Homebuyers should think about buying their first home in Boulder, CO, as it is ranked the best housing market for growth and stability by a recent Smart Asset report. According to their findings, the odds of a major drop in home prices are 0 percent in the city, while properties have increased 268 percent in price in the last 25 years. Metro cities in both Colorado and Texas make up a majority of the top ten housing markets.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Tag Archives: homeowner

How Agents Can Better Serve Single-Women Homebuyers

Married couples might comprise the greatest share of homebuyers, but single women follow close behind, especially retired women over the age of 55, according to the Wall Street Journal. Gone are the days when women had to wait until marriage to buy a home; now, women are feeling more confident in creating their own sanctuary and means of wealth-building through homeownership.

If agents hope to maintain their success in the industry, they must prepare for a growing market of single-women homebuyers—a trend that will only increase as more women earn degrees, attain higher-paying jobs and seek properties to buy. Whether your client is a six-figure earning professional, a single mother or a divorcee looking to start a new chapter in her life, or all of the above, here are some important factors to consider when helping your clients, courtesy of the 2018 NAWRB Women in the Housing Ecosystem Report.

Couples, married or unmarried, normally have more buying power than single homebuyers because they have two sources to pull from that could go toward mortgage payments. According to 2016 NAR data, married couples have the highest income of around $99,200, compared to single buyers; however, dependence on a primary income is not deterring single women from buying homes.

Home-Buying Process for Single Women

- Single women are independent; thus, all home-buying decisions—including where to live, how much of a mortgage payment they can afford, how to decorate their house, etc.—will be made by them.

- Single women are interested in buying a home as a means of wealth-building. They’re taking the necessary steps to ensure their financial security in the future, whether or not they have a partner.

- As a single woman, size may not be as important as location and affordability. Some women are interested in owning a home to get a pet, so a sizable backyard is a must.

- Stringent lending standards make it more difficult for singles applying for loans with one income.

Home-Buying Process for Single Mothers

- With a limited income, saving money will be difficult because of child-related expenses. Single mothers are also looking for a property they can afford in the long term.

- Single mothers will want a safe, supportive community with a low crime rate and reputable education system. Having nearby infrastructure and basic amenities like shopping centers, hospitals and parks will be preferred.

- Working mothers, like other single women, have limited time on their hands; however, single mothers are crunched even more for time, as being a mother is another job in and of itself.

- Smart home technology, such as security alarms, intercom systems, carbon monoxide detectors and nightlights, could be especially important and appealing to single mothers.

A home is a woman’s sanctuary, a place to call her own, and an invaluable asset that cements one’s professional progress and economic foundation. It would be beneficial for agents to keep this in mind as they assist the needs of women buyers. Your clients will return the favor by referring your services to like-minded friends interested in taking the leap into independent living and property investment.

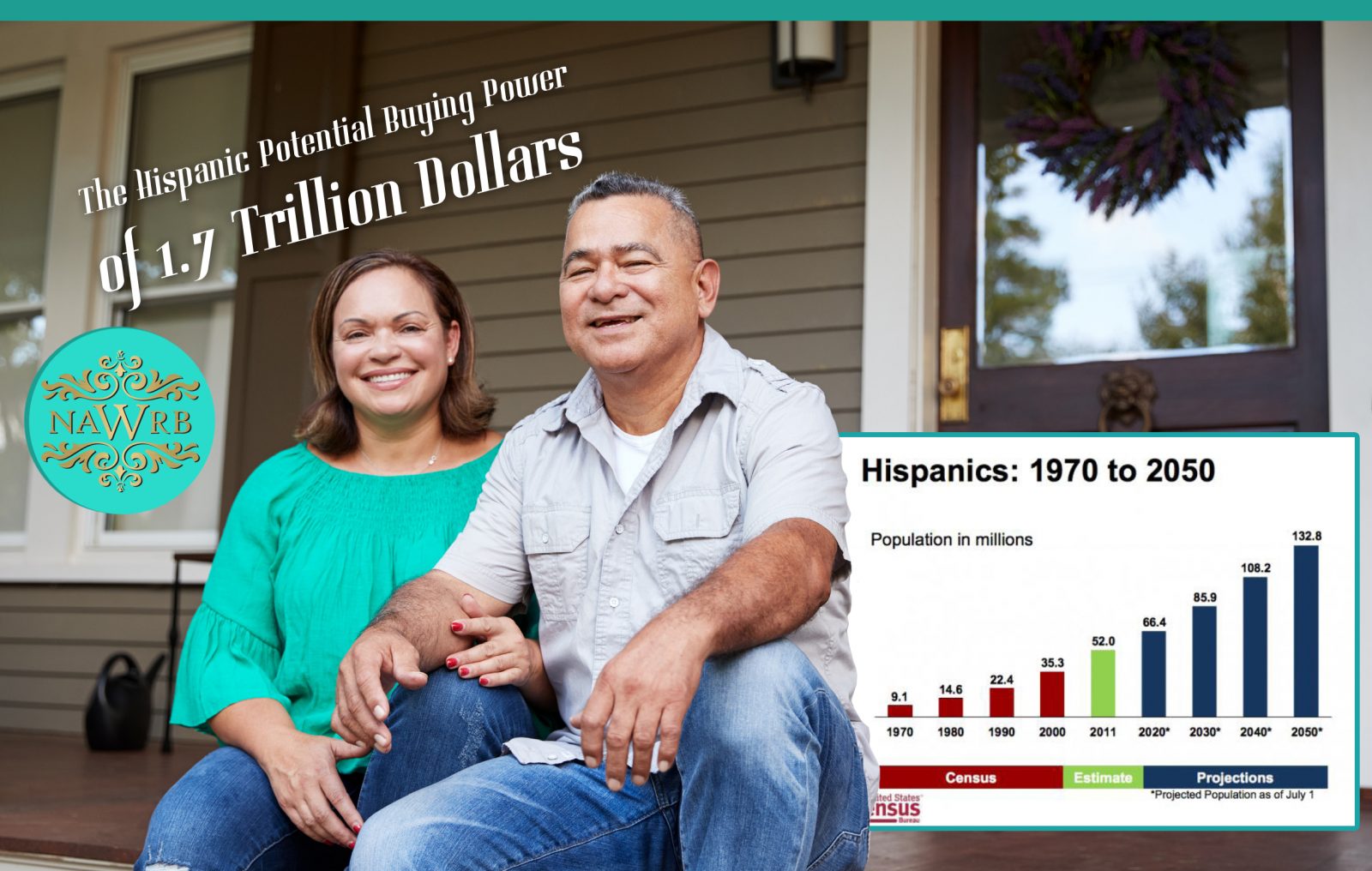

The Hispanic Potential Buying Power of 1.7 Trillion Dollars

The goal of every business is to make a profit and the real estate industry is no different. An often undermined market is the Hispanic and this article will help you uncover the potential within the Hispanic market that most overlook, which means millions of dollars for businesses looking to invest in this market.

Tap into the 1.7 Trillion Dollars Market

The U.S. houses an ever-growing Hispanic population resulting in an increase in potential purchasing power that is generally overlooked. Statistics from Pew Research Center, as at 2015, indicate that about 57 million Hispanic people live in the U.S.; that is 18 percent of the whole U.S. population, compared to 1980 when the percentage stood at a mere 6.5 percent. Additionally, the Census Bureau in 2014 predicted that the Hispanic population will double to about 119 million come 2060.

Continue reading →

Deadliest Fires in California 2018: Resources for Financial Recovery

After dealing with numerous deadly fires earlier this year, California is currently dealing with three major wildfires, including the Camp Fire in Butte County, the Woosley Fire in Los Angeles County and the Hill Fire in Ventura County. California Governor-elect Gavin Newsom recently issued emergency proclamations in response to the wildfires and requested statewide FEMA Emergency Declaration. While Cal Fire firefighters still work hard to contain these fires and affected homeowners plan their next steps, it is important to know about the available resources for financial and physical damage recovery.

While we still await updates, these California fires are being named the deadliest in the state’s history. At time of writing, the number of deaths from the Camp Fire in Northern California has risen to 63 while over 600 people remain missing. According to recent updates by Cal Fire, the Camp Fire has burned approximately 142,000 acres, causing over 40,000 residents to abandon their homes and find safety. The Woosley Fire has burned more than 98,000 acres and numerous homes, and the Hill Fire in Ventura County has burned over 4,000 acres, including RVs and outbuildings. While the Hill Fire is fully contained, the Camp Fire is 45 percent contained and the Woolsey Fire is 69 percent contained.

Continue reading →

Attention All The Single Ladies: 5 Ways To Help You Become a Homeowner

Despite the pay gap, women are increasingly becoming financial powerhouses. Case in point: they now control 51 percent of American wealth, totaling some $14 trillion in assets. One of the ways they’re using those assets to their advantage? Home buying.

According to the latest data from Ellie Mae, women are the primary borrowers on 32 percent of all closed mortgage loans. When women take the lead on a home loan, they’re single 61 percent of the time. Buying a home is tough enough with a spouse or a significant other, but it can be even more challenging when flying solo. To better help your clients who are first-time homebuyers, here are some of the most important things you need to keep in mind.

1. Affordability is about more than Purchase Price

One common pitfall many homebuyers often fall into is misjudging how much they can really afford to spend. For single women, that can be especially problematic because they rely on just one income, and it’s often lower than what men earn.

The Bureau of Labor Statistics (BLS) puts the median weekly income for women who are working in full-time management or professional positions at $1,019. That adds up to $52,988 annually, or $4,416 a month. By comparison, men make a median annual salary of $73,060.

Assuming your client has an annual salary of $52,988, zero debt, and $40,000 for a down payment, they could theoretically afford a $245,900 home if they got a 30-year loan at a rate of 3.39 percent, according to Realtor.com’s home affordability calculator. Their payments would come to approximately $1,224, including the principal and interest, taxes, homeowners’ insurance and private mortgage insurance, leaving them with $3,192 a month to pay the rest of their bills, cover everyday expenses, and save.

That seems like plenty of money, but it can go relatively quickly if homeownership results in higher utility costs, or they’re spending more on transportation because they have a longer commute to work. They also have to factor in the added expense of things like maintenance and home repairs, which could put even more of a strain on their financial resources.

In that scenario, something like saving for retirement could easily get pushed to the backburner. Considering that women are more likely than men to retire poor, socking away money for retirement isn’t something your clients can afford to skip out on. Before your client makes a move on a home, make sure that it doesn’t come at the expense of their other financial goals.

2. Your Clients Down Payment Matters

Putting 20 percent down on a home is the generally accepted industry standard, but it is possible to buy a home with less cash out of pocket. An FHA loan, for instance, will allow your client to put down as little as 3.5 percent.That’s tempting for a single woman who’s trying to keep short-term costs as low as possible, but it comes at a price. Taking on an FHA loan or a conventional loan with a down payment of less than 20 percent means paying private mortgage insurance (PMI), which drives up the cost of home buying.

Let’s say your client has their eye on a $250,000 home, and they want to get a 30-year, fixed-rate loan at a rate of 3.39 percent. If they put 20 percent down, that eliminates the private mortgage insurance requirement and sets their payment at $1,139, which breaks down to $886 for the principal and interest, $63 for homeowners’ insurance and $190 for property taxes.

On the other hand, if they only put 10 percent down, that adds $117 a month for private mortgage insurance. The principal and interest part of their payment increases to $997, so they’re now looking at a payment of $1,367 a month, including the PMI, property taxes and homeowners insurance.

If your client is a single woman who’s pulling in a modest salary, a difference of more than $200 a month in the mortgage payment can have a significant impact on their bottom line. Saving up a larger down payment may mean delaying your client’s home purchase, but they will thank you if it allows them to shrink their monthly housing costs in the long term.

Continue reading →

Agents: Closing Gifts for a Lasting Impression

The process of buying a home can be stressful for many buyers, especially first time home buyers. Luckily, real estate agents have the expertise to help clients navigate the process to find their perfect home. The constant interaction between buyers and agents can also result in the formation of strong bonds. What better way to cement your friendship and business relationship with your client than with a small closing gift?

Login

Login