buyers, Fannie and Freddie lowering down payment requirements, and declining fuel prices. It is perhaps the lowering of down payment requirements that brings about the most hand-wringing. Many see this as a way to bring buyers back in the market to ease the credit crunch. Others see it, along with proposed bank deregulation in our new House and Senate, as déjà vu all over again inviting abuse and the return to the problems of the previous decade.

Continue reading

Login

Login

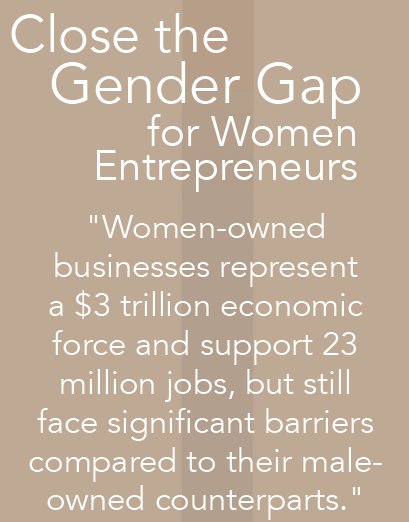

“Small businesses are at the heart of America’s economic engine. We need to ensure that our women entrepreneurs have the right tools available to help them succeed,” Cardin said. “I’m proud to support the Women’s Small Business Ownership Act, which gives women a fair shot at helping improve our economy and strengthen the middle class through small business ownership.”

“Small businesses are at the heart of America’s economic engine. We need to ensure that our women entrepreneurs have the right tools available to help them succeed,” Cardin said. “I’m proud to support the Women’s Small Business Ownership Act, which gives women a fair shot at helping improve our economy and strengthen the middle class through small business ownership.”

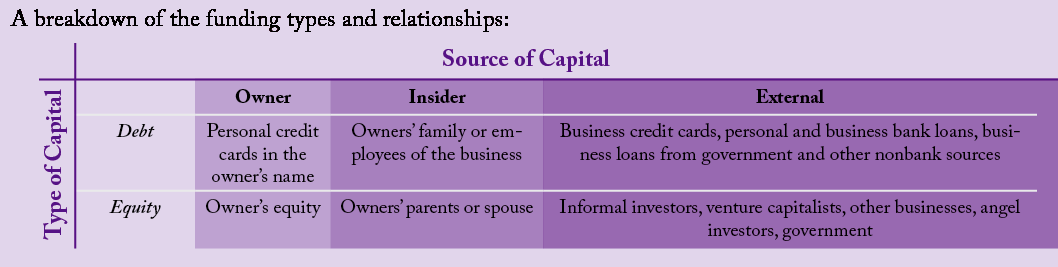

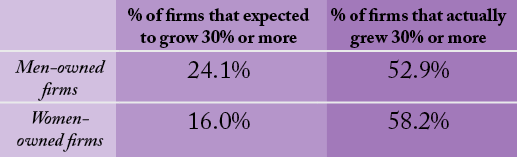

are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.

are more likely to have characteristics that are associated with lower amounts of capital in general—these include less previous industry experience, less previous startup experience, and lower credit scores, being a sole owner, and being home-based. However, these trends occur even among women-owned firms with high growth potential. One of the biggest differences seen was with regards to the amount of outside equity used. The presence of women is notoriously low on the investment side, e.g. as angel investors. Increasing women’s presence on the investment side (e.g. as angel investors) might help ameliorate some supply-side issues.