The National Association of Hispanic Real Estate Professionals (NAHREP) released The 2019 State of Hispanic Homeownership Report®, the tenth installment of their annual report, which synthesizes data and research of a broad cross-section within and outside of the housing industry. The purpose of the report is “to evaluate how the U.S. Hispanic population is faring in terms of homeownership acquisition and to review the primary opportunities and barriers to future homeownership growth,” the report states.

Know an Incredible Woman Preserving the

Quality of Life During COVID-19?

Submit your story today!

Read More

Consulting & Branding Opportunities

Grant your business access to insider,

proven knowledge to improve the quality of your procured

services and maximize business performance.

If you need D&I

Contact Us!

A Team Focused on Bring Diversity and Inclusion to Every Level

Learn More

#1 Top Real Estate Influencer

Desiree Patno

Diversity & Inclusion, Quality of Life, Know the Rules of the Game ®

Your Next Event

Grow Your Business

NAWRB: An SBA Resource

NAWRB is listed as a women-owned business resource for the SBA.

Check It Out

NAWRB Aging Population

Help Protect Elders

from Financial Abuse

Over $36.5 billion a year is lost annually in the U.S.

Prevent Financial Abuse

Women's Homeownership:

Dream. Stability. Sanctuary.

Life often presents us

with unplanned disruptions.

AI Technology

with

a Human Touch

Is

The Perfect Balance

NAWRB Women's Global Resource Center

A women’s depository for vendors & clients to grow their diverse spend & increase women’s employment at all levels within the housing ecosystem.

Tag Archives: homeownership

Know the Rules of the Game® for Homeownership with Angie Weeks

Welcome to the very first episode of the Know the Rules of the Game® Podcast, hosted by Desiree Patno, CEO of Women in the Housing & Real Estate Ecosystem (NAWRB)! Her first guest is Angie Weeks, a broker at Metro Estates, NAWRB Certified Delegate Spokeswoman and creator of 2020 Homeownership Day at Chapman University, who joins Desiree Patno to discuss the value add of homeownership.

Join NAWRB at the OC Home Fair at Chapman University on Jan. 18th!

If you are looking to buy or sell a home or investment property, you don’t want to miss the 8th Annual OC Home Fair on January 18t, 2020 at Chapman University from 10 AM to 12:45 PM, PST. Attendees will have access to a variety of free educational classes from industry experts, including Desiree Patno, CEO & President of NAWRB, and NAWRB Certified Delegate Angie Weeks, Realtor, First Time Buyer & Move Up Specialist.

WHER Chat: Happy Hispanic Heritage Month!

From September 15th to October 15th, National Hispanic Heritage Month celebrates the histories, stories, cultures and contributions of American citizens whose ancestors came from Mexico, Central and South America, Spain and the Caribbean. The observance began in September 1968 as Hispanic Heritage Week and was expanded into a month in 1989.

AREAA Releases 2019 State of Asia America Report

The Asian Real Estate Association of America (AREAA) just released the 2019 State of Asia America Report, which provides a thorough profile of Asian American and Pacific Islander (AAPIs)communities residing in the United States. The report provides information on the education, homeownership rates, economic impact, consumerism and other important topics on this often underrepresented and misrepresented segment of the population.

10 Most Popular Cities for Millennial Homebuyers

We often hear that Millennials are currently driving the housing market. This rings true even for those in their 20’s nearing their 30’s, a prime time for first-time buyers. In a recent report, Realtor lists the most popular U.S. cities for Millennial homebuyers between the ages of 20 and 29 by looking at where they took out the highest percentage of mortgages last year from a pool of 200 large metropolitan areas.

How Agents Can Better Serve Single-Women Homebuyers

Married couples might comprise the greatest share of homebuyers, but single women follow close behind, especially retired women over the age of 55, according to the Wall Street Journal. Gone are the days when women had to wait until marriage to buy a home; now, women are feeling more confident in creating their own sanctuary and means of wealth-building through homeownership.

If agents hope to maintain their success in the industry, they must prepare for a growing market of single-women homebuyers—a trend that will only increase as more women earn degrees, attain higher-paying jobs and seek properties to buy. Whether your client is a six-figure earning professional, a single mother or a divorcee looking to start a new chapter in her life, or all of the above, here are some important factors to consider when helping your clients, courtesy of the 2018 NAWRB Women in the Housing Ecosystem Report.

Couples, married or unmarried, normally have more buying power than single homebuyers because they have two sources to pull from that could go toward mortgage payments. According to 2016 NAR data, married couples have the highest income of around $99,200, compared to single buyers; however, dependence on a primary income is not deterring single women from buying homes.

Home-Buying Process for Single Women

- Single women are independent; thus, all home-buying decisions—including where to live, how much of a mortgage payment they can afford, how to decorate their house, etc.—will be made by them.

- Single women are interested in buying a home as a means of wealth-building. They’re taking the necessary steps to ensure their financial security in the future, whether or not they have a partner.

- As a single woman, size may not be as important as location and affordability. Some women are interested in owning a home to get a pet, so a sizable backyard is a must.

- Stringent lending standards make it more difficult for singles applying for loans with one income.

Home-Buying Process for Single Mothers

- With a limited income, saving money will be difficult because of child-related expenses. Single mothers are also looking for a property they can afford in the long term.

- Single mothers will want a safe, supportive community with a low crime rate and reputable education system. Having nearby infrastructure and basic amenities like shopping centers, hospitals and parks will be preferred.

- Working mothers, like other single women, have limited time on their hands; however, single mothers are crunched even more for time, as being a mother is another job in and of itself.

- Smart home technology, such as security alarms, intercom systems, carbon monoxide detectors and nightlights, could be especially important and appealing to single mothers.

A home is a woman’s sanctuary, a place to call her own, and an invaluable asset that cements one’s professional progress and economic foundation. It would be beneficial for agents to keep this in mind as they assist the needs of women buyers. Your clients will return the favor by referring your services to like-minded friends interested in taking the leap into independent living and property investment.

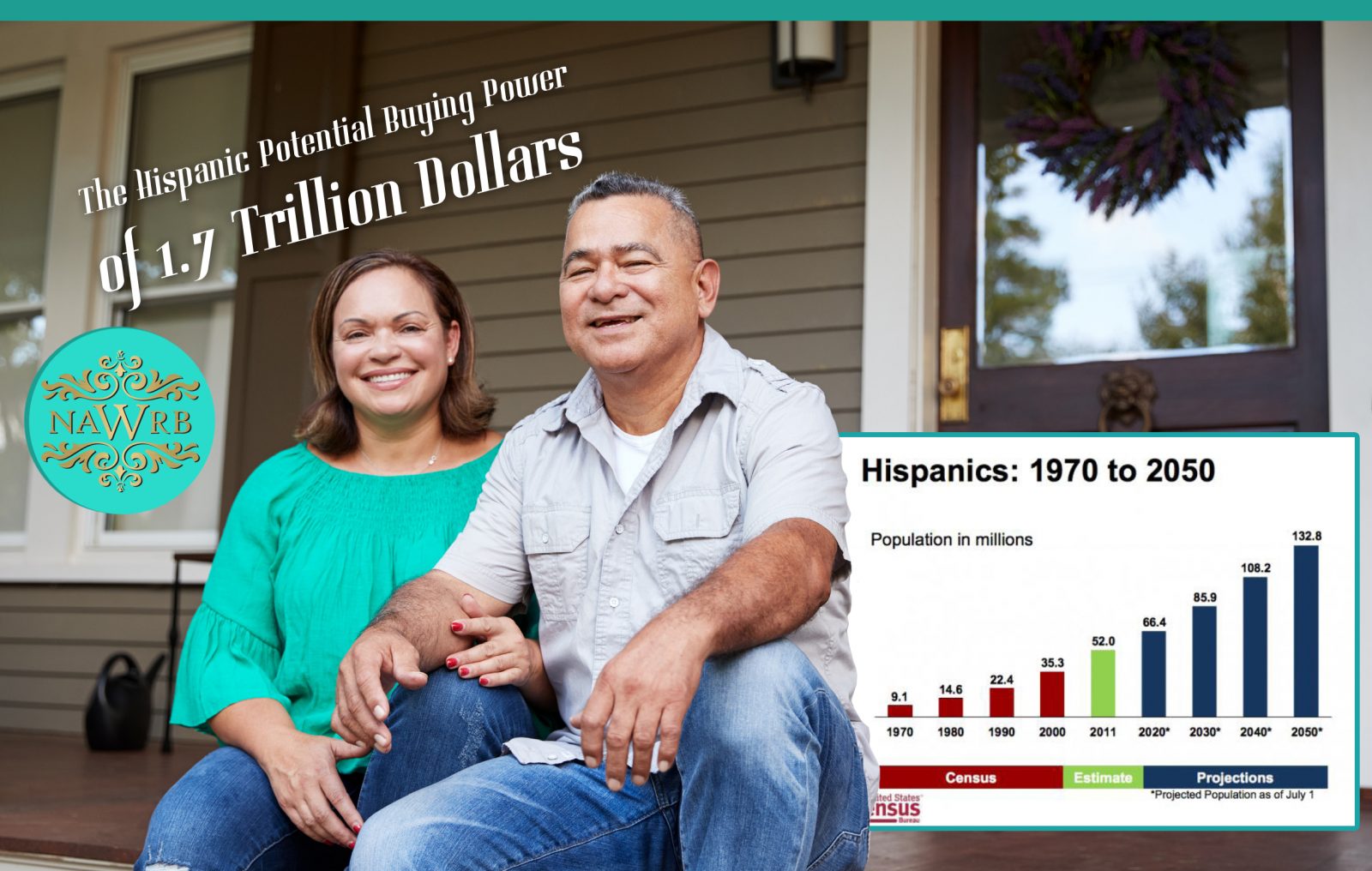

The Hispanic Potential Buying Power of 1.7 Trillion Dollars

The goal of every business is to make a profit and the real estate industry is no different. An often undermined market is the Hispanic and this article will help you uncover the potential within the Hispanic market that most overlook, which means millions of dollars for businesses looking to invest in this market.

Tap into the 1.7 Trillion Dollars Market

The U.S. houses an ever-growing Hispanic population resulting in an increase in potential purchasing power that is generally overlooked. Statistics from Pew Research Center, as at 2015, indicate that about 57 million Hispanic people live in the U.S.; that is 18 percent of the whole U.S. population, compared to 1980 when the percentage stood at a mere 6.5 percent. Additionally, the Census Bureau in 2014 predicted that the Hispanic population will double to about 119 million come 2060.

Continue reading →

Housing Starts at Lowest in More Than Two Years

According to a report by the U.S. Department of Commerce, the number of homes that were being built as of December 2018 was at its lowest level in the more than two years. The decrease in housing starts during this period indicates that developers are anticipating fewer new houses that will be sold this year. Building permits increased by just 0.3 percent, suggesting that growth in new housing will continue to be sluggish in the future.

Fannie Mae & Freddie Mac Conclude Expansion in Single-Family Rental Market

The Federal Housing Finance Agency (FHFA) announced yesterday that government-sponsored enterprises Fannie Mae and Freddie Mac will end their expansion into the single-family rental market by halting the single-family rental pilot programs initiated in the last two years. The FHFA has concluded that the market is able to run smoothly without the assistance of GSEs, even though they will still retain previous investor programs such as Fannie Mae’s Multiple Financed Properties and Freddie Mac’s Investment Property Mortgages.

Login

Login