Advocating for change, more than 300 women business owners and their leaders descended on Washington, D.C. packing one of the largest Congressional hearing rooms on Capitol Hill to standing room only. Congressional hearings rarely draw this kind of attendance or celebrity, but both were on display for a July 23, 2014 hearing, “Empowering Women Entrepreneurs: Understanding Successes, Addressing Persistent Challenges, and Identifying New Opportunities,” chaired by newly appointed Committee Chair Maria Cantwell (D-WA).

The hearing, which coincided with the annual conferences of Women Impacting Public Policy (WIPP) and the Association of Women’s Business Centers (AWBC), featured witness testimony from Maria Contreras-Sweet, Administrator of the Small Business Administration, Barbara Corcoran, host of the hit ABC TV series “Shark Tank,” Nely Galán and women entrepreneurs who spoke of their experiences – both the successes and the struggles – of starting and growing businesses. The hearing was broken into three separate sessions: access to capital, access to federal contracts, and access to counseling and training.

The takeaway was simple: there are federal policies that can help women business owners in each of the three areas and the Congress should act on them immediately. The reaction from the Senate was swift; one week after the hearing, Committee Chair Cantwell and six of her Senate colleagues introduced legislation, appropriately titled the Women’s Small Business Ownership Act of 2014, S.2693.

“Women make up half of the population, and we have a lot of ideas that could become great products and spur our economy,” said Chair Cantwell at the bill’s introduction, adding, “This legislation will help ensure women entrepreneurs get the right tools they need to turn those ideas into new businesses and create jobs.”

The Senate bill was largely founded on a report released by the Committee in July, 21st Century Barriers to Women’s Entrepreneurship. The findings are summarized neatly – yet alarmingly – into two short sentences: “In the 21st Century, women entrepreneurs still face a glass ceiling; while women-owned firmsare the fastestgrowing segment of businesses, and many succeed, women must overcome barriers their male counterparts do not face.” The report highlights the fact that women businesses generate $3 trillion in economic activity and support more than 23 million jobs, but continue to face significant obstacles when it comes to business ownership.

More specifically, the Senate report identified critical challenges women confront in three issue areas: access to capital, access to business training and counseling, and access to the federal marketplace. According to the report, women entrepreneurs account for just $1 out of every $23 in small business lending in the United States, despite representing 30 percent of all small companies. Women’s Business Centers (WBCs) provide entrepreneurial and business training to women entrepreneurs (which they do efficiently and effectively at a cost of approximately $137 per entrepreneur) but are stretched extremely thin with most states having just one center with a small staff.Despite a 500 billion dollar a year federal marketplace, women-owned small businesses got only 4.3 percent of federal contracts in FY2013, despite a Congressionally mandated goal of five percent.

More specifically, the Senate report identified critical challenges women confront in three issue areas: access to capital, access to business training and counseling, and access to the federal marketplace. According to the report, women entrepreneurs account for just $1 out of every $23 in small business lending in the United States, despite representing 30 percent of all small companies. Women’s Business Centers (WBCs) provide entrepreneurial and business training to women entrepreneurs (which they do efficiently and effectively at a cost of approximately $137 per entrepreneur) but are stretched extremely thin with most states having just one center with a small staff.Despite a 500 billion dollar a year federal marketplace, women-owned small businesses got only 4.3 percent of federal contracts in FY2013, despite a Congressionally mandated goal of five percent.

In order to lift the glass ceiling for women business owners, the legislation proposes specific actions, which are described in greater depth below:

Access to Capital

The bill enhances the SBA’s Microloan program by allowing lenders in the program to increase overall lending capacity to $7 million and by offering more flexible loan terms, and improved business counseling and technical assistance. This legislation also makes the SBA Intermediary Lending Program permanent and would extend for one more year the fee waiver on 7(a) business loans below $150,000. Together, these changes would allow for greater access to capital for women-owned businesses. If you do not know about these lending programs, go to the Small Business Administration’s website.

Access to Counseling and Training

To boost support and modernize the national network of Women’s Business Centers, the bill increases funding of the program from $14.5 million per year to $26.75 million and increases the maximum grant award from $150,000 to $250,000. The bill also requires that a formal set of program guidelines be issued and reinstates the SBA’s authority to waive the federal matching requirement.

Access to Federal Contracting

Finally, the legislation would provide sole source authority in the Women-Owned Small Business (WOSB) Procurement Program. Currently, government agencies must find multiple women-owned small businesses capable of competing for a contract before the WOSB program can be used. Sole source authority removes this burden, making it easier for agencies to award contracts to women through the program. It is also a matter of fairness, as the WOSB is the only government small business contracting program that does not have sole-source authority.

These policies are important and advocates such as WIPP, the AWBC, and the Association for Enterprise Opportunity (AEO), are working hard to see them signed into law.

The sheer number and awe-inspiring presence of so many women – who traveled from all over the country – to unite in support of a common cause was powerful. The hearing room, more typically accustomed to hushed tones and wonky exchanges, was packed to the brim with successful women business owners ready to act.

While organizations dedicated to assisting women business owners will press for enactment, it is the push from each woman business owner in the country that will make the difference.

Together, we can break through the glass ceiling that now limits women businesses from reaching their full potential.

—

Ann Sullivan

WIPP Government

Relations

Login

Login

NAWRB’s Inaugural Women in Housing Financial Fitness Road Show is a first-of-its-kind, breakthrough program for women in all industries within the housing economy. More than just tools to navigate women’s existing business through the changing terrain, NAWRB’s Women in Housing Financial Fitness Road Show reached a whole new level. Utilizing a specialized hybrid of women in housing and women in government outreach, women can take advantage of our Fast Track niche. By connecting women with federal and local programs, set-asides, funding options and contracting opportunities available to grow their businesses both vertically and horizontally, women in housing will have the awareness to sustainable growth and live beyond commission to commission.

NAWRB’s Inaugural Women in Housing Financial Fitness Road Show is a first-of-its-kind, breakthrough program for women in all industries within the housing economy. More than just tools to navigate women’s existing business through the changing terrain, NAWRB’s Women in Housing Financial Fitness Road Show reached a whole new level. Utilizing a specialized hybrid of women in housing and women in government outreach, women can take advantage of our Fast Track niche. By connecting women with federal and local programs, set-asides, funding options and contracting opportunities available to grow their businesses both vertically and horizontally, women in housing will have the awareness to sustainable growth and live beyond commission to commission. “Thank you for having the vision and for putting it all together! It was a great event!” -U.S. SBA-Santa Ana District Office, Economic Development Specialist Sylvia Gutierrez.

“Thank you for having the vision and for putting it all together! It was a great event!” -U.S. SBA-Santa Ana District Office, Economic Development Specialist Sylvia Gutierrez.

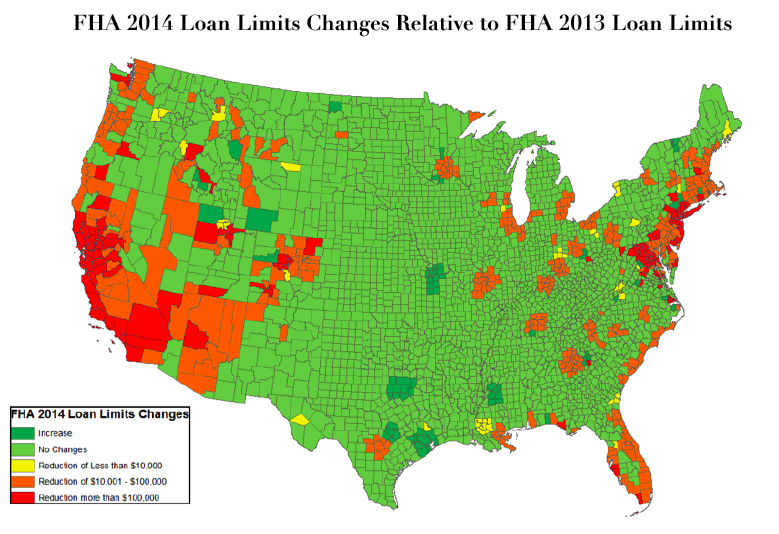

With more aggressive lending compliance standards and regulations in 2014, lenders have been scrambling to implement internal systems in order to comply. Every real estate professional should understand the central issue that will impact their clients who obtain loans at the closing table: the “Ability to Repay” Rule (ATR).

With more aggressive lending compliance standards and regulations in 2014, lenders have been scrambling to implement internal systems in order to comply. Every real estate professional should understand the central issue that will impact their clients who obtain loans at the closing table: the “Ability to Repay” Rule (ATR).

Mortgage loan volumes have experienced a consistent drop across all lenders throughout 2014. In the first quarter, lenders made a total loan volume of $226 billion, an all-time low amount that hasn’t been achieved since 1997. One of the largest lenders, Wells Fargo, took the hardest hit with a 67% drop in originated residential mortgages.

Mortgage loan volumes have experienced a consistent drop across all lenders throughout 2014. In the first quarter, lenders made a total loan volume of $226 billion, an all-time low amount that hasn’t been achieved since 1997. One of the largest lenders, Wells Fargo, took the hardest hit with a 67% drop in originated residential mortgages.

homeowners with mortgage debt increased by 2.3 million. Rising home values and the trend of people purchasing their first homes in the latter half of their lives all contribute to the increase in mortgage debt.

homeowners with mortgage debt increased by 2.3 million. Rising home values and the trend of people purchasing their first homes in the latter half of their lives all contribute to the increase in mortgage debt.

show at the Long Beach Convention Center. Each year, the conference gathers talented performers, doctors, successful entrepreneurs, and many more to provide an unparalleled experience for attendees. From entertainment, to financial seminars and health talks, the conference had a presentation to interest anyone.

show at the Long Beach Convention Center. Each year, the conference gathers talented performers, doctors, successful entrepreneurs, and many more to provide an unparalleled experience for attendees. From entertainment, to financial seminars and health talks, the conference had a presentation to interest anyone.

Houghtailing’s goal at the conference was to help both men and women achieve financial freedom through analyzing and changing personal behavior. She successfully blended humor with informative financial awareness practices to captivate attendees at the first financial presentation of the day, Disrupting and Dismantling the Five Beliefs that are Compromising your Financial Freedom.

Houghtailing’s goal at the conference was to help both men and women achieve financial freedom through analyzing and changing personal behavior. She successfully blended humor with informative financial awareness practices to captivate attendees at the first financial presentation of the day, Disrupting and Dismantling the Five Beliefs that are Compromising your Financial Freedom.

The bill establishes an Office of Minority and Women Inclusion that promotes employment and contracting opportunities to address diversity matters. The offices will coordinate technical assistance to minority-owned and women-owned businesses and establish diversity requirements throughout various industries.

The bill establishes an Office of Minority and Women Inclusion that promotes employment and contracting opportunities to address diversity matters. The offices will coordinate technical assistance to minority-owned and women-owned businesses and establish diversity requirements throughout various industries.

Agent training sessions were provided on Sunday by BLB Resources, Green River Capital, Round Point Mortgage, Precision Asset Management, PEMCO, RIO Genesis, iServe Real Estate Operations, Matt Martin Real Estate Management, LRES, Noteschool, Wells Fargo, and Equator to help serve the attendees with direct connection with their clients.

Agent training sessions were provided on Sunday by BLB Resources, Green River Capital, Round Point Mortgage, Precision Asset Management, PEMCO, RIO Genesis, iServe Real Estate Operations, Matt Martin Real Estate Management, LRES, Noteschool, Wells Fargo, and Equator to help serve the attendees with direct connection with their clients. That evening, a charity auction featured sports memorabilia, jewelry, and purses, with bidding wars and exciting wins. Monies from the silent and live auctions benefited the REOMAC® Foundation’s Scholarship Program.

That evening, a charity auction featured sports memorabilia, jewelry, and purses, with bidding wars and exciting wins. Monies from the silent and live auctions benefited the REOMAC® Foundation’s Scholarship Program.

The Inland Empire is comprised mainly of blue-collar workers, and a potential industrial spike will likely increase blue-collar jobs. In John Husing’s same presentation he highlighted that manufacturing could be a major growth source for the Inland Empire. This in turn will attract more workers, and as a result increase the demand for housing. With the median wage for manufacturing sectors between $40,000-$55,000, and using the industry standard that a mortgage payment should not represent more than 35 percent of monthly wages, the higher quartile of blue-collar workers qualify for a $225,000 dollar home, with a 3.5 percent down payment. What the above figure describes is a need for moderately priced housing.

The Inland Empire is comprised mainly of blue-collar workers, and a potential industrial spike will likely increase blue-collar jobs. In John Husing’s same presentation he highlighted that manufacturing could be a major growth source for the Inland Empire. This in turn will attract more workers, and as a result increase the demand for housing. With the median wage for manufacturing sectors between $40,000-$55,000, and using the industry standard that a mortgage payment should not represent more than 35 percent of monthly wages, the higher quartile of blue-collar workers qualify for a $225,000 dollar home, with a 3.5 percent down payment. What the above figure describes is a need for moderately priced housing. Scott Kueny

Scott Kueny