The National Association of Women in Real Estate Businesses (NAWRB) has launched a national Certified Delegate Spokeswoman Program. Industry veterans specializing in the housing ecosystem will bring laser focus to women’s economic issues with one, unified voice. The nature of the program will perpetuate nationwide collaboration to mitigate gender-based imbalances in the workforce and increase small business sustainability, especially women-owned.

Continue reading

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Author Archives: NAWRB

First Lady Melania Trump and State Department Honor Courageous Women

Earlier today, First Lady Melania Trump and Under Secretary of State for Political Affairs Thomas A. Shannon honored incredible women from around the world with the 2017 Secretary of State’s International Women of Courage Award. The award annually “recognizes women around the globe who have demonstrated exceptional courage and leadership in advocating for peace, justice, human rights, gender equality, and women’s empowerment, often at great personal risk.”

Introducing the ceremony, Shannon stated, “These women have mobilized public sentiment and their governments to expose and address injustice, speak against corruption, prevent violent extremism and stand up for the rule of law and peace, often with little more than their voices and sheer determination. We are honored to recognize this incredible group … Women’s empowerment is not just a moral imperative; it is a strategic investment in our collective security. In short, when women do better, countries do better.”

Read more

Make Your Voice Heard in Diversity and Inclusion

It takes a community to fuel a movement, and diversity and inclusion (D&I) is growing and moving forward through passionate advocacy and work. What’s most important is not the size of your organization, but your contribution to D&I and the awareness you are creating.

Leading entities like the Federal Housing Finance Agency (FHFA), the Department of Labor (DOL) and the Department of General Services (DGS) readily request input and participation from members of the public. As the people being directly affected by the rules these agencies introduce and pass, it is incumbent upon you to make your voice heard.

Read more

Financial Services Committee: Testimonies

on Bank Lending

Yesterday, the Subcommittee on Financial Institutions and Consumer Credit held a hearing entitled “The State of Bank Lending in America,” to hear testimony on the effects of regulation on small business owners and homebuyers seeking access to credit.

The subcommittee heard testimony from Scott Heitkamp, President and Chief Executive Officer, ValueBank Texas, on behalf of the Independent Community Bankers of America; Holly Wade, Director, Research and Policy Analysis, National Federation of Independent Businesses; David Motley, President, Colonial Companies, on behalf of the Mortgage Bankers Association; and Michael Calhoun, President, Center for Responsible Lending.

Read More

NAWRB Roaring Thirty Award Nominations!

The NAWRB Roaring Thirty Awards honor the women leaders in the housing ecosystem making a difference with a seat at the table for women. These are trailblazers succeeding through unprecedented obstacles and demonstrating women’s power as influencers in business.

The women at the top have had to work harder to arrive and stay there, and it is important to recognize their achievements and inspire future generations. Be inspirational by nominating women leaders for a NAWRB Roaring Thirty Award!

Submit Your Nomination Today!

Upcoming Events

April 2: Women’s Professional Growth and Homeownership

We are growing our platform of Women’s Nonpartisan Coalition of Economic Growth. This event will provide business owners with guiding principles for long-term success and address actionable strategies needed to increase women’s homeownership.

April 2-4: 15th Annual Enterprising Women of the Year Awards Celebration & Conference

Join Desiree Patno, NAWRB’s CEO and president as she speaks on “The Impact of Real Estate Decisions on Your Bottom Line” from 3:15 p.m. – 4:00 p.m.

April 14: NAWRB Certified Delegate Spokeswoman Training

NAWRB Delegates possess the unique opportunity of being a leading voice for women in the housing ecosystem and increasing their outreach on a national stage. Leverage your skills as a leader and influencer in the women’s movement to start making a difference.

July 16-19: NAWRB 4th Annual Conference, Women’s Collaboration for the Future

The NAWRB Annual Conference will highlight actionable solutions to increase women’s gender equality in the American workplace. The only way to beat the competition tomorrow is by preparing today. Register to take your business to new heights!

Nominate and Inspirational Woman Leader

Even When an Obese Person Loses Weight, Health Problems Could Persist Due to Epigenetics

When an obese person loses weight, he or she immediately starts to feel better. Blood pressure improves, cholesterol levels diminish and energy levels rise. Because that person is no longer obese, the risk of developing type 2 diabetes, as well as liver, colon and breast cancers and other diseases linked to obesity, diminishes, right?

When an obese person loses weight, he or she immediately starts to feel better. Blood pressure improves, cholesterol levels diminish and energy levels rise. Because that person is no longer obese, the risk of developing type 2 diabetes, as well as liver, colon and breast cancers and other diseases linked to obesity, diminishes, right?

That might not be the case.

A new study by City of Hope researchers found that even after a low-fat diet is consumed, long-term disease risks could persist.

The reason could be epigenetics, which refers to changes to genes caused by external factors, such as pesticides or nutrients, that don’t change the DNA sequence. However, these changes can be passed to the next generation, according to Dustin Schones, Ph.D., an assistant professor in the Department of Diabetes Complications and Metabolism within the Diabetes & Metabolism Research Institute at City of Hope.

Continue reading →

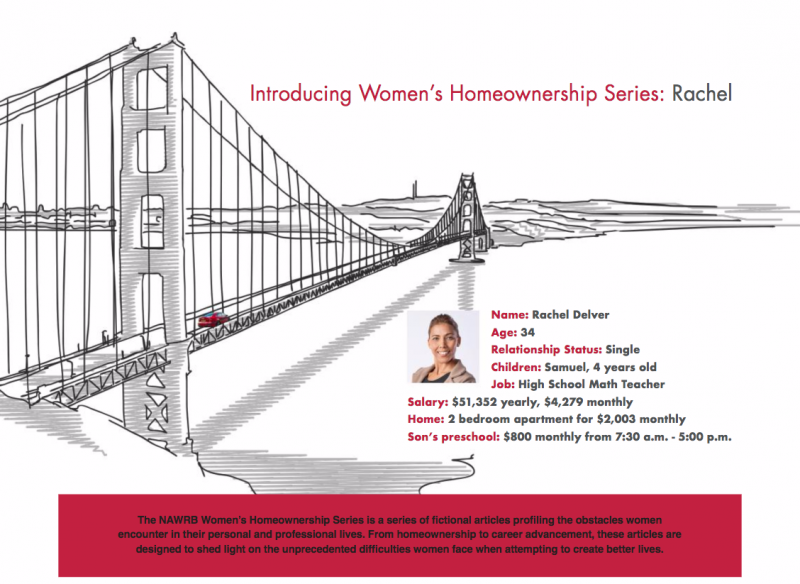

Introducing Women’s Homeownership Series: Rachel

Rachel, a single mother living in Hayward, California, enjoys spending time with her son, seeing friends, going to the movies and imagining her dream home. Her weekday morning routine consists of waking up at 6:30 a.m. to pack lunches, dropping Sam off at preschool by 7:30 a.m. and driving 15 minutes north to her job at the local high school.

Rachel loves her job, and she’s great at it; helping her students thrive in a daunting subject matter is incredibly rewarding. Her talent and dedication as an educator recently earned Rachel a job offer from a private San Francisco school. It’s a dream job, head of the mathematics department with the opportunity to create her own programs and curriculums.

During the interview, Rachel fell in love with the school and felt welcomed by the staff. Whether she wants the job isn’t the issue, it’s whether she can make it work.

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour.

Commuting to San Francisco from her home is out of the question. A two-hour commute would mean having to leave home before 5:00 a.m. and moving closer, perhaps to Oakland, still results in a commute exceeding an hour.

Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined.

Despite earning more than the median weekly income of $1,049 for women with a bachelor’s degree or higher, Rachel’s salary doesn’t go very far in the City by the Bay. In fact, after rent, Sam’s preschool tuition is more than all her other bills combined.

Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city.

Rent for a two-bedroom apartment in San Francisco would run Rachel about $4,550 a month. Neighboring Oakland’s rent is much more affordable, but still averages a whopping $2,500 a month in addition to the commute. With rents averaging $3,330, Rachel wouldn’t even be able to afford downsizing to a one-bedroom in San Francisco.The difficulty in affording a move for her job is an unusual challenge for Rachel, a successful, independent person who has always earned her keep by the sweat on her brow. Her life has developed in line with her achievements. Now, though, Rachel’s efforts have landed her a dream job, but they cannot sustain the living expenses. The scale is tipped, the conditions imbalanced. She is qualified to teach students in San Francisco, but not capable of living in their city.

—

Rachel’s new salary—an attractive $60,071 a year—is a great increase from her current earnings; but still leaves her with less than $4,000 a month and makes a minimal dent in her projected living expenses. What does she do? What needs to change? What can change?

Let’s keep in mind that for a person seeking a move, Rachel is equipped well. She has a steady job, good credit, is a responsible mother and even has a job secured in her desired city. And yet, the obstacles facing her are powerful and pervasive. What would be the case for a person hoping to move without a good job or a great job offer? Would this feat be impossible and keep them perpetually stuck in their current location?

—

Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.

Being priced out of certain neighborhoods has been a reality for Americans. This is a difficult situation, but could she make it work if she really wanted to? There’s options. Possible options range from having a roommate, maybe two, asking someone to borrow money, even just making do and enduring a long commute to the city.

—

What if a person doesn’t have somebody to grant them the huge favor of lending money? Consider the impact commuting would have on Rachel’s quality of life. Spending hours driving every day to accommodate her job and rent. Having just a few moments to relax with Sam after her long commute rejuvenates the essence of being a working mother.

Rachel has put in the work, what does the future hold for her options?

What’s the SCORE?

Last month you read about all the fantastic resources available to you through the U.S. Small Business Administration (SBA) and its resource partners, including SCORE. This month we delve deeper into how SCORE assists entrepreneurs like you in starting and growing business enterprises every day all across the country.

Started in 1964, SCORE (Service Corps of Retired Executives) is a nonprofit association dedicated to helping small businesses get off the ground, grow and achieve their goals through education and mentorship. Celebrating its 50th anniversary this year, SCORE has assisted over 10 million of America’s entrepreneurs in that time. As a national organization, SCORE is comprised of over 11,000 volunteers available at 320+ locations throughout the country and online. In 2013, the work of SCORE’s volunteer mentors and small business clients resulted in 38,630 new businesses started and 67,319 new jobs created in the U.S.

SCORE accomplishes these results through a variety of methods including educational workshops, webinars, and helpful online resources, but the real value that sets it apart from other organizations is free, personalized, one-on-one mentoring by business experts who have truly “been there and done that.” SCORE’s brigade of 11,000+ volunteer mentors is made up of men and women who are both retired and currently working, with experience in a huge variety of industries and fields. And true to the organization’s motto, SCORE mentors are there to assist “For the Life of Your Business” – from concept to creation, through growth and even eventual exit.

SCORE accomplishes these results through a variety of methods including educational workshops, webinars, and helpful online resources, but the real value that sets it apart from other organizations is free, personalized, one-on-one mentoring by business experts who have truly “been there and done that.” SCORE’s brigade of 11,000+ volunteer mentors is made up of men and women who are both retired and currently working, with experience in a huge variety of industries and fields. And true to the organization’s motto, SCORE mentors are there to assist “For the Life of Your Business” – from concept to creation, through growth and even eventual exit.

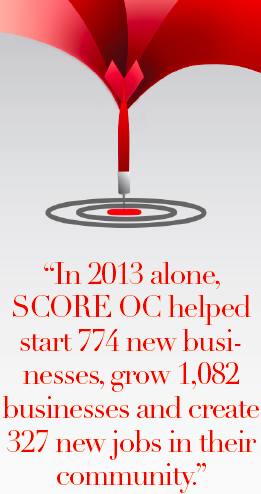

With 320+ chapters, many with their own additional branch locations, and a robust online educational offering, SCORE seeks to serve entrepreneurs through whichever information outlet is most convenient for them. One chapter in particular located in Orange County, California was recently named the 2013 SCORE Chapter of the Year for its commitment to excellence in serving entrepreneurs.

SCORE Orange County (OC) consistently serves the highest number of clients of all the SCORE chapters across the nation. In 2013 alone, SCORE OC helped start 774 new businesses, grow 1,082 businesses and create 327 new jobs in their community. But this chapter succeeds in much more than volume alone – a culture of innovation is their hallmark, driving continual expansion and improvement in services, bringing more and more clients into their educational and mentoring services.

One of the most groundbreaking developments to come out of Orange County is the concept of the CEO Forum program. These forums consist of monthly half-day collaborative meetings of small business owners that are facilitated by SCORE mentors. SCORE OC hosts seven of these ongoing forums with over 80 small business owners, and the concept has now been successfully replicated in a number of other SCORE chapters, including Minneapolis and San Diego.

SCORE OC has also made it a priority to effectively serve female entrepreneurs by hosting bi-monthly Women in Business Breakfasts that facilitate learning and networking, as well as annual Women Business Owners Conferences. The annual conference is a fantastic opportunity for female business owners to hear from knowledgeable speakers, learn from successful peers and network with others.

In fact, SCORE OC has been so successful in helping local businesses start and grow that two of their small business clients were chosen from nominees across the country to be honored with national SCORE awards in August of 2013.

ViArch Integrated Solutions, a leading provider of automated precision measurement and control solutions, was named the 2013 SCORE Outstanding Minority-Owned Small Business award winner. Owners Angela and Eric Jones teamed up to start their business in April of 2008. They both had the technical know-how to achieve great results for their prospective clients in the aerospace industry, but needed help with their marketing and sales tactics. They worked with SCORE OC mentor John Pietro to create a thorough and thoughtful plan to keep their enterprise on track towards their goals. Angela reflects on the start of their business saying, “We spent a lot of wasted effort reacting to issues we could have anticipated and addressed ahead of time, had we only done a bit of planning at the start. After working with SCORE Orange County, we gained critical business knowledge and management skills, and are in a better position to plan and strategize as well as operate our business effectively going forward. Compared to the alternative, I much prefer having a ‘map’ directing us where we are going, with a plan for addressing hurdles when they arise.”ViArch now boasts an impressive list of clients including The Boeing Company.

Orange County’s second national award winner caters to a slightly different clientbase: pet lovers! Dog is Good, a pet-themed retail operation in Los Alamitos, took home the 2013 SCORE Outstanding Veteran-Owned Small Business award. Owners Jon and Gila Kurtz knew being entrepreneurs was in their blood. In 2005 the couple recognized a void in the pet marketplace and seized the opportunity to start their own business. By 2008, Jon (an active captain in the U.S. Navy) and Gila (a professional dog trainer) began designing and selling dog-themed apparel at small retail events such as charity dog walks and fundraisers. Eventually they began selling their products in retail stores in Orange County and Los Angeles County. By the end of 2009, their revenues had nearly quadrupled, and sales have grown every year since then. When Jon and Gila needed help taking their business to the next level they turned to SCORE OC and met with Tom Patty, a marketing expert and SCORE mentor, who helped them focus their message to keep it centered on their core audience. With these defined goals in mind, the Kurtzes have begun licensing other products and are now branching into cat and horse products as well.

ViArch Integrated Solutions and Dog is Good are just two of the 10 million small business owners who have benefited from working with SCORE mentors over the past 50 years. And SCORE Orange County is just one chapter of more than 320 across the country that is dedicated to helping small businesses start and grow. With free expert business advice just a click or call away, why not take advantage of the wisdom and insight a SCORE mentor can bring to your business? Get started at www.score.org or by calling 1-800-634-0245.

Constance Freedman Talks to NAWRB about NAR’s REach Program

Constance Freedman took some time out of her extraordinarily busy schedule to talk to us about Second City Ventures and REach. REach is NAR’s program to hand-pick technology startup companies that can provide value to the Real Estate Industry, and help them grow and integrate with the industry.

The Second Century Ventures Fund (SCV) is a fund set up by the National Association of Realtors (NAR) six years ago, after their 100th anniversary (hence the name Second Century). Constance Freedman manages all aspects of the fund, from cultivating investment opportunities to helping portfolio companies achieve their strategic goals. Constance is also Managing Director of REach™, Second Century Ventures’ technology accelerator program.

It is a known fact that Real Estate represents 15% of the U.S. economy, over $7 billion of ad spend and 2.5 million jobs. If you were a technology company that developed a hot product, how do you break into the Real Estate market? You apply for REach, and if selected, NAR partners with you to make your name synonymous with Real Estate. It’s literally a dream come true for tech startups that can benefit the industry.

“NAR is the nation’s largest trade organization, and they literally hold your hand and give you access to their 1 million plus members. It’s more than just acceleration,” says Constance.

To clarify and give some background, we are really talking about two different entities here, Second Century Ventures, and REach. SCV is the investment arm of NAR, providing capital and resources to companies that can benefit the Real Estate Industry. Some past SCV investments include such familiar brands as ePropertyData, ZipLogix, Sentrilock, ifbyphone, Move Inc., and DocuSign. SCV actually funds the tech startups, whereas REach mentors and fine tunes the tech startups, then introduces them to the Real Estate Industry as preferred partners, accelerating their growth without providing actual startup capitol.

Most companies that are considered for either SCV or REach have a product or service that can serve a number of different industries, including Real Estate. For example, DocuSign provides enormous value to any industry with tight deadlines and that requires authenticated signatures, but the revolutionary value and convenience if offered the Real Estate Industry was enough to make SCV give them financial backing and literally roll out the red carpet to present DocuSign to the Real Estate Industry.

“Some companies don’t meet SCV’s investment threshold, but still have great potential, so we created REach to help them accelerate into the Real Estate Industry with mentoring, exposure, access to investment opportunities, and guidance on how to target this crazy industry,” says Constance.

“Some companies don’t meet SCV’s investment threshold, but still have great potential, so we created REach to help them accelerate into the Real Estate Industry with mentoring, exposure, access to investment opportunities, and guidance on how to target this crazy industry,” says Constance.

REach helps companies tailor their product or service specifically to the Real Estate Industry. REach mentors (some of the most highly regarded executives and entrepreneurs in the industry from companies with combined revenues of several billion dollars in real estate alone) guide them in optimizing both their marketing efforts and product offering to be real estate specific. REach also provides focus groups comprised of real estate professionals, to give real feedback on the product before it hits the market.

But by far, the greatest benefit of REach is being associated with, and introduced by, the National Association of Realtors. Having NAR introduce you as a preferred product and technology partner carries some serious weight; real estate professionals will not bother to stop and compare your product to your competitors’ after NAR has given their seal of approval.

For real estate professionals, both SCV and REach help them sort through the thousands of technology options, and immediately know which ones to choose, as they’ve been researched, tried and tested by NAR. The result is a true win-win situation for NAR, their chosen technology partners, and the Real Estate professionals who will come to rely on them.

Who is Afraid of the Big Reit?

Let’s start with REITs.

REITs, or real estate investment trusts, are often referred to as “real estate stock.” REITs are corporate entities that own a portfolio of properties and/or mortgage loans. Anyone can buy shares in a publicly traded REIT, and they are an attractive option for investors, since they offer the benefits of property ownership without the hassles of being a landlord.

REIT shares can be sold quickly, providing the key advantage of liquidity. There is also higher yield and less risk, since the investment is in an entire portfolio of properties, not just one or two.

REITs came into being in 1960, when Congress decided to made it possible for smaller investors to invest in large-scale, income-producing real estate via the purchase of equity, the same way one can buy stock in corporations in any industry.

Types of REITs

REITs generally fall into three categories: equity REITs, mortgage REITs, and hybrid REITs, with equity REITs (a.k.a. eREITs) being the largest category. Equity REITs own and manage income-producing real estate, which are acquired through bulk sales at discount prices directly from banks. Mortgage REITs, on the other hand, earn money either in the form of interest on mortgage loans or through the acquisition of mortgage-backed securities. Hybrid REITs invest in both properties and mortgages.

Investment trust firms benefit from the discount prices obtained from bulk purchases, enabling them to yield higher and faster returns. Banks enjoy the clear and much-needed benefit of being able to dispose of large volumes of non-performing assets without having to pay administrative costs, maintenance costs and broker fees to list each one separately. However, what is good for banks and investors is seldom good for the average homeowner.

Concerns

Some argue that regulators should expand their oversight of the large REITs that use borrowed money to invest in mortgage-backed securities, as the rise in interest rates may lead the firms into asset sales that destabilize markets and potentially damage the broader U.S. economy. The reliance by the industry on short-term loans to invest in government-backed mortgage securities involve interrelated risks, and should be monitored closely to reduce the risk of a cascading failure of counterparties with systemic implications. Sizable disruptions in the secondary mortgage markets against the possibility of rising mortgage rates could also have macroeconomic implications, jeopardizing the already-fragile housing market recovery.

The New Landlord

Most of us thought the single family rental market was robust before the housing market crash, with sixteen million SFRs already designated as rentals in 2010. If we add to the mix approximately five million foreclosed homes, and consider that many of them will become investor-owned rental units, we begin to see the enormity of the impact of bulk SFR sales that are allocated as rentals. Thus, the REO-To-Rental market has emerged as an institutional asset class.

The bulk sale-to-rental model provides a long-term rental income stream as well as the opportunity for appreciation. Consider the fact that these bulk sales are contributing to an inventory shortage on the open market, which means the model itself is ensuring faster appreciation as home prices increase due to limited supply. Many argue that this win-win for investors is a no-win for prospective homeowners, especially those who are rapidly getting priced out of the market. And those who get priced out of the market most likely end up renting, further feeding into the bulk sale investor’s win-win scenario.

The bulk sale-to-rental model provides a long-term rental income stream as well as the opportunity for appreciation. Consider the fact that these bulk sales are contributing to an inventory shortage on the open market, which means the model itself is ensuring faster appreciation as home prices increase due to limited supply. Many argue that this win-win for investors is a no-win for prospective homeowners, especially those who are rapidly getting priced out of the market. And those who get priced out of the market most likely end up renting, further feeding into the bulk sale investor’s win-win scenario.

What do critics say?

Many housing industry professionals are objecting to bulk foreclosure sales, considering them a gift for investors at the expense of taxpayers and prospective home buyers, and calling for changes at the Federal Housing Finance Agency (FHFA), the agency that initiated the program. While the bulk sale-to-rent program was initiated by the FHFA to help Fannie and Freddie unload thousands of foreclosed assets weighing down their books, banks began to quickly follow suit to dispose of bulk assets. When you consider that Fannie and Freddie own approximately 200,000 homes, and the nation’s banks own close to 600,000 homes, it is a feasible argument that the shift toward bulk sales will inevitably slow or halt the recovery of the housing market.

Although economic indicators show that the housing market is improving, many believe that tightened lending restrictions, negative equity, the deleveraging of borrowers and lenders, and the overhang of delinquencies will continue to suppress owner-occupied home sales while increasing the percentage of renters. If a large chunk of purchases are by investors and REITs, only investors benefit, and individual buyers and real estate professionals are excluded from the marketplace. We are looking at an entirely different real estate market with rapid gains in momentum down this path.

Bulk Sales inhibit the social benefits of home ownership – our government has historically recognized the stability that home ownership brings to communities, particularly urban communities. Programs such as the Community Reinvestment Act of 1977 served to boost ownership amongst those who would otherwise be shut out of the home ownership opportunity. Transferring increasing numbers of properties to big fund investors may turn the U.S. into a nation of renters instead of a nation of owners.

In an industry already devastated by dramatic reductions in earnings and inventory, bulk sales are forcing more and more real estate professionals to abandon their careers. The ‘shadow inventory’ or 2nd wave, that was once a buzzword that held promise among real estate professionals, has not yet made it to the market, and it is hard to predict at this point how much (if any of it) will. Another looming concern is that bulk sales may lead lenders to move back into the practice of direct selling in competition with agents, a clear conflict of interest.

Conclusion

While bulk sale purchases may yield significant ROIs for investors, the housing market at the MLS level will suffer from the loss of properties, which feeds a rise in home prices bolstered by the massively disruptive speculator intrusion. Many housing industry professionals will leave the industry. Future home buyers are left to wrestle with the consequential inflated housing prices, as critics accuse the FHFA of choosing to support investors instead of Americans that want a home to own and live in.

Despite such concerns, there is reason to believe that bulk sales to REITs, under a watchful eye, can help lighten the burden of REO inventory, which remains heavy. RealtyTrac estimates that the industry still has some 600,000 bank-owned homes to sell, and they can’t all go to bulk sale. Will the industry adapt?

Running Guide

Proper Running Technique

Proper Running Technique

Try not to overstride. When you lengthen your legs out too far in front of you while running, you can injure yourself. Instead, run in a way that feels comfortable for you. Try to land in the middle of your foot as opposed to on your heel or toe. This helps to absorb the shock and is best for your calves and knees. Once you have landed in the middle of your foot, you should roll through to your toes. Make sure you are standing erect and looking straight forward. Make sure your shoulders are back—but that you’re still comfortable.

Proper Running Shoes

According to Running Warehouse, people should purchase running shoes that are a size bigger than their normal shoe size. The reason for this is because running shoes generally run small. It’s also important to have your feet measured once every year because they can increase in size with age, and with pregnancy. When trying on running shoes, it’s best to do so later in the day, because feet tend to swell toward the end of the day. Runners can use the website RunnersWorld.com to find the perfect shoe for their height, weight, foot shape, running level, and more.

Business Climate for Women: NAWRB’s Recap of the 2014 NWBC Annual Report

The National Women’s Business Council (NWBC) independently advises the President, Congress and the U.S. Small Business Administration regarding economic matters that relate to women business owners. The Council seeks to improve conditions for women business owners and is the only independent voice for women entrepreneurs.

The NWBC has released its Annual Report for 2014. NAWRB has compiled valuable excerpts that expand on the council’s milestones and outlook for the future. NWBC Chair Carla A. Harris provides her personal message highlighting 2014.

Message from the Chair

At the end of 2013, the National Women’s Business Council committed to conduct earnest research to discern the challenges and obstacles that impede the growth and origination of women-owned and women-led businesses. The Council sought to deploy that research in a way that would expand the national conversation on women’s entrepreneurship and further an agenda to expand opportunities, resources, and access for women entrepreneurs.

Building on the Council’s four pillar platform — access to capital, access to markets, job creation and growth, and data collection— we worked to identify the challenges and intervention points and to develop implementable solutions and strategic opportunities that will ultimately improve the outcomes for women business owners as they seek to successfully grow and scale their businesses. Leveraging platform, experience, and convening power, the Council strategized to engage both the private and public sectors in providing tools, visibility and access to opportunities and resources.

In 2014, we delivered on this commitment with research, engagement and communications efforts that continue to inform policy, influence culture and strengthen the institutions that are necessary to support and sustain women’s entrepreneurship. We convened and engaged key stakeholders to address the challenges that women entrepreneurs face and worked together to change the outcomes, including exploring new and innovative sources of capital. We presented at conferences, published articles, engaged online audiences and used our profiles as Council Members to elevate the conversation around women and entrepreneurship. We strengthened our role as advisors to the U.S. Small Business Administration, Congress, and the White House and kept these customers informed and engaged with research and updates on developments in the field. We continue to stand in support of the passage of the Women’s Small Business Ownership Act of 2014, introduced by the Chair of the Senate Committee on Small Business and Entrepreneurship, Senator Maria Cantwell, and its specific components to improve access to lending, business training and federal contracting for women-owned businesses. We celebrated the growing economic and social power of women business owners and learned from their stories of resilience and success. We distributed the lessons learned to prospective entrepreneurs via innovative social media campaigns and other public awareness efforts.

In 2015, we are committed to building on this important work and acting on the lessons learned with impactful

In 2015, we are committed to building on this important work and acting on the lessons learned with impactful

research. The research agenda will highlight effective and new strategies that increase women’s access to capital and markets, including analysis of social networks, undercapitalization, participation in accelerators and incubators, as well as corporate supplier diversity programs. We will build regional networks and inform women entrepreneurs of the best opportunities and resources. We will engage women business owners and the public to broaden the Fconversation on women’s entrepreneurship and support the creation of a culture that encourages women’s business ownership and growth.

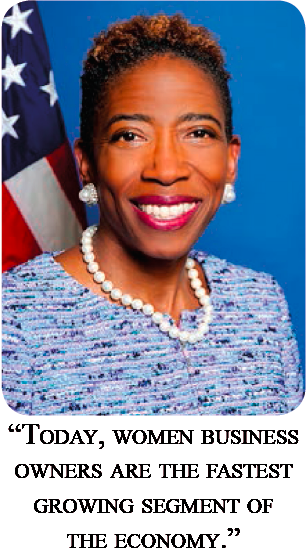

Women entrepreneurs have significantly increased their economic impact in the past few decades. Today, women business owners are the fastest growing segment of the economy. The Council remains committed to using research as a springboard for continued action and change as the landscape for women and entrepreneurship shifts. Our hope is to build bridges between influencers, institutions, and entrepreneurs, leveraging the power of research and collaboration, so that we can impact the business climate for women. The numbers confirm that the full economic participation of women and their success in business is critical to the continued economic recovery and job growth in this country— and we are honored to be part of the movement to impact and better the business climate for women.

We are excited to share our 2014 annual report, Building Bridges: Leveraging Research and Relationships to Impact the Business Climate for Women. Here you will find an in-depth look at our activities, research, key learnings, analysis and planned agenda for FY 2015.

– Carla A. Harris, Chair

Building on the words of Carla A. Harris, the NWBC is committed to its research regarding the state of women’s businesses and discovering better opportunities for women business owners. This includes the Council analyzing SBA loan data. The Council staff worked with the SBA Office of Women’s Business Ownership on a project to analyze SBA loan data. The purpose was to better understand women’s participation in SBA lending programs so that the outreach efforts to increase women’s participation could be better targeted by geography and program. Council staff is continuing the partnership with the SBA Office of Women’s Business Ownership to complete analysis based on more comprehensive data. This research will be released in 2015; the Council will then shift its focus to supporting the implementation of best practices based on the research conclusions.

The NWBC uses its research to discover what works and what doesn’t in terms of women-owned businesses.

As a follow-up to previous NWBC research that found that undercapitalization is associated with business failure, and that women-owned and women-led firms display certain characteristics (such as lack of capital from external sources) that are associated with business failure, the Council commissioned research on undercapitalization as a contributing factor to business failure. The goal of this research is to gain a better understanding of the role that access to capital and undercapitalization have on business outcomes for women-owned firms in particular.

Women-owned small businesses (WOSB) are still not meeting the goal in securing five percent contracts across all federal agencies. Eligible parties to receive North American Industry Classification System (NAICS) contracts include businesses being at least 51 percent directly owned and unconditionally controlled by one or more women who are citizens (born or naturalized) in the United States. The business must be small, meaning in congruency with the SBA’s size standards for that industry.

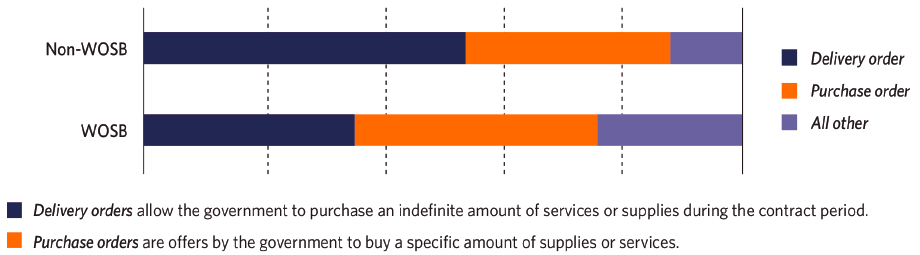

Here are the NWBC’s findings for contracting opportunities as well as awards to WOSBs:

- In 2012, WOSBs were awarded 182,791 contracts worth $11.5 billion.

- Since 2000, WOSBs have received an increasing share of contracts and awards, not only within the 83 designated industries but in other industries as well. But although WOSBs are generally meeting the contract threshold within the 83 underrepresented industries, they remain underrepresented in terms of awards share.

- Award dollars are concentrated among a small number of WOSB vendors. For example, in 2012, 20.0% of awards (amounting to $2.3 billion) went to 44 WOSB vendors. The other 80.0% of awards ($9.2 billion) went to 17,648 vendors.

- The contract action most frequently awarded to WOSBs from FY2007 to FY2012 was purchase orders; next most frequently awarded was delivery orders. An average delivery order is worth about eight times as much as the average purchase order. In other words, there is a great disparity between WOSBs and non WOSBs with regard to award amount, likely due to contract type awarded.

The SBA’s FY2013 Small Business Procurement Scorecard is used to analyze if federal agencies are meeting their objectives for their small business and socio-economic prime contracting and subcontracting goals. It is also used as a means to gather contracting data and report agency-specific progress. Some agencies were able to meet their agreed upon goals for 2013, while others were not.

Upon the release of the SBA’s FY2013 Small Business Procurement Scorecard, the Council congratulated the 20 federal agencies meeting the 5.0% WOSB procurement goal. The Council also called attention to the four agencies that did not meet the goal: Department of Defense, Department of Energy, Department of Veterans Affairs, and the National Aeronautics and Space Administration. A closer look at the data shows only a 0.32% increase in contract dollars awarded to women-owned small businesses, up from 4.00% in FY2012 to 4.32% in FY2013, but again falling short of the goal.

In order to bolster the statistics, the Council provided additional access to more resources pertaining to government contracting.

The Council promoted SBA online courses on government contracting, including: “The WOSB Advantage,” “Government Contracting 101,” and “Women-Owned Small Business Program: A Primer for Contracting Officers.

Business-to-business (B2B) sales refer to the business between two different companies, as opposed to business conducted between a business and a consumer. Normally, a supply chain works with multiple B2B transactions. However, there is a trend of B2B sales accumulating more revenue than business-to-consumer (B2C) sales.

The Council released an infographic on women-owned businesses in the supply chain showing that women-owned businesses with business-to-business (B2B) sales earned higher receipts regardless of industry, and tend to have better access to capital. Anecdotal evidence suggests that having other businesses as customers is a key strategy to scaling a company. The infographic features the success story of Stacy Madison, the founder and former owner of Stacy’s Pita Chips, and details her use of B2B sales to scale her chip empire.

From online courses to studies on B2B sales, the NWBC needs data to understand what resources to provide and what is trending. The Council continues to foster the creation of hard statistics to help better assist women business owners. Federal agencies can be especially helpful in collecting meaningful data.

The Consumer Financial Protection Bureau (CFPB) is a federal agency that overlooks financial products and services.

The Council urged the implementation of an annual Survey of Business Owners and called on the Consumer Financial Protection Bureau to begin collection of data on demand for small business credit.

The Council urged the implementation of an annual Survey of Business Owners and called on the Consumer Financial Protection Bureau to begin collection of data on demand for small business credit.

Council staff met with staff from the Consumer Financial Protection Bureau’s Office of Community Affairs and the Office of Regulations to elevate the need for collection of demographic information on demand for credit, specifically requesting an updated timeline on compliance with the Dodd-Frank Act. Council staff learned that implementation of Section 1071 of the Dodd-Frank Act, which amends the Equal Credit Opportunity Act to require that financial institutions collect and report information concerning credit applications made by women-owned and minority-owned businesses, continues to be on hold until the Bureau’s release of implementation regulations, which they have signaled will happen upon completion of the Home Mortgage Disclosure Act implementation.

Other agencies and influential runners that the Council appealed to for data collection include the U.S. Census Bureau and Secretary of Commerce Penny Pritzker.

The U.S. Census Bureau and the Kauffman Foundation confirmed a partnership on an annual survey of business owners — as a complement, not a replacement, to the U.S. Census Bureau’s Survey of Business Owners that currently takes place every five years. This annual survey will collect 2014 data, be completed in 2015, and be released in 2016.

The Chair met with Secretary of Commerce Penny Pritzker to recommend the collection of the following data points for the quinquennial Survey of Business Owners:

- Future plans for business at present (regardless of original intentions)

- Intentions behind starting firm (for example, necessity vs. lifestyle vs. growth)

- Amount of capital by source

- More detailed industry information available in the public use microdata set

- Information about patents and intellectual property

- Longitudinal data

- Title/role of owners (for example, CEO) to determine if “women-led”

- Information on STEM education

- Legal form of organization (for example, C-corporation, S-corporation, LLC, partnership or sole proprietorship)

- Participation in exporting

In addition to the NWBC’s recommendations for new data collection, there is one important subject that could benefit from further research: the women’s entrepreneurship ecosystem.

Many membership organizations, government agencies, financial institutions, academics and others are nurturing the women’s entrepreneurship ecosystem, which provides support to the 7.8 million women business owners in the country. However, there is little understanding of the system as a whole and how its component parts work together. Because of the Council’s convening power and relationship with many of the stakeholders in the women’s entrepreneurship ecosystem, the Council is uniquely positioned to make recommendations to strengthen the support organizations that help women grow their businesses.

The NWBC proposed a series of hypotheses and questions:

- How do demographic, social, economic and other factors impact the ability of women business owners to gain entry into and successfully participate in corporate supplier diversity programs?

- How aware are women business owners of supplier diversity programs and the opportunities for growth they might offer?

- How have women business owners overcome the challenges and barriers that hinder their participation in corporate supplier diversity programs?

- What “best practices” and characteristics are most common to corporations with successful supplier diversity programs?

- What are the benefits of supplier diversity programs — to both women business owners who participate in and corporations that offer such programs?

- For what reasons do some women entrepreneurs choose to seek to participate in corporate supplier diversity programs while others do not?

- In what industries do women-owned businesses have a growing presence in corporate supplier diversity programs and what is contributing to the growth?

The data and methodology will be established in January 2015.

The data and methodology will be established in January 2015.

Moving forward with 2015, the NWBC has proposed multiple strategies to better connect women-owned businesses with the proper opportunities to expand their businesses. One strategy includes the following:

- The Council will propose an expansion of the NAICS codes in which WOSBs are eligible for set-asides — currently 83 NAICS codes — to better represent the demographics of today’s women business owners and increase participation within the WOSB program.

- The Council will celebrate and learn best practices from the government agencies that met their 5.0% goals, and share with those that did not meet the goal.

- Research will identify existing opportunities and potential barriers for women entrepreneurs in corporate supplier diversity programs and share best practices of corporate supplier diversity programs.

- The Council, in partnership with the six participating membership organizations and other interested parties, will conduct matchmaking events for women and government contracting opportunities — by region, industry, and readiness — by leveraging the SBA’s Business Opportunity database.

Research that better serves women-owned businesses and provides greater awareness is most effective when shared with extended outreach. The Council has adopted strategies to bring the necessary awareness. One of its strategies is to “share research and findings through consistent and strategic outreach and updates to policymakers, influencers, partners, and other stakeholders.

- The Council will begin a new project, in partnership with the SBA Office of Women’s Business Ownership and Carnegie Mellon University, to map out the entrepreneurship landscape — including membership organizations, Women’s Business Centers, government agencies, financial institutions, academic institutions, and other entities — and its impact.

- The Council will work with participating membership organizations on a journey mapping of women’s entrepreneurship, offering guidance for the potential challenges and highlighting available opportunities and resources.

NAWRB appreciates everything the NWBC does to expand opportunities and champion for women in business. For the full 2014 NWBC Annual Report, visit www.nwbc.gov.

Login

Login